Agtech’s long M&A drought may be lifting — Dealspeak North America

After two seasons of disappointing returns, a thought is germinating in the agricultural technology sector: 2025 might be a better year for M&A.

But maybe not by much.

“Agtech has really taken it on the chin in recent years,” said Ramsey Masri, CEO of agricultural data and analytics provider CeresAI. “The sector itself has grossly underperformed and is ripe for consolidation. Private equity will be shopping aggressively.”

Sector investor Jim Schultz, founder and managing partner of ag-focused private equity firm Open Prairie, sees opportunity but is hedging his bets.

“I still think we are in a bit of a difficult period,” he said. “It has not been great. A lot of companies are triaging, and others will be looking for rollups and consolidation opportunities.”

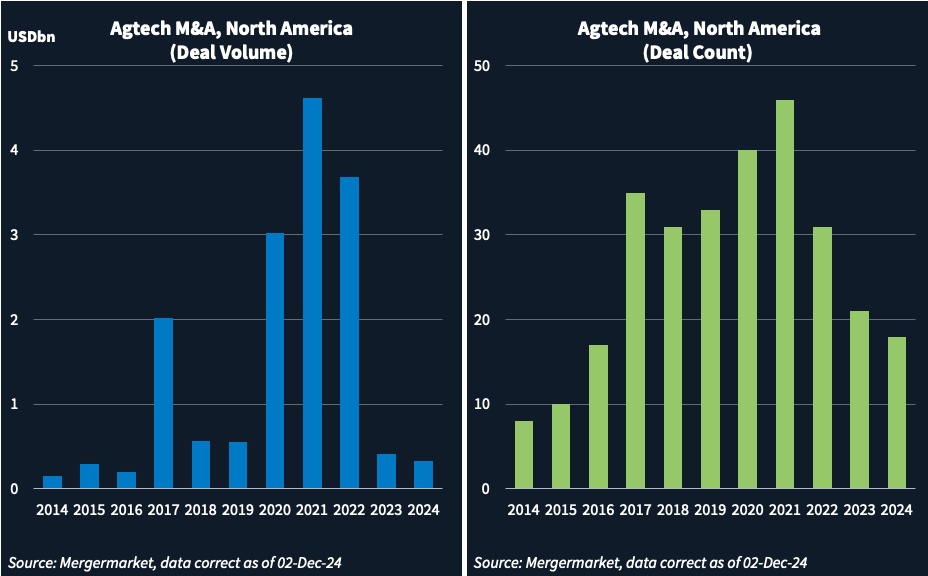

Deal volume and count in North American agtech has shriveled ever since 2021’s record harvest of 46 transactions worth USD 4.6bn, according to Mergermarket data. (see charts)

Overindulgence

What continues to plague the industry is what Schultz calls the influx of “space traveler money,” especially in the 2019-21 period. In his telling, Silicon Valley investors were the primary space travelers in question, in search of new frontiers but unfamiliar with the farm economy and longer investment timelines generally at play in the sector they sought to disrupt.

“They didn’t understand agtech and they ended up putting way too much money in,” he said.

Exhibits A, B and C of the age of excess, according to Masri and Schultz, might be San Mateo, California-based Farmers Business Network (FBN), a social network and online marketplace for ag; Benson Hill [NYSE:BHIL], a developer of genetically modified soybean varieties; and Boston-based Indigo Ag, a provider of plant microbes designed to improve yields.

FBN had a reported valuation of USD 3.9bn after raising a USD 300m Series G in November 2021, but Schultz estimates its current valuation is “probably 5% of what it was.” FNB declined to comment.

In 2012, Benson Hill went public through a blank-check merger with Star Peak Corp II at a USD 2bn valuation, but has a current market cap of USD 23m and is undergoing a strategic review.

Indigo Ag completed a funding round in 2023 at a USD 200m valuation, down from USD 3.5bn two years earlier.

From excess to success

Masri puts his own company, which has raised USD 85m to date and could seek more in 2025, in the category of overindulging on funding without enough financial discipline. Masri replaced CeresAI’s founder as CEO in 2022 and began to refocus the business on providing agricultural data to lenders, insurers and agribusinesses, and away from the original small farmer clientele. CeresAI is on a path to profitability, he said, and hopes to acquire one or more technology companies in 2025 as it works toward an IPO in several years.

One potential bright spot is among seed biotech companies that, through gene editing of seed traits, can make plants more resistant to herbicides, drought tolerant, or have higher protein content. Potential acquirers include global seed companies, like Bayer [ETR:BAYN], Corteva [NYSE:CTVA] and Syngenta.

Pairwise, a plant genetics company developing fruit, grain and vegetable varieties, raised USD 40m in Series C funding in September and counts Corteva and Bayer among its investors. It would like to go public after establishing itself as a reliably profitable business, CEO Tom Adams and CFO Lynsey Wenger recently told Mergermarket.

The fruit-science sector has already seen consolidation. In 2021, private equity group Bridgepoint acquired Sun World International, a global fruit genetics, R&D and licensing company, for undisclosed terms. In August 2024, Palm Desert, California-based Sun World acquired Biogold Group, a South Africa-based plant breeding and fruit genetics supplier, for undisclosed terms.

Animal and livestock health is another area that could be active in 2025. Earlier this year, Mason City, Iowa-based NutriQuest engaged Feed Marketing Advisors (FMA) to help identify acquisition candidates in animal research and product development, especially producers of nutraceuticals or regulated supplements, according to co-founder and CEO Steve Weiss. With more than USD 100m in revenue, NutriQuest is “scouring the globe for new technologies,” Weiss said.