Loan Highlights 1Q24: Don’t call it a comeback – loan refinancing share hits historic high, but IG issuance stymies YoY global growth

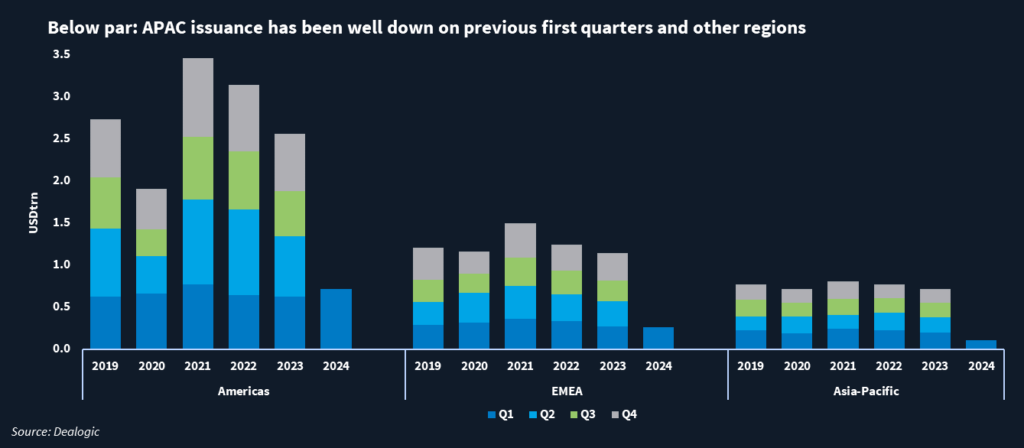

Last year’s loan issuance in the Americas, EMEA and Asia-Pacific was poor, standing 9.3% below the 2018-23 average, but there are few signs of a revival thus far in 2024. Combined issuance in the three regions reached USD 1.08trn in 1Q24 year to date (YTD), close to 1Q23’s USD 1.17trn, yet this remains less than the first-quarter results in every year since 2018.

Expectations that central banks will cut interest rates in the US and Europe at some point this year have boosted issuance in the Americas and in EMEA’s leveraged loan market, but disappointing volumes printed in APAC have cooled the likelihood of global growth.

Issuance in the Americas ticked up 15% year-on-year (YoY) in 1Q24 YTD to USD 717bn. Volume is at its highest since 2021 albeit slightly beyond the 2019-23 average of USD 663bn.

EMEA has recorded loan issuance of USD 259bn so far this year, not far off the USD 268bn seen in 1Q23 (‑7.8%), but still the lowest volume since 2018. Issuance in 1Q24 is 17% below the 2019-23 first-quarters average.

The worst news, though, comes from Asia-Pacific, where loan issuance amounted to only USD 103bn in 1Q24 YTD, as volume halved in YoY comparisons, marking its lowest level for any quarter in recent years.