Clean energy firms face funding suspension, spurring M&A activity

- IRA funding freeze hits cleantech

- Deal activity seen rebounding in 2H25

- Valuations discounted by 1x-2x revenue

A sudden suspension of funding by the new US administration is expected to spur a wave of consolidation among cleantech companies. President Donald Trump’s executive order on his first day in office froze funding disbursements made through the Inflation Reduction Act (IRA), which had provided tens of billions of dollars to clean energy firms from 2022 to 2024.

The abrupt halt in federal funds has left many companies struggling to execute projects due to a shortage of working capital, raising questions about their survival. “Anyone who relied on that will be strapped for cash and will face major hurdles until that grant funding comes back,” said a Texas-based M&A advisor. “M&A will start heating up as other people see opportunities.”

These companies are expected to start coming to the market in the second half of the year, the advisor said.

Clean technology companies in the US and Canada are struggling to secure funding from private investors, with some pulling back due to geopolitical risks, according to CFO Bett Summers at Hydrostor, a Toronto-based developer of long-duration energy storage systems. Trump’s aggressive policy stance has also created uncertainty. “Typically, investment funds pull back until things get more stable. It’s hard for such companies if you don’t have the funding because you can’t move forward,” Summers added.

Consolidation out of chaos

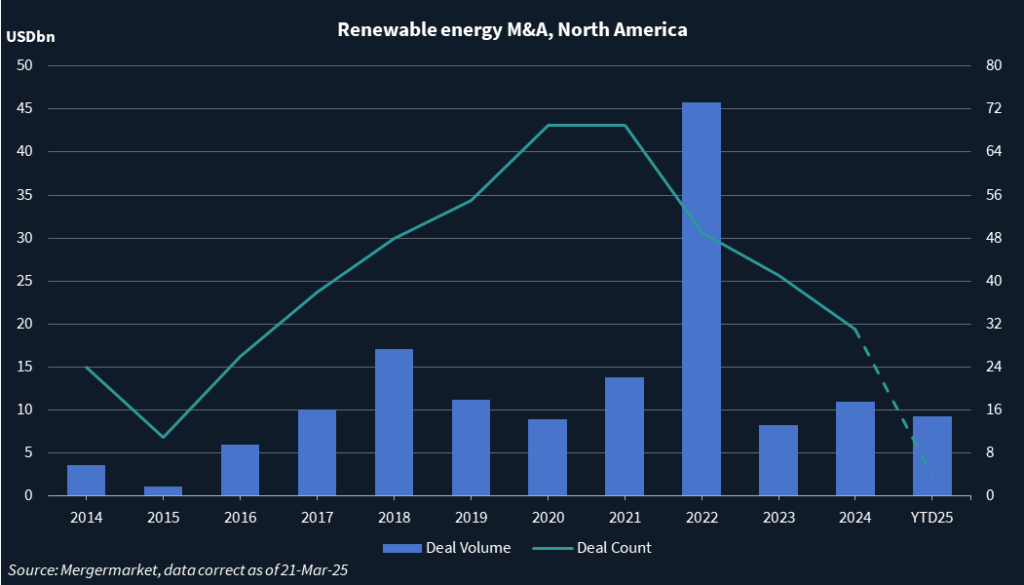

Deal volume in North America’s renewable energy sector peaked at USD 45.8bn in 2022, the year the IRA was passed into law. Deal count has been on a downward trajectory since peaking at 69 transactions in 2021, according to Mergermarket data.

In the year to date (21 March), deal volume totalled USD 9.2bn across four transactions, led by Innergex Renewable Energy’s USD 6.73bn take-private by pension manager CDPQ and TPG’s USD 2.2bn buyout of Altus Power, both announced in February.

Amid the policy chaos, there could be forced consolidation, according to a top executive at another clean tech company based in Texas. “There is confusion in the marketplace and that is spurring some of these M&A events, without looking at the long game. Companies could be bought for pennies and their technology absorbed by other providers,” the executive added.

Financially sound companies such as Ampure, a Monrovia, California-based electric vehicle (EV) charging solutions provider, are readying themselves to latch on to the opportunity, according to Global CRO and CMO John Thomas. Most small to mid-sized EV charging firms that relied on incentives provided by the IRA are in “survival mode,” he said. The move is expected to open a “spectrum” of acquisition opportunities for companies like Ampure, Thomas added.

Valuation discount

Valuations have already come down from the “frothy valuations” of 2022 and 2023. Because many cleantech firms are being pushed into a sale due to lack of funding, acquirers can demand a discount, said the Texas-based M&A advisor. Depending on the company size and business model, a valuation discount of 1x to 2x revenue is available, bringing valuations to below 10x revenue.

Any business that makes money and isn’t reliant on tax credits will be sought after, unlike those built on tax credits and subsidies, the advisor added.

Overall, the balance between energy security and decarbonization is delicate given recent geopolitical developments, according to Jose A. Moran, a partner at Baker & McKenzie.

There is now a universal recognition that the build-out of clean energy technologies has not been fast enough to meet growing global energy demand, Moran added.