Feeling peckish: Snacking takes the spotlight in Mars’ Kellanova deal — Dealspeak North America

A mega deal for the maker of Pringles and Pop-Tarts brings hope of a dealmaking comeback after years of decline in North American food M&A.

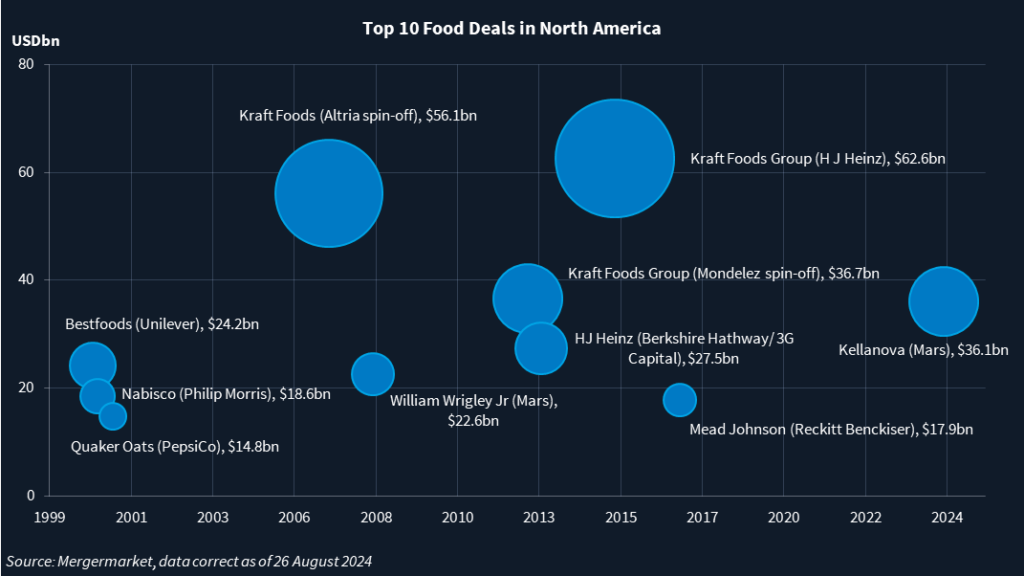

Mars’ USD 36bn acquisition of Kellanova, announced 14 August, is the biggest transaction in nearly a decade for North America’s food sector and the fourth-largest since Mergermarket records began in 1995. A deal bigger than this has not been seen since HJ Heinz’s USD 62bn acquisition of Kraft Foods in March 2015.

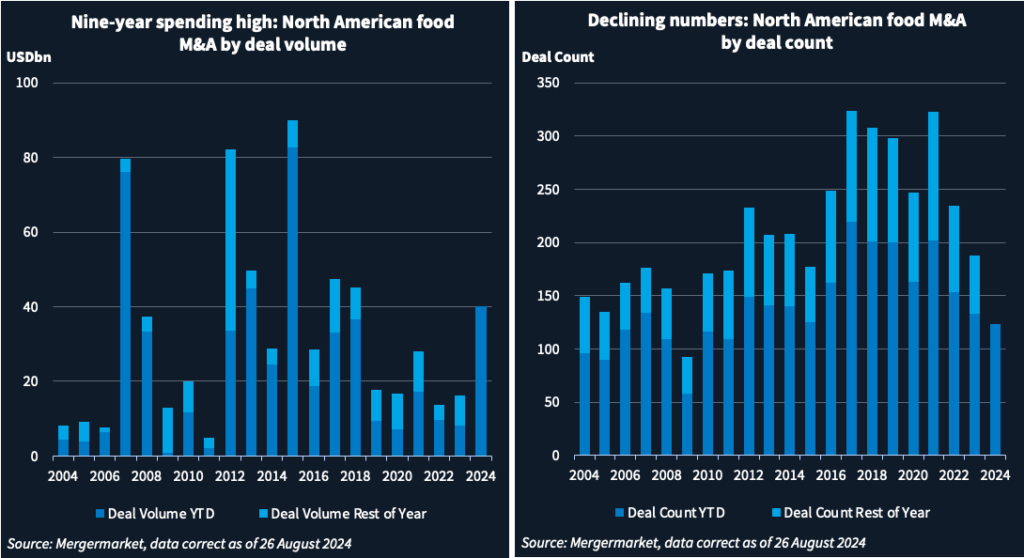

North American food M&A volume of USD 40.2bn so far in 2024 is the highest it’s been at this point of the year since 2015, according to Mergermarket data. Despite that, the deal count continues to be dwarfed by the highs of 2017 and 2021.

More mega deals?

It remains to be seen what the knock-on effects of Mars’ acquisition could be.

Uncertainty in the political environment, particularly with Democratic presidential candidate Kamala Harris’ recent vow to ban price-gouging in food, could mean Mars’ deal simply remains an outlier, says Cathy Jaros, managing director at Peakstone Group.

“I don’t know what’s going to happen in November [with the presidential election], but companies are not going to have the opportunity to increase margins,” Jaros says. Consumers prefer cheaper white-label products over higher-priced branded versions following years of talk about an economic slowdown. “Will this [Mars/Kellanova] set off any trend? I think it was a one-off.”

The rise of weight loss medications such as Ozempic and a stricter antitrust environment towards Big Food transactions also could present roadblocks to more M&A in snacks, says Justin Craig, managing director at Moelis. One recent example of the hurdles Big Food faces is the delay in closing Campbell’s acquisition of Sovos Brands.

“Mars/Kellanova was a unique transaction in that there is minimal overlap,” Craig said. “When you think about a lot of the other permutations on the strategic chess board, the problem is a lot of them would be complicated from a regulatory perspective.”

Increasing appetites

Some remain bullish. The snack food category continues to grow as busy consumers increasingly see the benefits of nibbling throughout the day, either to provide an energy boost or to replace a meal, says John LeVert, managing director at Solomon Partners. Big Foods’s strategic appetite for snacking brands and contract manufacturers has increased in tandem.

Food leaders such as Mondelez International [NASDAQ:MDLZ], Conagra Brands [NYSE:CAG] and PepsiCo [NASDAQ:PEP] could consolidate the snacking space, LeVert notes. Potential acquisition targets that food leaders are tracking include companies such as Utz Brands [NYSE:UTZ], Simply Good Foods [NASDAQ:SMPL] or Hain Celestial [NASDAQ:HAIN], Craig adds.

Functional food and beverages – broadly defined as items that are “better-for-you” – could be another category that draws more M&A interest soon, LeVert and Jaros say. Ethnic foods also could draw strategic interest, add Craig and LeVert.

Lower interest rates – with the Federal Reserve expected to make cuts in September – should spur processed food giants into dealmaking action, as the CFO of General Mills [NYSE:GIS] said in July.

Why now?

Kellanova brings Mars, best known for its chocolaty treats, into the snack aisle, echoing the rationale for JM Smucker’s [NYSE:SJM] deal for Twinkies maker Hostess Brands last year.

“Opportunities to acquire scaled businesses in a category that’s as interesting as Kellanova’s don’t come along very often,” Craig says.

The complementary nature of Mars’ and Kellanova’s geographies and portfolios helped the stars align, he adds. Kellanova is strong in Africa while Mars is more prominent in China. Kellanova’s focus is on snacks, while Mars’ dominance is on pet foods and confectionery.

Kellogg’s decision to spin off WK Kellogg, its North American breakfast cereal division, also likely made it more attractive to Mars, Craig says.

Mars’ status as a private company gave it a significant advantage over some other reported bidders such as Hershey [NYSE:HSY], Mondelez and PepsiCo. Being private allows the family-owned business to focus on its long-term goals for Kellanova and pursue the integration at its own pace, says Craig.

“When Mars sets their sights on a particular target, it’s very hard for the publicly traded players to compete with them.”

Who’s next?

| Target Company | Business Description | Owner/ Financial Sponsor | Financials | Latest Intel |

|---|---|---|---|---|

| Del Real LLC | Hispanic refrigerated foods | Palladium Equity Partners | USD 60m projected EBITDA for 2024 | 03 August 2024 – Del Real Foods sale process advances, sources say |

| Voortman Cookies Ltd | Cookies and wafers | JM Smucker Co [NYSE:SJM] | > USD 350m valuation sought | 30 July 2024 – JM Smucker taps Goldman Sachs to engage possible buyers for Voortman – report |

| Spice World LLC | Garlic and other spices blends | Palladium Equity Partners | Around USD 80m EBITDA | 26 July 2024 – Spice World considers a sale, sources say |

| Mead Johnson Nutrition Co | Infant formula brands Enfamil and Nutramigen | Reckitt Benckiser Group [LON:RKT] | N/A | 24 July 2024 – Reckitt Benckiser shareholders keen to explore sale of Mead Johnson unit |

| Frozen and canned vegetable businesses of B&G Foods | Includes Le Sueur and remaining Green Giant brands | B&G Foods [NYSE:BGS] | Sales of USD 105m in 1Q24 , down 17% from 1Q23 | 20 July 2024 – B&G Foods taps Deutsche Bank, Barclays to explore sale of frozen and canned vegetable businesses |

| CandyCo LLC | Confectioner | CandyCo LLC | USD 25m-USD 30m EBITDA | 20 July 2024 – CandyCo in advanced stages of sale process, sources say |

Source: Mergermarket