KKR, Thoma Bravo exploits competitive lending markets to revamp portfolios

Private equity firms like KKR and Thoma Bravo, eager to reprice existing private debt in a borrower’s market, are weighing the benefits of the cheaper syndicated market against the drawback of high fees.

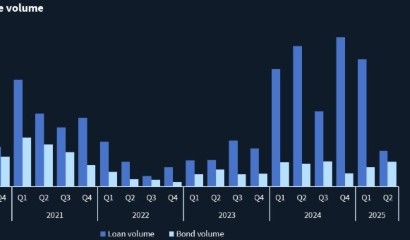

As high interest rates disrupted capital markets in the past years, the broadly syndicated loan (BSL) market saw periods of inactivity. During this time, some direct lenders only looked at high quality deals and would only “pick up the pen” for pricing over 700 basis points (bps), said Matt Gilbert, managing director for capital markets at Thoma Bravo. The tide started to change in 2023 and now the market fully favors borrowers due to an influx of private credit dry powder and the reopening of the BSL market.

“When all markets are functioning and are competing, we are able to drive a better outcome for ourselves as an issuer because we can evaluate all options,” said KKR Capital Markets Partner Cade Thompson. In this environment, sponsors can lock in more favorable terms for general refinancing, repricing and dividend recapitalizations for portfolio companies, and this reduction of debt costs benefits their investment returns.

Both Thoma Bravo and KKR took advantage of the new market conditions and lowered the debt burden on some of their portfolio companies this year with KKR refinancing Groundworks on the BSL market and Thoma Bravo repricing Coupa with its original lenders. The Groundworks buyout that took place last year included more than 30 private investors in what KKR describes as akin to a “distributed unitranche,” according to Thompson. Because KKR Capital Markets led that syndication, when the call protection stepped down in 2024, KKR saw an opportunity to refinance, he said.

After talking to the existing lenders and examining a syndicated option, Groundworks was ultimately refinanced with KKR Capital Markets serving as the left lead on a syndicate that included a host of traditional Wall Street banks. Refinancing on the BSL market saved the company around 300 basis points of running annual spread from where the spread existed on the original private credit deal, a person close to the situation said. From where the direct lenders were willing to reprice in the current market, the savings were closer to 125pbs to 150bps.

Thoma Bravo also took the opportunity to negotiate a better lending deal but chose to keep software portfolio company Coupa with its existing private lenders. The sponsor shaved off 200 basis points from the original deal, a recurring revenue loan priced at S+750bps, according to Gilbert. The incumbent direct lenders saw improvement in Coupa’s financials and agreed to a traditional cash flow loan priced at S+550bps, he said.

Sometimes it makes sense to reprice with the original direct lenders even if the BSL market can offer even cheaper pricing because the cost of fees can erase any benefits, Gilbert said. In comparison, the existing direct lenders might “do it for free or only [charge] 25 basis points, and you save yourself 150-200 basis points,” he said. The BSL market and its fees become more compelling if the sponsor can save 300 to 400 basis points of ongoing interest expense.

Doing a BSL deal can cost the borrower anywhere from 50bps to 200bps upfront, according to Karl D’Cunha, managing director at Ankura. Ankura provides services such as investment banking, consulting and turnaround and restructuring advisory. On a USD 100m debt facility, the borrower pays USD 500,000 to USD 2m in fees just for the leading bank, depending on the size of the syndicate, the structure of the debt and other factors. The ratings agency also charges a small fee, approximately 25bps to 50bps, and the administrators take another 10 basis points, he said.

Money must also be set aside for legal expertise and any early repayment penalties. Lawyers typically charge less on covenant-lite, more straightforward structures and charge more based on complexity, D’Cunha said. Repayment penalties can also vary with 50bps being “not a big deal” but a 3% penalty being high enough to erase the pricing change. Sponsors must carefully weigh the costs of these fees versus the benefits of securing lower pricing.

“It’s incumbent upon us day-to-day to find out where the market exists on all alternatives, so that we can manage our processes effectively and optimize outcomes,” Thompson concluded.