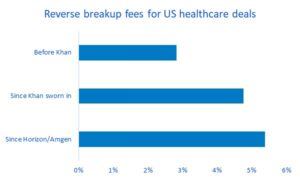

Healthcare reverse breakup fees reflect higher US antitrust risk

- Two-thirds of deals announced under Biden Administration’s FTC have buyer termination fee

- Average amount nearly doubled to 4.76% of deal value from 2.83%

Target companies in the healthcare sector are seeking more and higher reverse breakup fees in case their takeover is hampered by US antitrust enforcement, an analysis by this news service shows.

This uptick in financial safeguards for a possible failed deal reflects the more aggressive stance by the Federal Trade Commission (FTC) and Department of Justice (DoJ) under the Biden Administration.

The majority of healthcare-sector deals are reviewed by the FTC, and this news service found that 58% of mergers announced since Lina Khan was sworn in as chair in June 2021 included a reverse breakup fee, compared to 25% of deals that were announced in the roughly 900 days before that (since January 2019).

This news service analysed healthcare sector deals involving US-listed companies – mainly in pharma and biotech – that were announced since January 2019, and with a deal value of USD 3bn or higher. The 64 deals had a total value of USD 11.5trn, with the largest being Bristol-Myers Squibb’s [NYSE:BMY] 2019 acquisition of Celgene for USD 87.7bn.

In seven out of 28 mergers announced between January 2019 and 15 June 2021, a reverse breakup fee was agreed between the parties. Twenty-one out of 36 deals announced between 16 June 2021 and 13 December 2023 had a buyer termination fee, often with specific reference to regulatory approvals.

The average share of the fee compared to purchase price nearly doubled from 2.83% before the current administration’s FTC, to 4.76% since then.

An even stronger effect can be seen since the FTC’s unprecedented challenge of Amgen’s [NASDAQ:AMGN] USD 28bn acquisition of Horizon Therapeutics in May this year: 86% of deals include a reverse termination fee, with a 5.38% price tag.

Source: Mergermarket data, SEC filings (n=64)

Source: Mergermarket data, SEC filings (n=64)

One deal most clearly exemplifies the stark difference in a pre-and-post-Biden Administration regulatory review: UnitedHealth Group’s [NYSE:UNH] takeover of Change Healthcare. That deal was announced back in January 2021 and with no reverse break-up fee. The DoJ challenged the deal in February 2022, three months after Assistant Attorney General Jonathan Kanter was confirmed, and, as a result, the companies extended their merger agreement through the end of the year and added a reverse termination fee of USD 650m, working out to 4.8% of deal value.

AbbVie’s [NYSE:ABBV] recent announcements of acquisitions of ImmunoGen [NASDAQ:IMGN] and Cerevel [NASDAQ:CERE] show how high the possible penalty can be for a buyer if a deal falls through. In the ImmunoGen deal, the reverse breakup fee is 6.84% of the USD 9.6bn purchase price. In the Cerevel deal, AbbVie promised to pay 7.51% of the USD 8.7bn value if it does not consummate for regulatory reasons.

The FTC this week challenged Sanofi’s [EPA:SAN] acquisition of an exclusive licence for Maze Therapeutics’ therapy in development for treatment of Pompe disease. The companies have abandoned the deal.

At the same time, the FTC approved Pfizer’s [NYSE:PFE] USD 43bn acquisition of Seagen [NASDAQ:SGEN], announced in March, which had a reverse breakup fee of USD 2.2bn (5.19% of the deal value).