Agriculture: Food producers’ M&A struggles may soon lift — Dealspeak North America

America’s food producers have had a tough time of late.

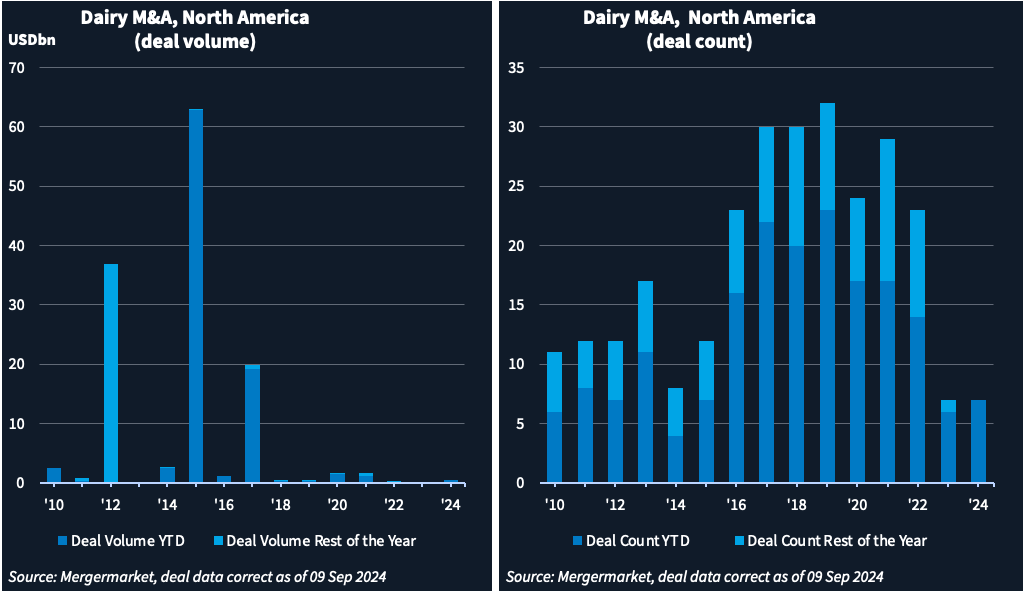

M&A activity in North American agriculture has sunk to some of the lowest levels on Mergermarket record.

Many producers of fresh produce, meat and dairy have undergone a period of distress in the last two years, as rocketing inflation destroyed consumer demand and soaring interest rates hurt those that had already agreed costly plant expansions.

It pushed several into survival mode, which involved selling assets to cut costs, shuttering plants, scrambling for injections of capital, and even flirtations with bankruptcy.

But the green shoots of a turnaround are showing. Deal activity in 2024 has inched up compared with the multi-year lows reached this time last year, according to Mergermarket data.

Many stressed companies have “already started to turn the corner and there’s been evidence of a bottom,” says Michael Seccuro of Intrepid Investment Bankers. “[There is] some visibility in the next 12 months that it’s starting to approach normalized numbers.”

Meat industry

The meat industry has been particularly hard hit, as runaway inflation turned consumers off the pricey proteins.

It led Tyson Foods [NYSE:TSN] to sell a poultry plant in Georgia to House of Raeford Farms in July on top of the six poultry facilities it shuttered in 2023. Smithfield Foods also closed its Vernon plant in California in June 2022.

Others have fallen into bankruptcy. Canada’s HyLife sold its pork processing plant in Windom, Minnesota in a bankruptcy auction to Iowa Premium Pork in June 2023.

For those with stronger balance sheets, this period of distress has been a buying opportunity, giving them the chance to acquire processing plants at a discount to replacement cost or appraised value, says Seccuro.

Another M&A bright spot is in “value-added” products such as cheeses, yoghurts, charcuterie and sausages, as well as “attribute-driven” products such as organic, heritage-breed, or pasture-raised meats or milk, Seccuro says.

In that vein, Tyson acquired Williams Sausage in February 2023, even while it was preparing to sell or shutter several meatpacking plants. Another example was Amylu Foods’ purchase of Klement Sausage from Tall Tree Foods in May.

Dairy decline

Dairy has suffered a secular decline in fluid milk consumption, as consumers move to plant-based milks instead. Consequently, many dairy producers and cooperatives have struggled. A case in point is Millenkamp Cattle, an Idaho-based dairy and cattle company, which received debtor-in-possession financing during chapter 11 proceedings in April.

Nonetheless, there are bright spots. Downstream players that make cheeses, yoghurts, kefirs or ice cream can still attract investors. Two recent transactions highlight this: Danone’s [EPA:BN] sale in January of Horizon Organic and Wallaby to Platinum Equity showed the enduring interest of ‘value-added’ or ‘attribute-driven’ dairy brands, particularly for private equity shops. Then in April, organic dairy product and ice cream maker Strauss Family Creamery landed an equity investment from Grounded Capital.

While acquirors are paying mid-single-digit multiples of EBITDA for commodity businesses, they are willing to pay high-single-digit to low-double-digit multiples for specialty products, according to Seccuro.

Fresh produce

Peddlers of fresh produce, because of its commodity nature, have largely struggled. The number of deals in fresh produce has dropped to the lowest level since 2016, even as deal volume has increased (see charts above).

Questions remain around what Dole [NYSE:DOLE] will do after it pulled the sale of its fresh vegetable business to Chiquita in April 2024 because regulators threatened to block the move on competition grounds.

Another fresh produce giant, Del Monte Foods, has been working with lenders to extend financing into the crucial pack season. Debtwire has given it a high likely to become distressed score of 79.

Consolidation is overdue in the produce sector, especially of family-owned businesses who are not ready to pass it on to the next generation, says Seccuro.

Agtech

One area that holds promise is technology that helps seeds produce higher yields. That is especially relevant in places afflicted by water shortages, such as California.

Gene editing seeds for certain traits, while still in its infancy, can help with that. Agricultural biotech companies are initially aiming to make seeds more productive, such as making them more resistant to herbicides. But they can design for other traits too, such as increased protein content in soybeans or non-allergenic peanuts.

Big seed companies, like Bayer [ETR:BAYN], Corteva [NYSE:CTVA] and Syngenta, have in-house programs there. Microcaps such as Cibus [NASDAQ:CBUS] and Moolec Science [NASDAQ:MLEC] are also trying to make inroads. Still early, consolidation is expected to increase after one of the first deals in that space saw Cibus merge with Calyxt in May 2023.

“Bankers will say to me, ‘there’s no Amgen or Genentech in agtech’. What they mean is there hasn’t been any big winners,” says one executive of a gene editing company. “I think there will be consolidation of some small companies that will allow them to think about how to compete.”