Convertible bond issuance on pace for best year since 2021 – ECM Explorer North America

Convertibles bonds issuance has surged across the first half of the year, with 2024 now on track to surpass the previous year in the months ahead.

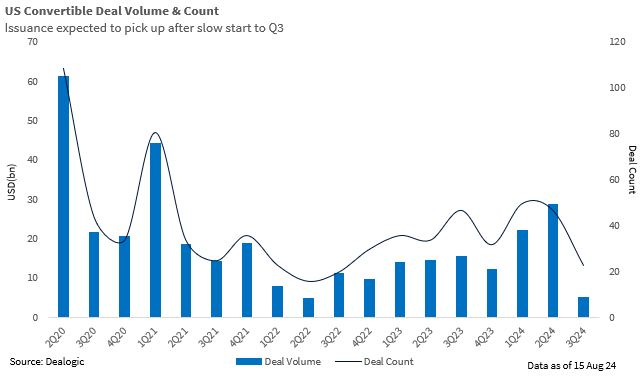

Issuance has reached USD 56.4bn in total value from 120 convertible deals so far this year, according to Dealogic. The numbers are almost on par with 2023’s full-year volume of USD 56.8bn. Upcoming issuers could soon bring numbers closer to the USD 96.4bn recorded in 2021, although they are unlikely to reach the high-water market established by 2020’s USD 118.4bn.

The largest volume came in 2Q, which recorded a staggering USD 28.9bn from 46 deals – an uptick from the promising start of USD 22.2bn in 1Q.

Issuance in the first half of the year marked the busiest two-quarter period since 2021, according to Bryan Goldstein, head of convertible bonds origination at advisory firm Matthews South.

“This year’s annualized volume significantly exceeds what we saw last year and the year before. While it may not reach the levels seen in 2020, there has been a wide variety of issuers from different sectors tapping the market,” he said.

Many bonds issued in 2020-2021 across all classes (straight debt, lower interest rate alternatives) are now needing refinancing, providing a strong tailwind for the market, he explained.

This third quarter, meanwhile, dipped significantly as earnings and the summer period stood in the way of issuance, recording around USD 3.8bn from 17 deals.

The third quarter tends to be slower both due to the summer season and the window when companies start approaching blackout periods preceding earnings. Issuers contemplating potential reductions in interest rates will weigh whether to enter the market now or wait until after rate cuts.

Alibaba [NYSE:BABA] has so far been the biggest CB deal of the first half, raising a record USD 5bn in May, followed by the March USD 2.3 CB of chemicals manufacturer Albermarle [NYSE:ALB], JD.Com [NASDAQ:JD]’s May USD 2bn as well as GlobalPayments [NYSE:GPN]’s USD 2bn earlier this year.

Market volatility in the runup to the US presidential election could affect volumes, Goldstein cautioned. Issuers may aim to enter the market about a month before the election to avoid this volatility, resulting in a somewhat front-loaded issuance schedule, he said.

Afterward, there could be a quieter period with issuance at a slower pace, he added.

The head of convertible bonds of a large asset management firm shared a positive outlook on upcoming issuance.

The end of the earnings blackout period — which prevents executives, directors, and employees from trading the company’s stock — should see more companies coming to the market, he said.

Overall yields in the credit market remain elevated, even with some rate cuts priced in, so the case for CBs to save interest costs remains strong, he added, as they usually offer lower interest rates compared to regular bonds by virtue of being converted into company stock.

Goldstein found “good connectivity between issuers and investors. Most deals have resulted in bonds trading up, leaving both issuers and investors satisfied.”

“If a company has a convertible bond outstanding, it’s not uncommon for investors to approach the company without any prior information, expressing interest in a new CB that could repay the existing bond. When top 10 holders reach out to suggest a deal, it increases the willingness of issuers to tap the market,” he said.