Canada’s dealmakers undaunted by leadership void and tariff threat – Dealspeak North America

Canadian dealmakers expect 2024’s positive momentum in M&A to carry over into 2025 despite Donald Trump’s tariff threat and the likelihood of a domestic change in government before year-end.

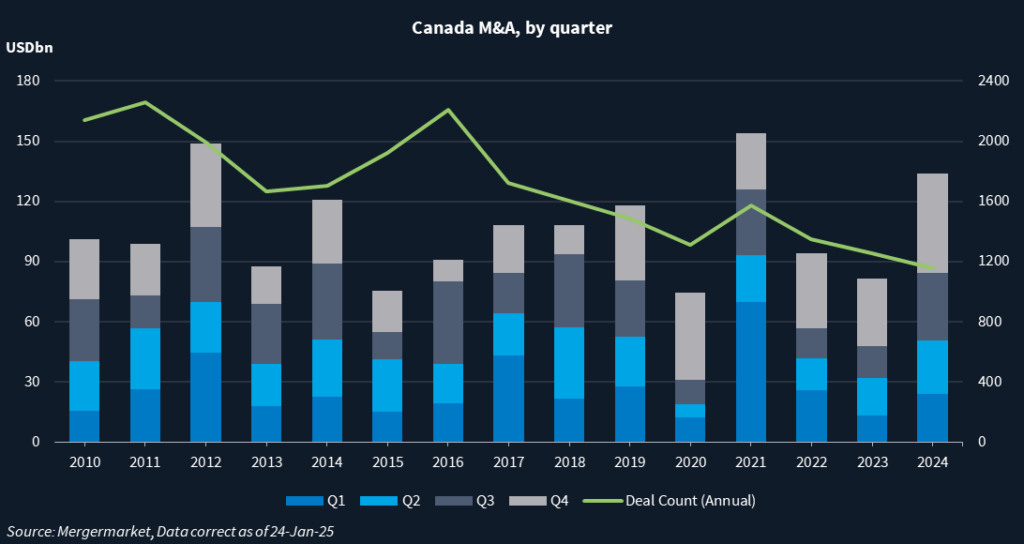

Canada’s M&A volume in 2024 jumped 64% year over year to USD 133.7bn (CAD 192.1bn), the second highest in a decade, according to Mergermarket data. The largest deal was TC Energy’s [TSX, NYSE:TRP] USD 10bn spin off of its liquids pipeline business South Bow in October.

That positive momentum is expected to continue on the back of lower inflation, stabilized interest rates, and the large, accumulated cash surpluses of companies and private equity firms. Also driving activity will be the need for PE to exit portfolio companies as they seek liquidity for investors, while the likelihood of a more merger friendly regulatory environment in the US also should aid cross-border transactions.

PE resurgence

Financial sponsors are expected to continue playing an important role in dealmaking, focusing mostly on mid-market transactions amid a shortage of larger targets, said Dominique Carli, an associate at Bennett Jones.

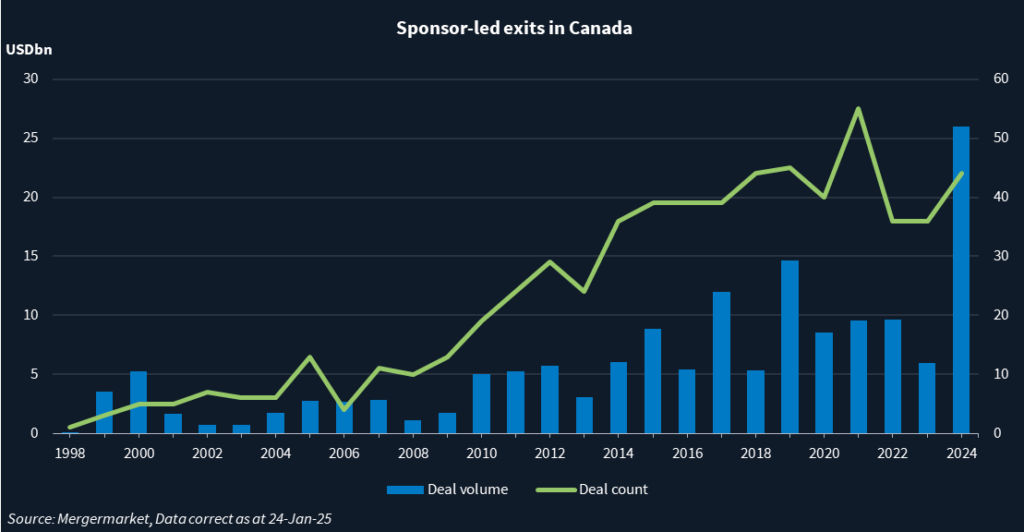

Additionally, a large number of sponsor exits were delayed in 2024 and are expected to happen in 2025, she added.

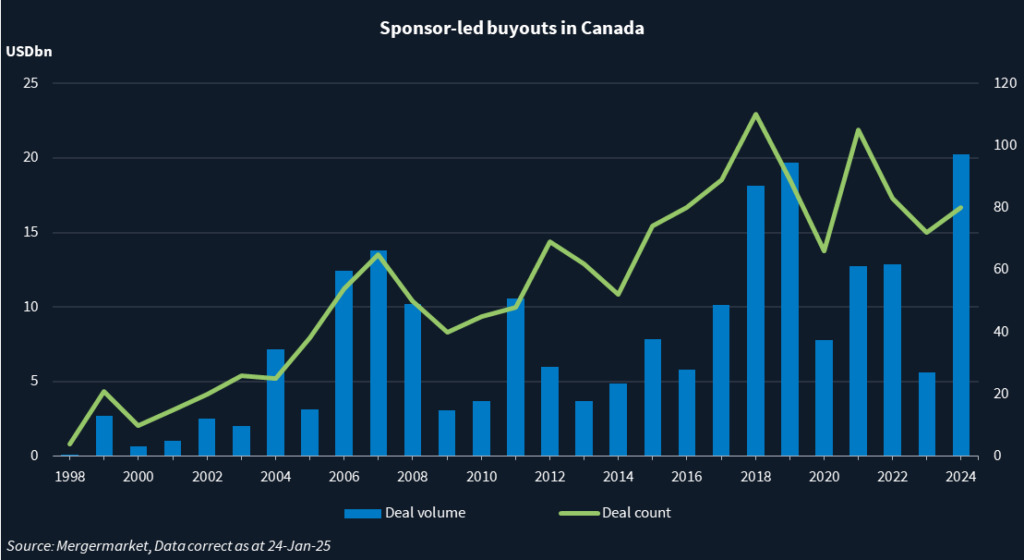

The PE comeback in 2024 – something this Dealspeak column predicted at the start of the year – was dramatic (see charts below).

Sponsor-led buyout volume in Canada last year reached USD 20.3bn, up 259% year over year, while sponsor exits rose 333% to USD 26bn, according to Mergermarket data. The proposed USD 9.7bn buyout of securities services provider Garda World Security by management and HPS Investment Partners last October was the year’s largest buyout.

Financial sponsors, mainly from the US, are likely to continue pursuing take-private opportunities given their bigger size, scope and scale compared to Canadian issuers, said Steven Cutler, a partner at Davies Ward Phillips & Vineberg.

About a dozen tech companies that went public in the last four years have gone private or delisted, including Montreal-based fintech Nuvei, which Advent International took private in November for USD 6bn.

A renewed focus on natural resources

Any hope for an uptick in initial public offerings (IPOs) following the November listing of women’s clothes retailer Groupe Dynamite [TSX:GRG] was dashed by Trump’s tariff threat, Cutler said. Without an IPO window, a number of Canadian companies could become targets to US buyers, while others might choose to pursue a US listing as a wink to Trump’s nationalistic agenda, he noted.

And yet, a new government in Canada could place a renewed focus on energy and mining and reinvigorate IPOs in the space, which forms “the heart of the Canadian capital markets,” said Cutler.

Prime Minister Justin Trudeau announced on 6 January he would resign, starting the clock on a federal election that must take place by the end of October.

Pierre Poilievre, leader of the Conservative Party and the frontrunner in the polls, has promised to scrap Trudeau’s tax on carbon. He also wants to lift caps on oil and gas emissions and loosen environmental regulations.

Although dealmakers struck far more technology deals than oil and gas transactions in Canada in 2024 (266 v. 57), the hydrocarbon industry continued to attract the most M&A volume with deals worth USD 29.2bn compared to USD 17.5bn in tech, according to Mergermarket data.

Trump card

Bennett Jones’ Carli admitted no one really knows if Trump will go ahead with his plans to impose tariffs and what impact it could have on the positive momentum in M&A.

Upon Trump’s inauguration last week, he said the US could impose 25% tariffs on Canadian and Mexican goods as soon as 1 February. The US president is using the threat of tariffs to pressure Canada and Mexico to start renegotiating the US-Mexico-Canada Agreement, which replaced the North American Free Trade Agreement in 2020, according to media reports.

More than 70% of Canadian exports are destined for the US. Primary metals, food and beverage manufacturing, chemicals, machinery and aerospace are the most vulnerable sectors to potential tariffs, according to a report by Desjardins Securities.

Canadian CEOs, however, are cautiously optimistic they will be able to navigate the tariffs with a combination of global expansion and homegrown productivity, according to PwC’s 28th Global CEO survey, which includes 167 CEOs in Canada. Canadian executives are slightly more likely than their global peers to make acquisitions and build new facilities in the US to mitigate the potential impact of Trump’s tariff, the survey added.

Helia Capital, the Toronto-based family office of real estate businessman Lee Piccoli, for example, is considering making its next investment in the US “to diversify the Canadian risk,” Managing Director Sebastien Koechli said.