Discretion emerges as key attribute for French bankers, lawyers – Advisory Viewer

The Advisory viewer is an overview of Mergermarket proprietary intelligence on content identifying advisory opportunities, including potential fundraising, M&A and IPO transactions reported on by this news service so far this year.

- Exploratory mandates on the rise to meet secrecy and extensive research ahead of auction launch

- France 2023 bankers’ M&A fees down 19% vs 2023 but among country’s decade top three

Signs of recovery in the French M&A market have not dampened caution among executives considering deals, who still favour discreet advisors in an uncertain environment.

Soon-to-be tamed inflation and stable interest rates have revived some M&A discussions, but these have not necessarily resulted in a surge of formal mandates, French financial advisors agreed.

A rise in exploratory mandates, or non-official mandates, to gauge market appetite before an official auction kicks off, also illustrates the increased need for heightened prep work and secrecy, they said.

Exploratory mandates could ensure more secrecy and time to identify the best bidders, set the right perimeter and valuation so that when a window of opportunity really opens, the sale process can roll out quickly and safely, advisors agreed.

The discussions around the potential 2H24 sale of TA Associates-owned French B2B software publisher Orisha were reported but with still no financial advisors mandated, Mergermarket reported.

Orisha has a score of 55 out of 100, according to Mergermarket‘s Likely to Exit (LTE) predictive algorithm.*

The pipeline of potential deals looks so far healthy for 2024. Mergermarket‘s LTE predictive algorithm shows some 26 sponsor-backed companies in France with scores of more than 50 (including Orisha) vs. 19 in November 2023.

The following table gives an overview of French companies with an LTE score of over 50 out of 100. All scores and data are as of 21 February 2024. A score over 50 means a sponsor is likely to exit.

| Company | LTE Score | Sponsor | Sector |

|---|---|---|---|

| Entoria | 62 | Seven2 SAS | Financial Institutions |

| RAD-x SAS | 61 | Gilde Healthcare Partners BV | Technology |

| Groupe Premium CGP | 60 | Eurazeo; Blackstone; Montefiore Investment SAS | Financial Institutions |

| Laboratoires DR NG Payot SAS | 59 | LBO France SA | Consumer & Retail |

| Vernet SAS | 59 | Stirling Square Capital Partners | Industrials |

| Digit RE Group SASU | 59 | La Financiere Patrimoniale d’Investissement | Business Services |

| Heroiks Media SAS | 59 | LBO France SA | Business Services |

| Echosens SA | 59 | Astorg Partners SA | Healthcare |

| Menix SAS | 58 | Five Arrows Principal Investments; Turenne Capital Partenaires SASU; Keensight Capital SAS | Healthcare |

| Lynx RH | 58 | Montefiore Investment SAS | Business Services |

| Ileos Group SASU | 58 | Trustar Capital | Business Services |

| InfoVista SA | 57 | Seven2 SAS; Thoma Bravo LLC | Technology |

| Harvest SA | 57 | Five Arrows Principal Investments | Technology |

| Sportfive Emea Apac SAS | 57 | HIG Capital LLC | Business Services |

| Europeenne des Desserts-Mademo… | 57 | IK Investment Partners Ltd | Consumer & Retail |

| Europe Snacks SAS | 56 | Seven2 SAS | Consumer & Retail |

| AD Education SAS | 56 | Ardian | Business Services |

| IDEX SA | 56 | Antin Infrastructure Partners SAS | Energy & Natural Resources |

| Fonderie de Bretagne SAS | 55 | Callista Private Equity GmbH & Co KG | Industrials |

| DL Software SA | 55 | TA Associates Management LP | Technology |

| EcoVadis SAS | 54 | Bain Capital | Technology |

| Sagemcom Group SAS | 53 | Charterhouse Development Capital Ltd | Communications, Media & Entertainment |

| Morpho | 53 | Advent International LP; Bpifrance Investissement SAS | Technology |

| Horus Pharma SAS | 53 | Eurazeo SE | Healthcare |

| Morel Diffusion | 51 | Evolem SA | Industrials |

| Inetum SA | 51 | NB Renaissance Partners Holdings Sarl; Bain Capital | Technology |

This year has so far heralded promising auctions including the EUR 1bn-plus sale of French information technology (IT) consulting firm Devoteam.Its owners KKR [NYSE:KKR] and founders Stanislas and Godefroy de Bentzmann, mandated Messier & Associés but still weigh options, this news service reported earlier this month.

Meanwhile, Bain Capital and NB Renaissance-owned French IT services provider Inetum is also weighing a sale of its software division with Goldman Sachs and still with no clear timeline this year, as reported this month. Inetum has an LTE score of 51.

Blockbuster year for fees despite headwinds

Investment bankers pocketed USD 1.3bn (EUR 1.2bn) in M&A fees from France in 2023, a 19% drop from 2022 figures, as dealmakers recalibrated to the higher interest rate environment, according to Dealogic data.**

The revenue data tracks deal closes instead of deal announcements. Still, a figure at north of USD 1bn has only been breached three more times previously in France indicating the revenue drop from previous years was not as drastic as in other European countries and the pipeline remains strong.

Strategic-led M&A, versus financial-sponsor driven, contributed to about 57% of total revenues; while financial institutions, technology and industrials together brought in more than half the M&A revenues.

“Markets may be less volatile but macroeconomic conditions could still change abruptly so that a solid preparation work is key to identify the right targets and the best window of opportunity to formally kick off a deal,” Head of M&A for France at Bank of America, David Ecot said.

“In this context, well-established advisors are best placed to deliver bespoke guidance to prevent deals from falling apart on the back of adverse market conditions, clashing valuation expectations or unexpected regulatory issues,” Ecot added.

“In addition to extensive research well ahead of deals, clients are looking for stable and trusted teams of advisors with proven expertise in résilient sectors with revenue predictability such as software, IT services or healthcare,” Franck Portais, CEO at Alantra France and co-chairman of Investment Banking, said.

With improved market conditions, well-funded large corporates which registered solid financial results and cash-rich private equity (PE) funds still sitting on a backlog of delayed auctions are expected to move French M&A away from record lows of 2023, French bankers and lawyers agreed.

After a first attempt more than a year ago Ardian-backed engineering, technology and consulting expert Expleo Group should be back on the auction block this year, as previously reported.

Meanwhile, 21 invest-owned contract development manufacturing organisation (CDMO) Synerlab, is coming back up for sale this year with Natixis Partners advising after a failed attempt in 2020 because of the pandemic, Mergermarket reported.

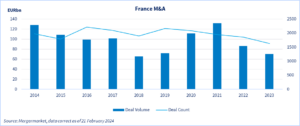

In terms of aggregate volumes of announced deals, 2023 was the lowest year since 2018 for French M&A, Mergermarket data shows. There was a 19% decrease (EUR 70.1bn across 1,636 deals) compared to 2022 (EUR 86.3bn with 1,857 transactions) due to a retreat of PE deals, as reported.

by Arezki Yaïche and Myriam Mariotte in Paris with analytics by Santosh Shetty and Anjali Piramal

*Mergermarket‘s LTE predictive analytics assign a score to sponsor-backed companies to help track and predict when an exit could occur through M&A, an IPO, a direct listing or a deSPAC transaction.

**Dealogic Revenue Data: Dealogic uses a proprietary revenue model to estimate investment banking fees across four key products: M&A, ECM, bonds or debt capital markets (DCM), and loans. France revenues indicate fees generated by fee-payers based in that market.

Advisory opportunities – French highlights from Mergermarket’s proprietary coverage:

Malteries Soufflet (14/02)

Malteries Soufflet, a malting business majority-owned by French agriculture cooperative InVivo, keeps screening the market for new acquisitions serving its objective to boost malted barley production capacity and quality worldwide, InVivo’s CEO Thierry Blandinières said. Last year, Malteries Soufflet kicked off the circa EUR 1bn acquisition of Australian peer United Malt Group [ASX:UMG], recently effective. It was then advised by Goldman Sachs and Credit Agricole CIB but would mandate other financial advisors depending on the situation.

Onoré (13/02)

French specialty food company Onoré backed by Dutch fund Waterland Private Equity is pursuing acquisitions of fellow European specialty food providers, Waterland investment director Xavier Rehman Fawcett said. It is interested in suppliers of frozen foods in the EU, UK, or beyond and would pursue either smaller deals which fit in well with the portfolio strategy or larger ones with a target EBITDA of EUR 10m and above. Onoré Waterland’s expertise in scouting for deals but is open to local advisor approaches for due diligence.

Kinvent (08/02)

Kinvent, a French-Greek developer of data solutions for physiotherapists, is holding discussions with three potential acquisition targets, founder and Chairman Athanase Kollias said. Kinvent’s management plans to mandate a financial advisor to originate new deals and is open to pitches. The French company will use the proceeds to fund R&D and international growth, notably by acquiring peers in Europe, North America and Australia. Kinvent aims to focus on profitable or about-to-break-even companies, with EUR 1m to EUR 4m in revenues. It will mainly look into peers, experts in online training for physiotherapists and distribution networks.

CLAREO Lighting (07/02)

CLAREO Lighting, a French manufacturer of LED lighting solutions for businesses, will look at acquisitions in France and Europe in 2024 following last week’s EUR 35m investment, President and founder Olivier Maschino said. The company, which has EUR 40m in revenues, is starting to screen the market and is targeting companies with revenues of EUR 3m to EUR 20m. CLAREO is also interested in expanding in new markets such as the Netherlands, Germany, Poland and Spain. The company has not mandated any financial advisor yet.

Greenerwave (01/02)

Greenerwave, a French electromagnetic wave control technologies developer, will consider mandating a US-based advisor in early 2025 as it seeks an entry into the US market via acquisitions, founder and CEO Geoffroy Lerosey said. The Paris-based company plans to expand in the US market from 2025 and will consider acquisitions to gain clients and penetrate its defence market, which will require it to be US-based. The mandated advisor will help it with the target search. The company will look for antenna developers or manufacturers, with aging technology but with a solid client base.

Limatech (31/01)

French Limatech, which produces new-generation batteries for use in aviation and defence, is looking to raise a EUR 10m to EUR 20m Series A round, co-founder and Director General Maxime Di Meglio said. The start-up is looking for industrial partners, ideally from the aerospace and technology sectors, for the raise. It would also welcome approaches from corporates, family offices, and private equity firms; and from financial advisors who can help with the fundraising.

Shippingbo (18/01)

French Shippingbo, which publishes logistics-automation software for e-retailers, will consider M&A to gain a foothold in new European markets from 2024, Chief Strategy Officer Romain Parent said. Shippingbo will enter Spain this year and is scouting the market for local peers. The company has not put a limit on target size and does not rule out a “significant” acquisition. It could also raise a Series B round exclusively to finance acquisitions, especially of a large target, up to the same revenues as Shippingbo. It could mandate a financial advisor for a Series B.

Cooper Consumer Health (17/01)

Cooper Consumer Health is interested in further buys among European over-the-counter consumer healthcare brands, Henri Vindevogel, investment manager at minority owner Damier Group said. Cooper, a Paris-headquartered, pan-European platform company, is interested in “brands to plug and play” in the retail healthcare consumer space. There is no set target size fort its potential M&A deals. The company has an internal M&A team based in Paris, and a network of advisors it works with but would also be open to sell-side advisor approaches.

Braincube (13/12)

Braincube, a French developer of AI-based software for the industrial sector, will be opportunistic on acquisitions in 2024-2025, following its Series B round, CEO Laurent Laporte said. The EUR 25m revenue company will be hiring a new CFO in the upcoming weeks, who will be looking at acquisition opportunities. It has not mandated advisors at this stage. The company is eyeing two types of target: startups developing AI solutions in the industry field, but which need access to clients; and consulting firms in a specific geography or targeting a specific client industry, such as pharma for example. On the consulting side, targets with up to 250 employees are being considered.

Umiami (05/12)

Umiami, a French startup specializing in the production of plant-based food similar to meat and fish, will seek a Series B of more than EUR 50m in 2024, Chief of Staff and shareholder Lucas Jacquet said. The company has raised EUR 110m to date, including some EUR 40m in non-dilutive financing. Umiami has not worked with any external advisor to date but will review its needs going forward. Outside of Europe, Umiami is interested in hearing from investors with expertise in the US, and in Asia as it sees opportunities to enter this region. In addition to venture capital firms and family offices, the company is also interested in hearing from sovereign wealth funds as it seeks long-term investors.

The following table gives an overview of key advisory appointments for France (01/01/2024 – 21/02/2024):

| DATE | COMPANY NAME – HEADLINE | INTELLIGENCE TYPE | DEAL SIZE / FINANCIALS | ADVISORS | SECTORS |

|---|---|---|---|---|---|

| 20/02/2024 | Dentego sponsor G Square relaunches sale with several advisors – report | Companies for sale, Private equity related | EBITDA between EUR 20m and 25m | PJT Partners, financial | Medical |

| 19/02/2024 | Sipartech owners hire advisors for sale – sources | Auction/Privatization, Cross Border, Takeover situations | EUR 30m of EBITDA in 2023 | UBS, financial | Real Estate, Telecommunications: Hardware, Telecommunications: Carriers |

| 16/02/2024 | Veolia to launch sale of sulfuric acid regeneration business – sources | Auction/Privatization, Companies for sale, Private equity related | marketing the business off EBITDA of up to USD 80m | Perella Weinberg Partners, financial; Messier & Associes, financial |

Chemicals and materials, Services (other) |

| 15/02/2024 | Synerlab sale comes back with Natixis Partners – sources | Auction/Privatization, Companies for sale, Private equity related | EUR 20m-EUR 22m EBITDA | Natixis Partners, financial | Medical, Medical: Pharmaceuticals |

| 09/02/2024 | Devoteam owners plot H2 24 sale for IT consulting firm – sources | Auction/Privatization, Companies for sale, Cross Border, Private equity related | EBITDA in the region of EUR 140m to EUR 150m | Messier & Associés, financial | Computer services, Computer software |

| 02/02/2024 | Inovie sponsor Ardian likely to relaunch auction with Rothschild & Co, Barclays as advisors – report | Auction/Privatization, Companies for sale, Private equity related | EUR 900m turnover and EUR 250m EBITDA in FY23 | Rothschild & Co, financial; Barclays, financial |

Financial Services, Medical |

| 01/02/2024 | Inetum weighs sale of software business with Goldman Sachs – sources | Companies for sale, Private equity related | EUR 150m in revenues | Goldman Sachs, financial | Computer services, Computer software, Services (other) |

| 24/01/2024 | Lemonway mandates UBS to find new investors ahead of M&A push – Executive Chairman | Bolt on/Opportunistic, Companies for sale, Cross Border, Large/Transformational Acquisitions | EUR 5m in net income in 2023; EUR 32m in revenue in 2023 |

UBS, financial | Computer software, Services (other) |

| 12/01/2024 | French jeweller Messika sees initial bids from sponsors – sources | Auction/Privatization, Companies for sale, Private equity related | EUR 100m in revenue | JPMorgan, financial | Consumer: Other |

| 11/01/2023 | Meanings taps Natixis Partners for Gaïana exit – sources | Companies for sale, Private equity related | EUR 9m-EUR 10m in EBITDA and EUR 35m in revenues for FY23 | Natixis Partners, financial | Agriculture, Computer software, Consumer: Foods, Consumer: Other |

| 09/01/2023 | Federation Studios picks Morgan Stanley to explore sale options – sources | Auction/Privatization, Private equity related | EBITDA in the region of EUR 40m-EUR 45m | Morgan Stanley, financial | Media |

| 05/01/2023 | ErgoSante hires Messier & Associes to seek minority sponsor – report | Companies for sale, Private equity related | EUR 23m turnover and EUR 3m EBITDA in 2022 | Messier & Associes, financial | Manufacturing (other), Medical |

The following table gives an overview of French active auctions:

| Target | Days in | Phase | Target size | Valuation check | Vendor | Financial advisor | Bidders | Sector | Latest update |

|---|---|---|---|---|---|---|---|---|---|

| Altice Europe (France Data centre) | 455 | Second round | EUR 36m EBITDA | EUR 1000m EV | Altice Europe | Perella Weinberg Partners | 4 | Computers & Electronics-Services | 8-Sep-23 |

| Le Wagon | 169 | Pre-launch | EUR 40m 2023 Projected Fiscal Year Revenue | Cathay Capital | Amala Partners | Professional Services-Schools/Universities | 5-Sep-23 | ||

| Hub One | 174 | Pre-launch | Aeroports de Paris | Barber Hauler Capital Advisers | Telecommunications-Wireless/Cellular | 31-Aug-23 | |||

| Eres | 182 | Pre-launch | IK Investment Partners | Professional Services-Management Consulting | 23-Aug-23 | ||||

| Juvise Pharmaceuticals | 195 | Undetermined | Undisclosed | Lazard | Healthcare-Drugs/Pharmaceuticals | 10-Aug-23 | |||

| Ipackchem Group | 348 | First round | EUR 60m-65m 2023 Projected EBITDA | SK Capital Partners | Goldman Sachs | 2 | Chemicals-Plastic | 3-Aug-23 | |

| Sabena Technics | 369 | Second round | EUR 700m 2023 Fiscal Year Revenue | Sagard, TowerBrook Capital Partners, Bpifrance Investissement | Lazard | 14 | Transportation-Airports | 17-Jul-23 | |

| UpSlide | 225 | Second round | EUR 20m Revenue | Closely Held | Amala Partners | Computers & Electronics-Software | 11-Jul-23 | ||

| Europa Group | 226 | Pre-launch | EUR 123m Revenue | Abenex Capital | Alantra | Professional Services-Miscellaneous | 10-Jul-23 | ||

| Groupe Sinari | 322 | Second round | EUR 11.5m 2023 EBITDA | NewAlpha Verto Capital | Bryan Garnier | 6 | Computers & Electronics-Software | 6-Jul-23 | |

| Sogelink | 231 | Pre-launch | EUR 131.4m 2022 Fiscal Year Revenue | Keensight Capital | Raymond James | Computers & Electronics-Software | 5-Jul-23 | ||

| La Rosee | 238 | Second round | EUR 15m-18m 2023 Fiscal Year EBITDA | 10x EBITDA | Closely Held | Lazard | 2 | Retail-Miscellaneous | 28-Jun-23 |

| Pure Trade Worldwide | 245 | Second round | EUR 80m Revenue | Sparring Capital | Rothschild | 4 | Professional Services-Miscellaneous | 21-Jun-23 | |

| Staci | 488 | Second round | EUR 800m Revenue | > EUR 1000m EV | Ardian | BofA Securities, Societe Generale | 8 | Transportation-General Logistics/Warehousing | 11-Jun-23 |

| Groupe Point Vision | 320 | Pre-launch | > EUR 16m EBITDA | Ares Management | CASE Corporate Finance | Healthcare-Hospitals/Clinics | 7-Apr-23 | ||

| Altice Europe (Portuguese data centre) | 400 | Second round | EUR 10m EBITDA | Altice Europe | Perella Weinberg Partners | 2 | Telecommunications-Cable Television | 5-Apr-23 |