Bond Highlights 1Q24: high-yield issuance remains modest, competing asset classes offer alternative funding routes

Bond issuance volumes have been relatively muted in 1Q24 so far, though deal counts have been picking up encouragingly ahead of Easter. Global high-yield (HY) asset class volumes have been constrained, with many issuers waiting for interest rates to fall and thus considering cheaper coupon issuance in the coming quarters, while there has also been increased competition from other funding sources such as leveraged loans and private credit.

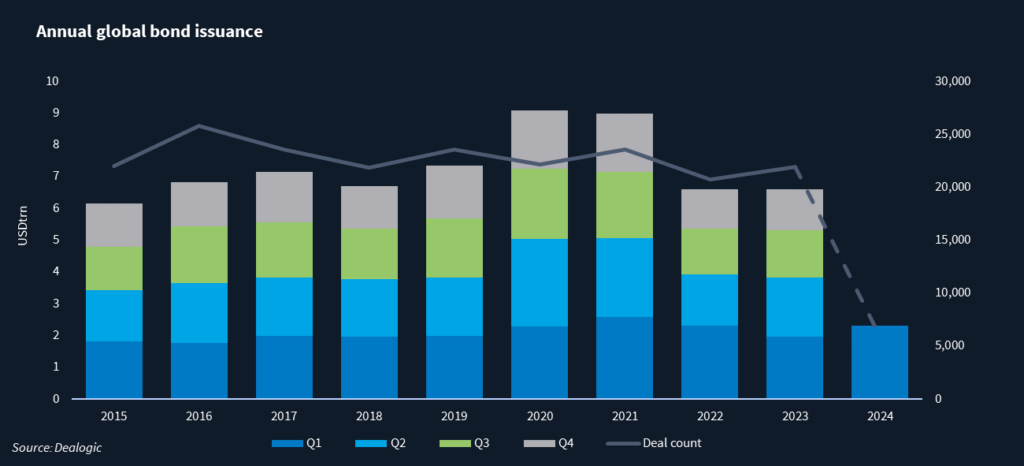

Global bond issuance in 1Q24, based on year-to-date (YTD) data to 27 March, suggests volumes have still staged an encouraging performance year-on-year (YoY) compared with 1Q23 (versus historical full-quarter comparisons). However, bond supply remains well down on the stronger issuance quarters of 1Q22 and 1Q21.

HY markets in recent years have been grappling with increased competition from other funding sources such as leveraged loans and private credit. Deals such as the bond and unitranche offering for London-based insurance company Ardonagh offered a mix of dollar and euro bond, and private debt funding, but private debt issuance has ballooned in recent years as an alternative source of funding for issuers. European HY has been beset in recent months by negative net issuance, as the volume of new issuance minus redemptions moved sharply lower. However, there are signs that more direct lenders may look to the syndicated market to refinance private debt, with Italian pharmaceutical manufacturer Neopharmed Gentili this week marketing a bond to refinance existing unitranche notes.

Global bond issuance for 1Q24 reached USD 2.30trn versus USD 1.97trn in 1Q23. The statistic provides an upbeat tone that bond issuance volumes have stabilised, but volumes continue to lag the first quarter of previous years. For example, global bond issuance volumes were USD 2.3trn in 1Q22 and USD 2.59trn in 1Q21.