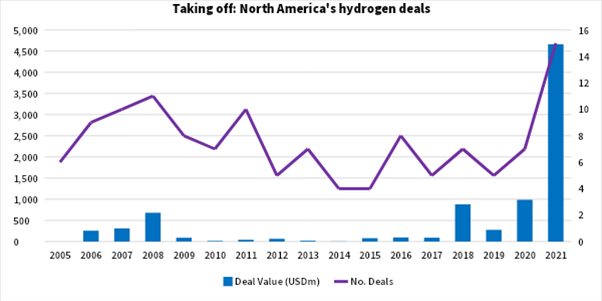

It’s a gas: How high can hydrogen deals fly?

Capital is flowing to companies in all stages and all corners of the hydrogen space this year – running the gamut from generation and storage to distribution. Vertically-integrated Plug Power [NASDAQ:PLUG] announced a slew of joint ventures, took on USD 1.5bn of investment from South Korea’s SK Group [KRX:034730], and improved its delivery and storage offerings by acquiring Applied Cryo Technologies. Hyzon Motors [NASDAQ:HYZN], a maker of hydrogen-powered commercial vehicles, went public in July following a merger with a special purpose acquisition company (SPAC). Pre-revenue Universal Hydrogen announced a prior funding round in April.

Source: Dealogic

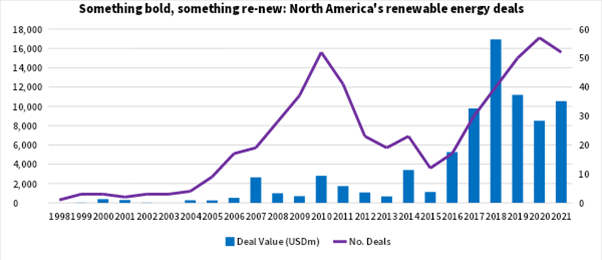

A rising renewables tide

Hydrogen’s emergence for investors and acquirers – particularly “green hydrogen”, which is made from renewables such as water instead of natural gas or coal – comes as enthusiasm for carbon-free energy spikes in the face of concerns about global climate change. In the year to date, North America has seen USD 10.5bn-worth of renewable energy deals, mostly in solar and then wind, according to Dealogic data. This figure ranks as the third highest since 1998, slightly behind 2019’s USD 11.2bn, but far behind 2018’s record of USD 16.9bn, which was buoyed by concerns that US federal tax credits for renewable energy investment and production could sunset.

More federal money is expected to accelerate the deployment of renewables. A USD 1.75tn reconciliation bill working its way through Congress contains USD 550bn of climate-related provisions. As written, the bill would provide a USD 3 per kilogram tax credit for green hydrogen production. “That’s huge,” notes Craig Irwin, an analyst at Roth Capital.

Source: Dealogic

Where the deals will flow

Among larger public integrated hydrogen companies, Plug Power has been the most active. CEO Andy Marsh says his company is focused on creating international partnerships, this year announcing deals with Acciona, Renault and Fortescue, among others. Ballard Power’s [NASDAQ:BLDP] outgoing CFO, Tony Guglielmin, told this news service in January that he would be surprised if the company sat out M&A in 2021, but it has yet to announce any buys.

Private-equity firms are “very active” after a pause, including names like BlackRock [NYSE:BLK], BV Investment Partners and New Mountain Capital, notes Russ Landon, managing director of North River Capital Advisors, a clean energy-focused investment bank. SPACs also could help bring more companies forward in what can be a capital-intensive space.

“Over the last 12-to-18 months, there’s really been a sea change in terms of interest, investment activity and valuations,” says Landon.