Private equity makes a comeback in Canada – Dealspeak North America

After nearly a one-year lull, private-equity firms are once again striking deals in Canada as interest rates level off and the country’s central bank flirts with rate cuts.

“Private equity is definitely back,” says Robert Hickey, managing director and head of mid-market M&A at RBC. “Four of the last five deals we’ve closed [in late 2023 and early 2024] were with private equity.”

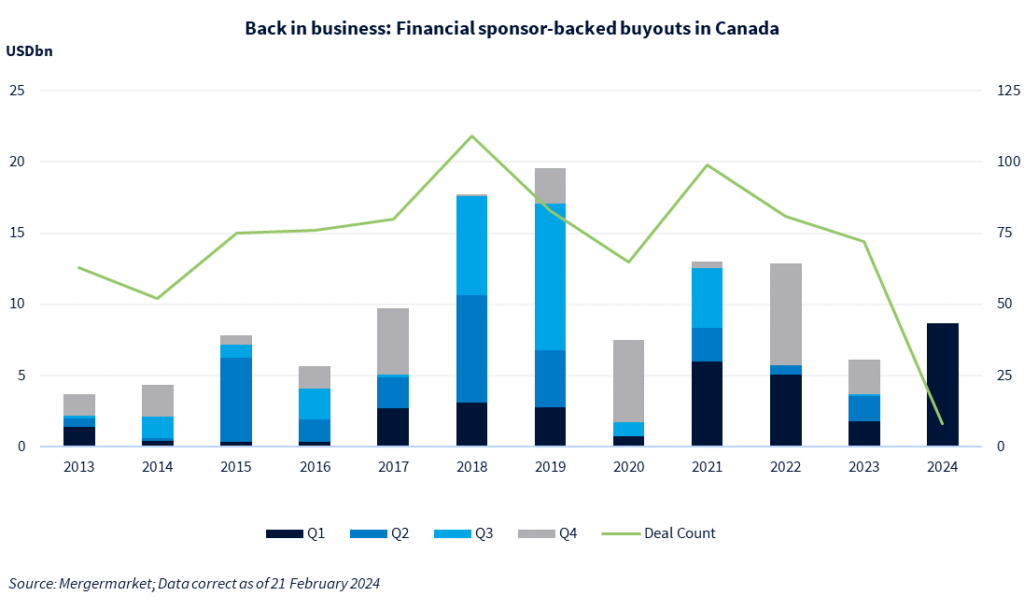

PE-led buyout volume skyrocketed in 4Q23 to USD 2.4bn from USD 174m the previous quarter, according to Mergermarket data. So far this year, financial sponsors have signed seven buyouts for a disclosed USD 8.7bn – more than the four previous quarters combined – driven almost entirely by Blackstone’s [NYSE:BX] USD 8.7bn agreement to take Tricon Residential [TSX:TCN, NYSE:TCN] private.

The cadence of dealmaking is expected to remain strong this year as buyers have had more time to factor in the new interest-rate environment and have more certainty on the cost of capital, says Angela Blake, a Canada-based partner at Bennett Jones.

War-chest building

Indeed, large asset managers are building up their war chests in anticipation of heightened deal activity. Toronto-based Brookfield Asset Management [TSX:BAM], for instance, expects to raise between USD 90bn and USD 100bn this year in “what should be an excellent environment for investing,” CEO Bruce Flatt said in prepared remarks during Brookfield’s 4Q23 earnings call.

One key driver for the jump in PE dealmaking is the narrowing of the valuation gap between buyers and sellers, says Hickey. PE transaction multiples in Canada last year were 7.3x EBITDA, down from 7.6x in 2022 and 2021, according to RBC, citing GF Data.

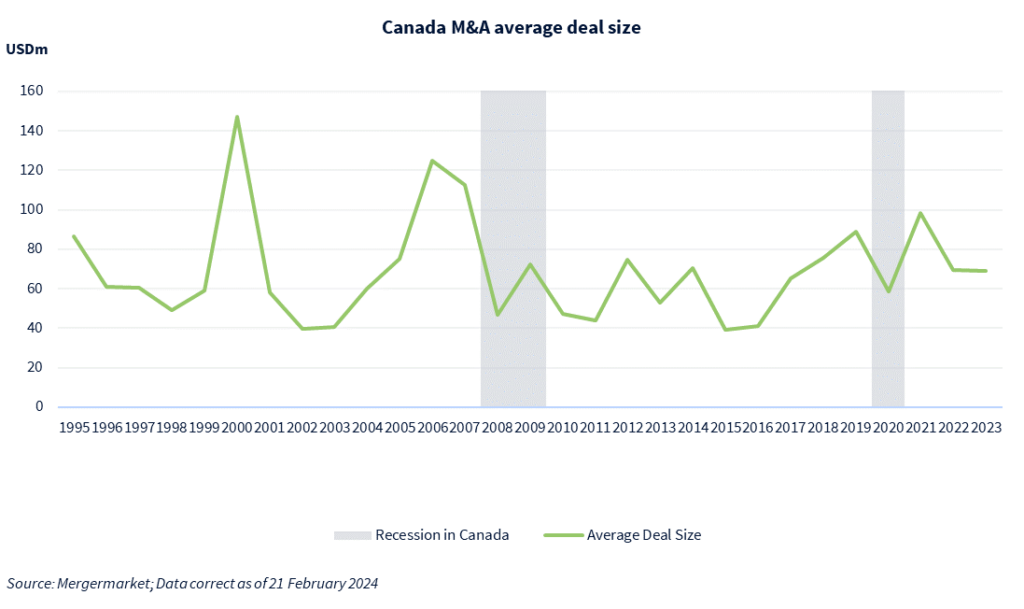

Average deal size in Canada in 2023 was USD 69.7m, down from USD 98.8m in 2021, according to Mergermarket data.

Tech wave

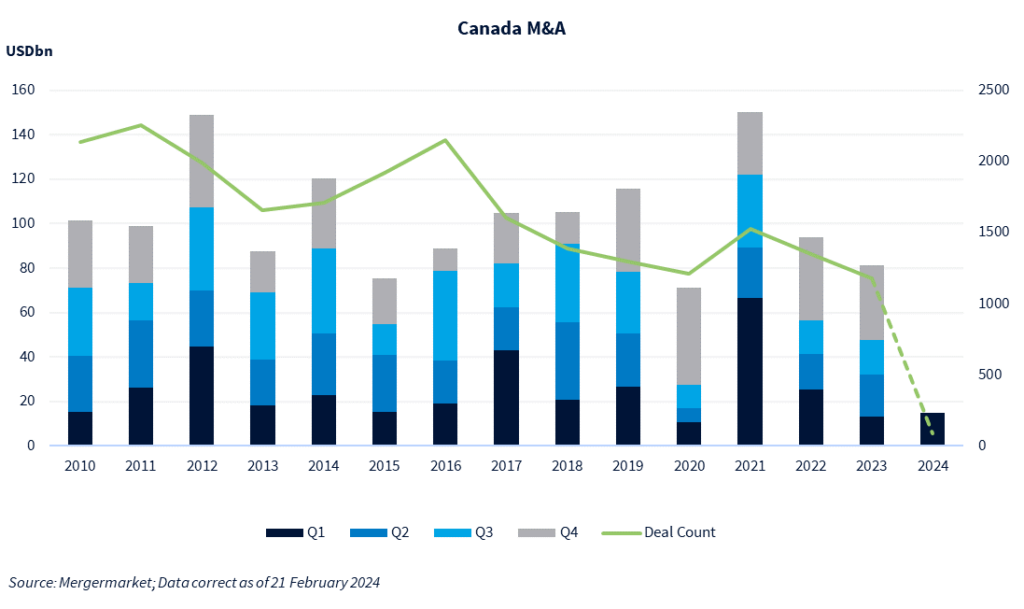

The country’s technology sector – which last year accounted for nearly a fifth of Canada’s total volume of USD 81.3bn, according to Mergermarket data – will continue to see dealmaking, says Lisa Weatherbed, partner, M&A Advisory at Deloitte Canada. In recent months, tech investors have tapped Deloitte Canada’s M&A Advisory for both buy-side and sell-side mandates.

Workflow solutions, artificial intelligence or machine learning-enabled platforms, and advertising technology should all drive tech dealmaking in the year ahead, adds Angshuman Gogoi, senior manager, M&A Advisory at Deloitte Canada.

Two of the five sponsor-backed companies in Canada with the highest Likely to Exit (LTE)* scores are software providers. PointClickCare, a Mississauga, Ontario-based provider of healthcare collaboration software, had an LTE score of 56 out of 100, and Ataccama, a Czech-Canada-based data management software company, had an LTE score of 53 out of 100.

Canadian sponsor-backed companies most Likely To Exit*

| Company Name | Likely To Exit (LTE) | Hold Period (y) | Financial Sponsor | Geography | Sector | Entry EV (USD) |

|---|---|---|---|---|---|---|

| Beanfield Technologies Inc | 64 | 3 | DigitalBridge Group Inc | Canada (Ontario) | Technology | 250-750m |

| Venus Concept Inc | 57 | 4 | EW Healthcare Partners | Canada (Ontario) | Healthcare | 155m |

| FLO | 57 | 7 | CDPQ | Canada (Quebec) | Energy & Natural Resources | 26m |

| PointClickCare Corp | 56 | 3 | Hellman & Friedman LLC JMI Equity Inc |

Canada (Ontario) | Technology | 947m |

| Mucci Farms Ltd | 51 | 6 | Novacap Investments Inc | Canada (Ontario) | Industrials | – |

Source: Mergermarket

* Mergermarket’s LTE predictive analytics assign a score to sponsor-backed companies to help track and predict when an exit could occur through M&A and IPO, a direct listing or a deSPAC transaction.

Take-private candidates

Increased PE activity is a welcome development for Canada’s technology sector, especially those companies whose valuations have soured on the capital markets. At least four of the 26 tech companies that went public on Canadian exchanges from January 2020 to September 2022 have since gone private, according to Mergermarket data. Those include Toronto-based capital markets access platform Q4, provider of analytics software for digital forensics research Magnet Forensics, and virtual healthcare and wellness platform Dialogue Health Technologies.

Some companies whose share price has plunged since launching their initial public offering (IPO) – such as Loop Energy [TSX:LPEN] and First Responder Technologies [CSE:WPN] – have agreed to merge with other companies. Others like online pharmacy Mednow [TSX-V:MNOW] have entered bankruptcy protection.

The question is what will happen to those still public but trading well below their debut prices.

Bullseye on their backs: Canadian tech firms trading at steep discounts to IPO pricing

| Pricing/Completion Date | Company | Company Ticker Symbol | % Change Price Offer/Current | Market cap USDm |

|---|---|---|---|---|

| 13-Apr-2022 | FRNT Financial Inc | FRNT | -60.00 | 15.6 |

| 30-Nov-2021 | Railtown AI Technologies Inc | RAIL | -58.75 | 11.6 |

| 06-Oct-2021 | Copperleaf Technologies Inc | CPLF | -59.13 | 335.4 |

| 29-Jun-2021 | LifeSpeak Inc | LSPK | -94.00 | 22.6 |

| 08-Jun-2021 | NetraMark Holdings | AIAI | -52.78 | 18.4 |

| 22-Apr-2021 | Thinkific Labs Inc | THNC | -72.85 | 213.4 |

| 02-Feb-2021 | TELUS International (Cda) Inc | TIXT | -55.16 | 3,080.1 |

| 26-Oct-2020 | Pivotree Inc | PVT | -82.59 | 33.1 |

Source: Mergermarket