Trump bump: Dealmakers hopeful of M&A surge – Dealspeak North America

Dealmakers are anticipating a surge in mergers and acquisitions following Donald Trump’s election as president.

The promise of lower corporate taxes, deregulation and leadership changes at key regulatory agencies all point to a friendlier environment for M&A under a Trump White House, say investment bankers and lawyers.

Combine that with the Republicans’ anticipated control of Congress, plus the expectation of a soft economic landing, positive growth and the Federal Reserve’s recent interest rate cuts, and the portents are good for M&A.

Wall Street responded in kind. Investment bank stocks – such as PJT Partners [NYSE:PJT], Evercore [NYSE:EVR], Lazard [NYSE:LAZ], Goldman Sachs [NYSE:GS], and Morgan Stanley [NYSE:MS] – jumped between 11% and 19% the day after the election on the expectation of a rise in their M&A advisory business, noted one tech banker.

Trump’s victory and Republican control of the Senate will be “more consequential for M&A,” said Bill Curtin, global head of Hogan Lovells’ M&A practice. He expects both larger transactions and an increase in their number as regulators adopt a more lenient approach.

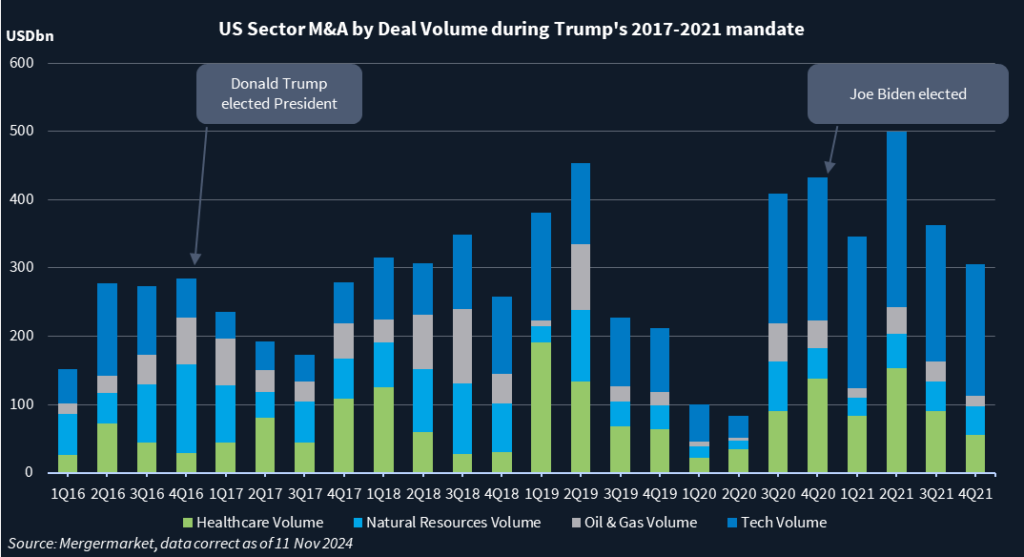

The technology, financial services, manufacturing, oil and gas, and healthcare sectors are expected to benefit, while those exposed to the energy transition suffer or pivot as Trump takes away incentives.

“It’s really going to be a huge positive for M&A,” said the tech banker.

Deal count increase

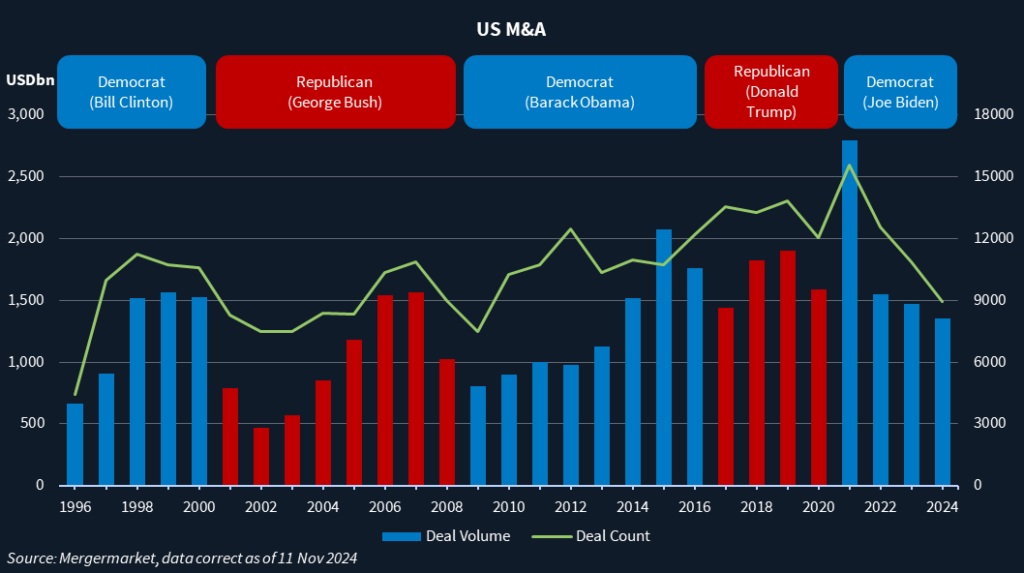

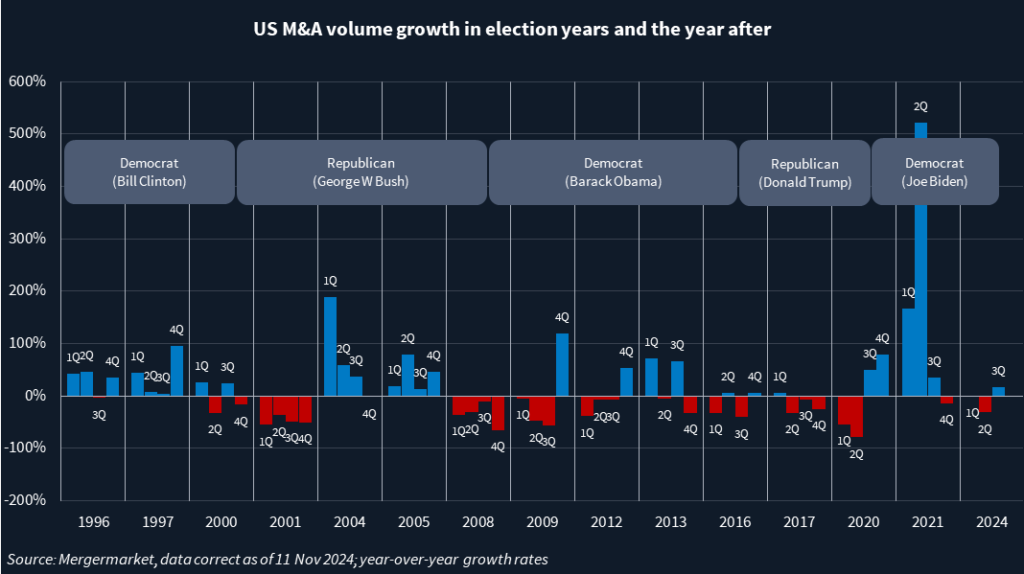

The number of M&A transactions tends to increase 10% year over year in the first two years of a presidential office, provided there is no recession, said Ron Chapoorian, US deals leader at PwC.

Deal count rose in the first two years of Joe Biden’s presidency (2021-22), Trump’s first term (2017-18), George W Bush’s second term (2005-06), and Bill Clinton’s second term (1997-98), according to Mergermarket data.

But it dipped early in Barack Obama’s second term (2013) and his first term (2009) at the tail end of the global financial crisis, before surging the following year. The number of transactions also declined in the first two years of Bush’s first term (2001-02) during the dotcom bust.

Provided the US achieves its soft landing and the interest-rate environment remains favorable, “We’re pretty hopeful we will get a bump post-election,” Chapoorian said.

Anti-trust caveats

Boosting M&A prospects are Republican proposals to lower corporate income taxes from 21% to as low as 15%, as well as no tax on stock buy backs. Also unlocking M&A is anticipation of deregulation. Trump could make leadership changes at the Department of Justice’s antitrust division and the Federal Trade Commission, leading to more lenient antitrust enforcement. That could help highly regulated sectors such as financial services, healthcare and energy, but also the tech sector, which has been under the crosshairs of regulators.

But there are caveats. Hogan Lovells’ Curtin cautions that Trump is a more traditional Republican akin to William McKinley, the 25th president, who favored tariffs in the 1890s, than the free-trade champions of the Republican party’s modern iteration. Neither is he a Reaganite on antitrust – during his previous term regulators sued to block AT&T’s [NYSE:T] merger with Time Warner, albeit unsuccessfully.

Could Trump’s second term actually continue with the ‘populist antitrust’ policies of FTC Chair Lina Khan, who cracked down on serial acquirers and Big Tech under Biden? Vice president-elect JD Vance is a Khan fan.

Despite that, the general consensus is that under a Trump second term, it still will be easier to get deals done, with the possible exception of Big Tech.

One tactic with which Big Tech may continue is the acqui-hire, particularly in artificial intelligence (AI) where government concerns about a concentration of power exist. Acquihires can sidestep antitrust scrutiny since no ownership stake is exchanged – instead, a right to hire employees and a non-exclusive right to use intellectual property is exchanged. Recent examples include Microsoft’s [NASDAQ:MSFT] USD 650m deal with Inflection AI in March, and Amazon’s [NASDAQ:AMZN] deals with AdeptAI in June and Covariant in August. Regulators abroad are starting to take note.

What to expect

Many corporations feel the need to make acquisitions – not least because they are under pressure to reinvent their business models to survive the decade, grow revenues and differentiate their products, said PwC’s Chapoorian.

Financial sponsors also have a pent-up desire to transact, especially as more than 2,000 portfolio companies have been held beyond their holding periods and need to be monetized, he added. “We think there will be a lot of activity there in the next 24 months.”

The tech sector is expected to see more M&A activity, particularly as the valuation gap – which had thwarted M&A in 2023 and early 2024 – also is closing, said the tech banker. A compression in the bid-ask spread has happened thanks to sellers’ falling price expectations and buyers’ rising ability to finance higher purchase prices as interest rates drop.

Under Biden, transactions regularly took 18-24 months to close because of all the regulatory hurdles, said the tech banker. That had a chilling effect on M&A. In one apparently innocuous example, two small tech companies each with about USD 100m in revenue called off their merger after receiving a second request from regulators, noted the banker.

Under Trump, that time to close is expected to shorten considerably. Regardless of his regulatory standpoint during the first term, a more business-friendly perception of his administration will be enough to unlock dealmaking, the banker said.

“For those of us doing M&A for a living, we’re quite happy about the potential changes.”