Corporate carveouts expected as companies prune portfolios

- Tariffs complicate diligence process

- Industrials, fintech sectors to watch

The US is likely to see more corporate carveouts this year, but tariff-related economic uncertainty may delay execution timelines and extend due diligence.

Shifting supply chains and evolving customer channels are increasingly encouraging companies to redefine their core operations, upping the number of divestitures of assets once considered core to the business, said Andrea Guerzoni, global vice chair at EY-Parthenon. Recent tariff and trade uncertainty is likely to “accelerate the intensity” of those portfolio reviews and could mean more activity in 2H25 and into 2026, he added.

Last year’s uptick in divestitures valued between USD 1bn and USD 5bn “signaled an increased willingness among companies to make bold portfolio decisions,” Guerzoni said. But that development “may be disrupted” by uncertainty this year, making smaller or undisclosed valuation deals most common, he added.

Increased uncertainty across economic, trade, and geopolitical landscapes has tempered broad M&A optimism seen at the end of 2024 and into the beginning of 2025.

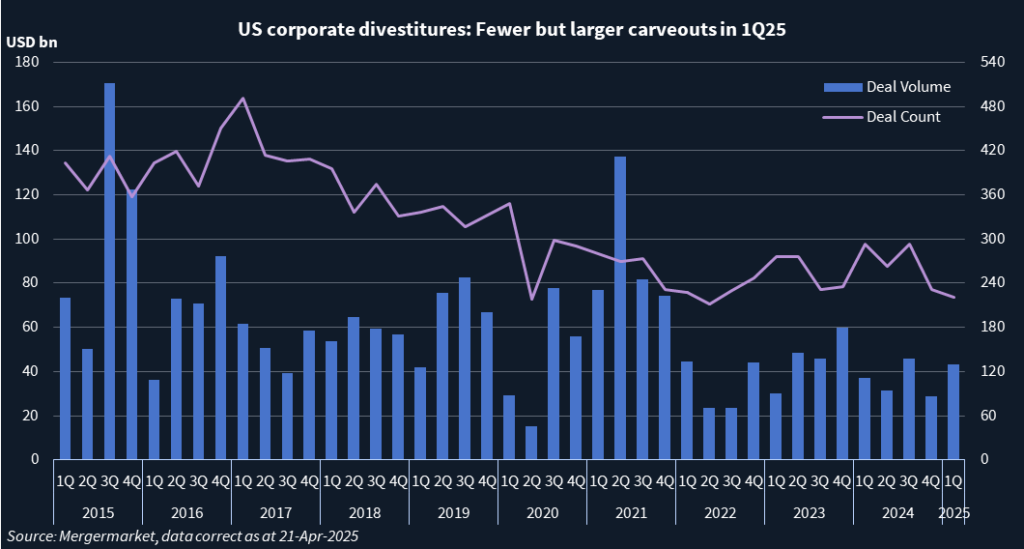

Although the first three months of the year saw the fewest corporate divestitures announced in any start to a year in the last decade, deal volume was the highest first-quarter volume since 2022, according to Mergermarket data. The US saw 221 transactions announced during 1Q25 totaling USD 43.07bn.

‘Wait-and-see’ mode

Ongoing uncertainty around tariffs and skepticism around the Trump administration’s 90-day pause has put numerous companies in a “wait-and-see” mode, said Keerthika Subramanian, partner at Winston & Strawn.

“Carve-outs, in particular, are deeply impacted by this environment,” Subramanian said, noting tariffs complicate the diligence process. “Buyers now need to thoroughly assess exposure to tariffs across the supply chain, which requires more time and resources.”

It also complicates valuation, as exposure to tariffs must be priced in, and legal drafting, as agreements must now explicitly account for tariff implications, she said.

Eyes on industrials, fintech

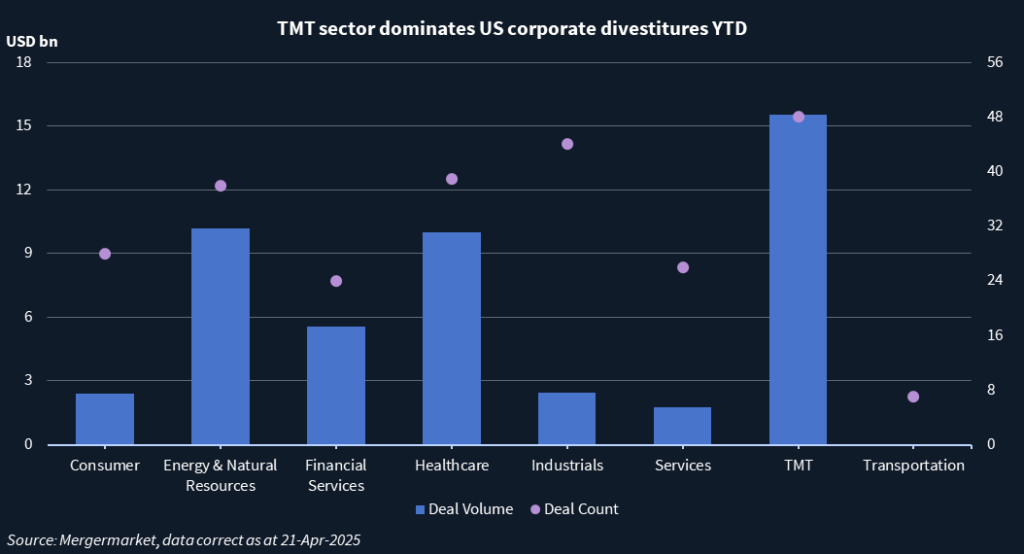

Industrials is one space to watch, given geopolitical and strategic factors are likely to drive heightened activity, EY’s Guerzoni said. The sector has seen the second highest deal count year-to-date (21 April), with 44 transactions totaling USD 2.45bn, according to Mergermarket data.

The aerospace and defense segment (included within industrials) continues to see an uptick in deal activity, including in corporate divestitures, one sector banker said. While tariffs will have an effect on some deals, especially for manufacturing-related assets, buyers will still pay for high-quality assets, he said, pointing to Leggett & Platt’s sale announcement earlier this month of its aerospace business to Tinicum in what ended up being around a 9x to 10x EBITDA multiple.

Boeing on 22 April announced it agreed to sell portions of its Digital Aviation Solutions business – including its Jeppesen, ForeFlight, AerData, and OzRunways assets – to Thoma Bravo in an all-cash transaction valued at USD 10.55bn.

“If anything, maybe there’s a buying opportunity for someone if a company wants to get rid of an asset,” the aerospace and defense banker said.

A fintech banker said he expects more carveouts from fintech companies given the sector’s historical focus on consolidation and the need to prune portfolios. Last week, payments giant Global Payments agreed to buy Worldpay from FIS and GTCR for USD 24.25bn, simultaneously selling its issuer solutions business to FIS for USD 13.5bn.

Global Payments was also reportedly seeking buyers for its payroll and Active Network businesses. Vista Equity Partners has launched the sale of Finastra’s Treasury and Capital Markets unit, Mergermarket reported last month.

The fintech banker is actively working on several carveouts and said his deals won’t be extremely price sensitive because carveout assets for sale are typically non-core businesses that will be less valuable.