Fertility services: Sector bankers hoping to deliver more deals — Dealspeak North America

Nine months into the year and the prognosis remains strong for dealmaking in the fertility services space, sector bankers say.

Several factors are giving the sector new life.

People are waiting longer to have children, which increases demand as fertility declines with age. Advances in technology have made in vitro fertilization (IVF) cheaper and more successful, while expanding insurance coverage in more states makes treatment more accessible.

The prospect of falling interest rates also is bringing financial sponsors to the table. IVF has even become a hot-button issue in the presidential election, with both candidates pledging to preserve or expand access to services.

“All these things make fertility services attractive to private equity,” says Rob Hauptman, a managing director and healthcare valuation expert for Stout. “We suspect there will be more acquisition activity and continued interest in the space,” especially in regard to rollup activity.

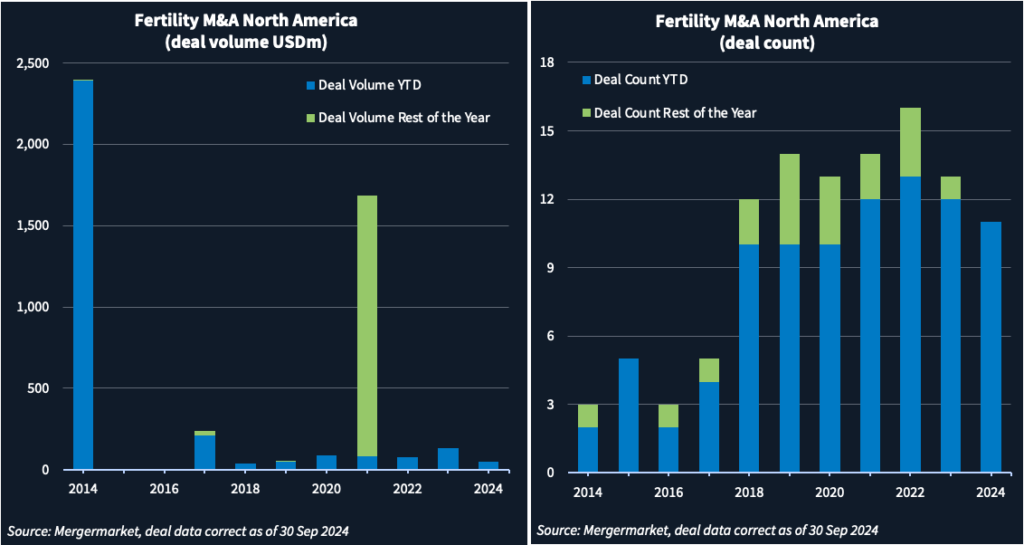

Eleven fertility deals have been agreed in North America during the first nine months of 2024, just behind the 13 signed in the same timeframe in 2022, a high-water mark for such transactions, according to Mergermarket data. Because the valuation of most deals is undisclosed, the number of transactions is a better gauge of activity.

Private equity firms looking to enter the space or expand existing platforms continue to ply this fertile ground, adds Mitchell Stern, a managing director at Dresner Partners. “We’re busy, and we’ve got a good handful of deals that should close this year and next.”

Sector scan

Notable deals in 2024 include Amulet Capital’s buyout of Genetics & IVF Institute this month, and Christ Hospital Health Network buying Mt. Auburn Obstetrics & Gynecologic Associates in July.

Vitaliy Marchenko, a director at Cascadia Capital’s healthcare group, sees the sector in the later phases of consolidation with more than 50% of fertility practices now part of a private-equity platform or university/hospital setting.

Still, there is more room for consolidation, with the 10 largest clinical practices accounting for less than 20% of overall revenue, according to a Hyde Park Capital report.

Valuations in the space have historically been around 11x-15x EBITDA but are currently at the low end of that range, says James Castro, co-head of healthcare services for Bailey & Company, a healthcare investment bank for middle market transactions. Many of the smaller deals are in the 7x-9x range, adds Stern.

Bump in economics

To be sure, the economics of owning a fertility clinic are strong. The US fertility services market was valued at USD 8.9bn in 2023 and is projected to grow at a CAGR of 13.6%, reaching USD 16.8bn by 2028, according to the Hyde Park report.

Driving that is rising infertility: In 2023, one in five American women could not get pregnant after one year of trying, another one in four women had trouble carrying to term, and 15% of American men were infertile, the report says.

Add in people waiting longer to get married and the mainstreaming of same-sex couples, and the result is increasing demand for services such as IVF, genetic testing, reproductive tissue storage, and donor services, says Castro. “The services are recession resistant and investors like the recurring revenue.”

Given the cost of one IVF cycle can reach USD 30,000, one major tailwind is the shift from cash pay to insurance reimbursement as more employers start to offer fertility benefits coverage to their employees. While federal law does not require health plans to cover infertility treatment, as of late 2023, 21 states and the District of Columbia require at least some coverage.

Smaller fertility practices are joining with larger platforms for their access to insurance and reimbursement models as they transition from cash pay models, Marchenko notes.

Buns in the oven

There has been a lack of platform exits of late, and sources agree that deal value is somewhat lower than in the immediate post-pandemic peak.

However, there are plenty of quality small-to-midsized assets on the market, says Stern, who has closed 15 fertility deals in the last five years and has four at the letter-of-intent stage.

Based on recent Mergermarket reporting, a handful of assets are expected to trade in the next 12 months as interest rates settle down. They include:

| Company | Financial Sponsor / Owner | Financials | Latest Intel |

|---|---|---|---|

| Spring Fertility | Wildcat Capital Management | EBITDA in low-to mid-teens (USDm) | Spring Fertility gauging PE interest with advisor, sources say |

| ARC Fertility | Chairman & CEO Dr. David Adamson | ~USD 20m revenue | ARC Fertility launches sale process, sources say |

| Global Premier Fertility | Triangle Capital | ~USD 15m revenue | Global Premier Fertility finishing up management presentations, sources say |

| Inception Fertility | Lee Equity Partners | ~USD 80m adj. EBITDA | Inception Fertility taps Moelis to explore a sale, sources say |

| Ivy Fertility | InTandem Capital Partners | ~USD 50m EBITDA | Ivy Fertility appoints Harris Williams to explore sale, sources say |

Source: Mergermarket, data correct as of 30 September 2024