Morning Flash AP (Japan): Will Kyocera’s KDDI stake come under scrutiny? Resona aligns with Digital Garage in face of activists

Our analysts pick out hints of future material developments in M&A and ECM situations to produce an exclusive report that offers short and long-term actionable ideas (no investment action should be taken without further investigation). If you have ideas for coverage, please email [email protected].

Emerging activist campaigns & deals

Kyocera’s KDDI stake could be in spotlight at FY24 results on 26 April

Pressure on Kyocera Corp [TYO:6971], a maker of hi-tech electronic equipment, to sell down its 14.55% stake in telco KDDI Corp [TYO:9433] is likely to rise at its FY24 results set to be published on 26 April.

Kyocera’s 14.55% stake in KDDI is worth JPY 1.5trn (USD 9.8bn) and represents 50% of the company’s equity value. It has long been targeted by activists, such as Oasis Management. And at the 2023 AGM, proxy advisor ISS recommended shareholders vote against the re-election of Chairman Goro Yamaguchi and President Hideo Tanimoto as the company’s cross-holdings amounted to more than 20% of its market value.

Subsequently, the two executives’ significantly low approval rates (~65%) prompted Kyocera at its interim results presentation on 1 November to announce a major u-turn in how it thinks about and plans to utilize its KDDI shares. Until then it had said it would simply use the stake as collateral to borrow against.

Since then, however, Kyocera has been more muted on the subject.

Nihon Keizai Shumbun reported on 23 January, quoting Tanimoto that Kyocera plans to sell off a portion of the [KDDI] stake. However, at its 3QFY24 earnings call on 1 February Tanimoto did not address questions from analysts about whether Kyocera is considering a sale of the KDDI stake. He merely reiterated that the company has made some borrowings using KDDI shares pledged as collateral and can borrow up to JPY 500bn (USD 3.3bn) as specified under its medium-term plan.

The reluctance to specify its plans might be due to the need to fund further growth in the semiconductor space. During the 1 February earnings call Kyocera discussed plans for aggressive investments to enhance production capacity and to position Kyocera to grow in the semiconductor market on the back of increasing demand for AI-related technologies.

Nikkei reported on 25 March that Kyocera is planning to spend about JPY 600bn (USD 4bn) in capital investments over the next 2 years until March 2026. This marks a 70% increase, on a per year basis, in investment compared to what it spent in FY23

Whilst Kyocera has acknowledged calls from major shareholders that the company should “effectively utilize cross-shareholdings for the group’s further growth”, it has yet to outline plans around enhancing shareholder value. It merely said the group will provide details on funding arrangements by autumn 2024.

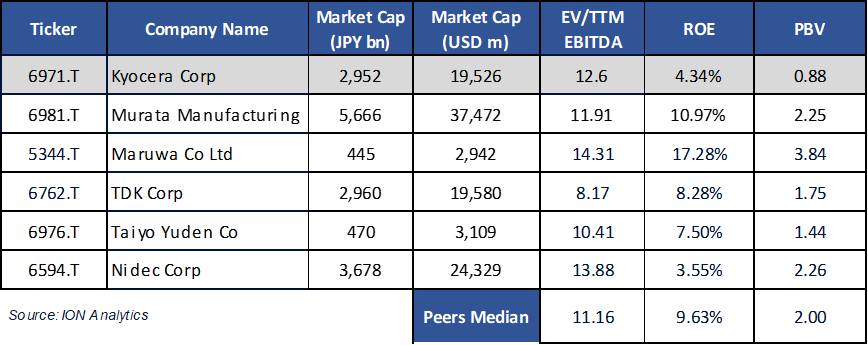

The JPY 3.0trn (USD 19.5bn) market cap Kyocera is trading at 12.6x EV/TTM EBITDA. But it is only trading at 5.4x EBITDA when the KDDI portion is stripped out. Comparable peers such as Murata Manufacturing [TYO:6981], Maruwa [TYO:5344], TDK [TYO:6762], Taiyo Yuden [TYO:6976] and Nidec [TYO:6594], are trading at higher multiples as shown below.

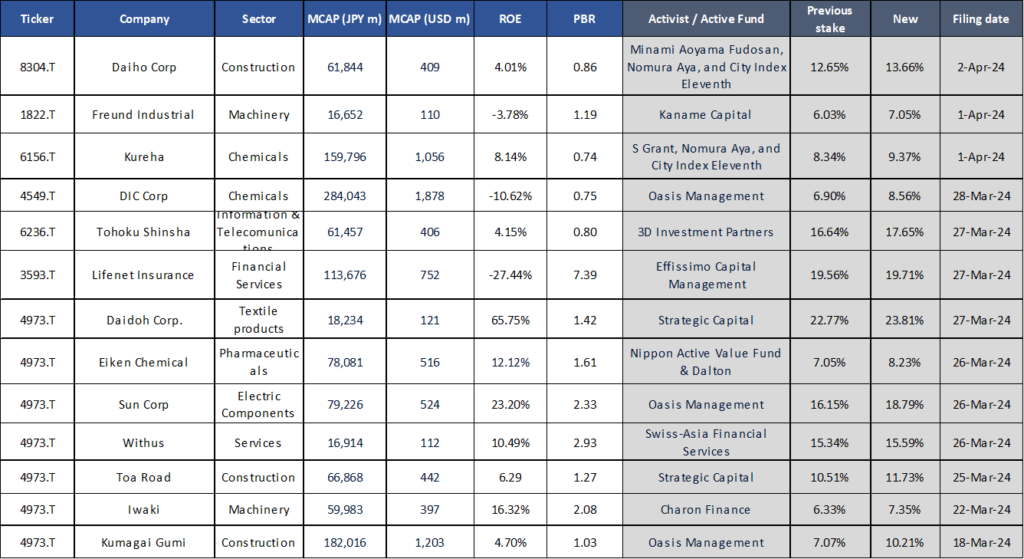

Notable shareholding changes by activists and actively managed funds

Ongoing Activist Campaigns & Deals

Resona strengthen ties with Digital Garage amid activist interest

Digital Garage [TYO:4819] (DG) now has a new second-largest shareholder after Resona Holdings [TYO:8308] and Resona Asset Management, which have a capital alliance agreement, increased their aggregate holding to 11.56% from 10.52% on 25 March.

Shares in DG have fallen 5.48% since Resona’s disclosure suggesting the stock market fears the move will reduce the prospect of shareholder value creation developments.

The Japanese payment platform is bracing for a proxy fight at its AGM in June. Activist shareholder Asset Value Investors, which reportedly owns a 3% stake in DG, said in November it would oppose the re-appointment of all DG directors at the forthcoming AGM. Oasis Management has a 9.4% stake in DG.

Founder Hayashi Kaoru is the largest shareholder with 16.17%. AVI.

DG last closed at JPY 3,105 on 4 April.

Palliser Capital still pushing Keisei Electric to reduce stake in Oriental Land

Bloomberg reported on 1 April that Palliser Capital has again urged Keisei Electric Railway [TYO:9009] to propose a resolution at its June AGM to reduce its stake in Oriental Land [TYO:4661] to below 15%.

The report added that the activist has set a deadline for the railway company to respond to its request by 3 April.

In October, Palliser Capital suggested several measures to enhance the railway company’s corporate value, including reducing its stake in Oriental Land to below 15%. Following this the company sold 1% and reduced its stake to 21.15% in Oriental land, a move some saw as a snub to the activist.

Keisei Electric Railway closed at JPY 6,186 on 4 April, down 5.5% year to date.

City Index Eleventh builds 5.11% stake in JSR

On 2 April, funds associated with Japanese activist investor Yoshiaki Murakami acquired a 5.11% stake in JSR [TYO:4185] which is subject to an ongoing JPY 4,350 p/s tender offer by JIC. The tender offer is expected to close on 16 April. Although the filing suggested the activist fund might make shareholder proposals, Nikkei reported a day later, quoting Aya Nomura, daughter of Murakami, that the funds intend to tender into JIC’s offer.

Prior to that article, Travis Lundy of Quiddity Advisors wrote on SmartKarma that Murakami’s most likely objective is to have the trade recorded as “deemed dividends” through an accounting “technicality”. Lundy reasoned that it is unlikely – but not impossible – Murakami was pushing for a bump to the offer price or seeking to exercise appraisal rights.

JSR closed at JPY 4,343 on 4 April, and is trading with a 0.161% deal spread.

Taisho Pharmaceutical minority shareholders seek court to increase squeeze out price

Taisho Pharmaceutical [TYO:4581] minority shareholders, which include investor Curi RMB Capital, and Kaname Capital, are planning to seek court orders to increase the price of the squeeze-out rights associated with its MBO, Nikkei reported on 18 March.

On the same day, Taisho shareholders approved the company’s delisting.

In early March Oasis Management was reported to be considering taking legal action against the MBO.

Taisho Pharmaceutical last closed at JPY 8,610 on 4 April, trading at 0.1% spread to the JPY 8,620 offer.