InterCement 4Q23 Credit Report (Part I) – More intercompany loans while awaiting negotiations with debenture holders

InterCement has not yet published financial results for 4Q23, but its two operating subsidiaries, Loma Negra and InterCement Brasil, have done so. Loma Negra reported EBITDA of USD 40m, the Argentine subsidiary’s lowest quarterly print since 2020. Free cash flow was USD 11m, and it has not distributed any dividends. President Milei’s devaluation took the official exchange rate to ARS/USD ~800 from ARS/USD ~400 and, along with his fiscal austerity measures, caused cement demand in Argentina to plummet. In particular, the March demand figure represented a decline of 43% from the same period of last year (See Figure 1).

As such, although Loma Negra has helped InterCement in the past two years significantly, we don’t expect the Argentine subsidiary to be able to do much under the current economic conditions. The country’s largest cement player has resumed share buybacks, which only serves to marginally increase InterCement’s stake in Loma Negra.

One positive aspect of Milei’s ARS devaluation is that Loma Negra had ARS 34bn (USD 97m) in debt as of 3Q23, which after the devaluation, represented “only” USD 45m (ARS 36bn), or 54% less (See Figure 2).

Cash and cash-equivalents ended the year at only USD 8m, and given low sales volumes during the first three months of 2024, it’s hard to imagine this amount will be significantly higher when 1Q24 numbers are released.

Brazil

For the Brazilian business, there are two important topics: how operations are going and the auditors’ conclusions regarding its viability. On the operational front, we have to highlight that over a 12-month period, free cash flow was basically neutral (just USD 1m), and this was in spite of the company paying almost no interest expense, as it PIKed the June and December coupons. The company managed to reduce debt with suppliers by USD 62m, which basically explains all of the incremental working capital needs for the period (See Table 1).

The stock of debentures during the year increased by 17% to BRL 3.2bn, from BRL 2.7bn at the end of 2022, as the coupons were PIKed. When measured in USD, the stock of debentures increased to USD 660m from USD 522m. Of this, USD 91m corresponds to the PIKed interest expense, and USD 48m is a result of BRL appreciation.

The second important topic was the auditors’ conclusion regarding the viability of the subsidiary for 2024. The auditors basically found that it was more likely than not that the company will “survive.” This means that the auditors believe that either a sufficiently large asset sale will take place that will allow the cement company to fulfil its obligations, or that somehow a refinancing will be successful in addressing short-term maturities.

Volumes sold in Brazil were 0.7% lower than 4Q22, and down 3.5% from 1Q23, driven by a 10.6% decline in March, as YTD February volumes were up 0.6% versus the corresponding period of 2023. This means that the operations themselves are not recovering very well, and that we don’t expect too much positive news on this front.

Holding company

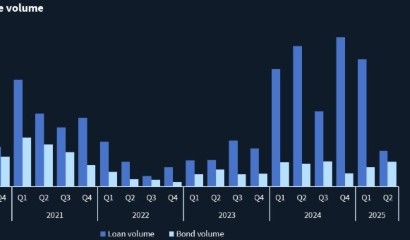

As of September, there was USD 32m in cash at the InterCement Participacoes level. Since then, the holding company paid BRL 40m in interest (USD 8m) in early December and the USD 16m coupon of the 2024 bonds in January. In addition, we saw a BRL 43m intercompany loan from InterCement Brasil to InterCement Participacoes in 4Q23. We estimate that the pro-forma cash level to be USD 16m. In addition, there is USD 232m from the sale of the Mozambique and South Africa assets, but those funds will (or should) be used to in part repay part of the domestic bond debt, and perhaps pay 2024 bond holdouts (See Table 2).

In the meantime, there are absolutely no leaks on the negotiations between the company and debenture-holders. The deadline is 8 May, and given that during previous talks we were all waiting until the last minute to hear news, it’s hard to imagine this time is going to be any different. Also, even if a solution hasn’t arrived by then, it’s probably optimal for banks to grant another short-term waiver than to execute their claims and sue InterCement.