US converts surge on refinancing wave and investor demand

At the height of April’s volatility, US convertible bonds briefly looked like a safe harbor, only to see issuance stall amid macro jitters and recession fears.

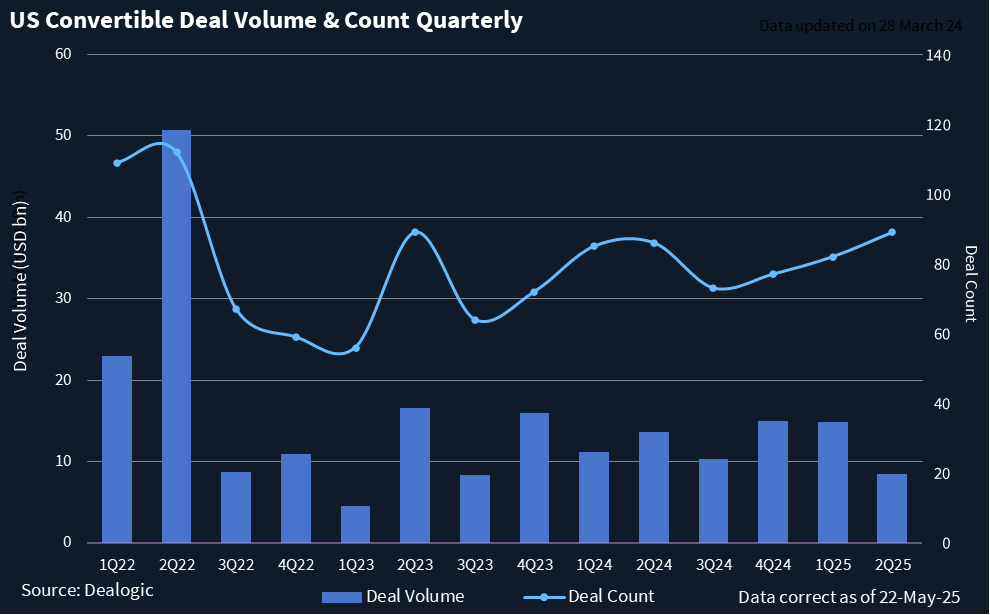

So far this year, 99 convertible bond deals have raised USD 28.29bn, a notable slowdown from the USD 39bn raised across 83 deals during the same period in 2024.

Weeks into May, the asset class is roaring back with a series of well-received transactions.

The USD 870m five-year deal from Hims & Hers Health (8 May) was a clear turning point, upsized by 93% and priced at a 0% coupon with a 37.5% premium. It was the largest upsize for a US convert in five years and showed just how eager investors are to re-enter the space.

“It’s a 180-degree turn from the tariff-driven fear we saw in April,” said Bryan Goldstein, head of convertibles origination at Matthews South. “There’s simply not enough paper to meet demand.”

Goldstein added that converts thrive on dislocation.

“Volatility helps pricing, even if credit is still a bit tight. Converts offer upside with built-in downside protection, unlike equities, which rely heavily on a strong use-of-proceeds story,” he said.

After a series of smaller offerings tested market appetite amid broader volatility, the big deals finally returned. On May 14, Akamai Technologies issued a USD 1.7bn eight-year note, priced at a 0.25% coupon and 20% premium. The deal was upsized from USD 1.4bn.

A rare twist came only one day before from Uber Technologies, with a USD 1.15bn exchangeable into shares of Aurora Innovation. The zero-coupon, three-year deal carried a 16.1% exchange premium and marked a rare exchangeable in the US market. Uber, which is a minority owner of Aurora Innovation, opted to use the exchangeable to monetize a portion of its stake.

“There are many other corporates with large holdings that could use a similar structure going forward,” said Ivan Nikolov, head of convertibles at Fisch Asset Management.

He added that, after a break in issuance around tariffs and earnings blackouts and with a number of maturities, there was some pent-up demand. He sees the recent flow as healthy and expects favorable issue terms to continue.

Secondary performance has added fuel. Many recent issues have traded up post-pricing, adding to investor confidence and emboldening other issuers to follow suit.

In this economic scenario, the very nature of convertible bonds maintains its attractiveness. With US Treasury yields still elevated, convertibles offer a compelling alternative for CFOs trying to balance growth financing with cost of capital.

William Blair ECM MD Steve Maletzky said the latest wave of convert issuance reflects a strategic pivot by companies looking to optimize capital structure while preserving much-needed flexibility.

“Refinancing those notes, especially via zero or near-zero coupon securities, can save 400 to 450 basis points in interest expense versus fixed-rate debt. It’s a strategic arbitrage.”

Whether refinancing legacy converts or tapping the market for growth, issuers appear to have found a welcoming window. For now, the feedback from ECM desks is clear. There is more coming.