Advanced air mobility: The future of flight needs patient capital — Dealspeak North America

To many, the idea of whizzing around downtown Los Angeles in an electric air taxi seems more Jetsons fantasy than near-future reality.

But for many of the biggest names in aviation now is a great time to invest in advanced air mobility – or AAM for short. That is because valuations are down substantially from 2021’s highs and existing investors are in desperate need of fresh capital to continue executing their business plans, said Brian Flynn, managing director and cofounder of DiamondStream Partners.

“It’s really a kind of Hunger Games, in terms of who gets funded and who does not, so the terms are attractive now,” Flynn said at the Revolution.Aero conference in Redwood City, California earlier this month. DiamondStream has made nine investments in aviation companies – most of them Series A – and typically stays until there is an exit.

Patient capital – and lots of it – is key, added Gopal Rajaraman, a senior investment manager at Lockheed Martin Ventures at the same event. “It takes USD 1bn and a long time” to finance an AAM company, he said.

AAM is a new corner of the aerospace industry that encompasses not just vertical takeoff and landing (VTOL) aircraft – commonly referred to as air taxis – but also ultra-short takeoff and landing (uSTOL) planes, autonomous aircraft, electric seaplanes and blended-wing airframes. It includes the infrastructure to support those aircraft and the batteries, sensors and engines, which are often electric or hybrid-electric, that go into them.

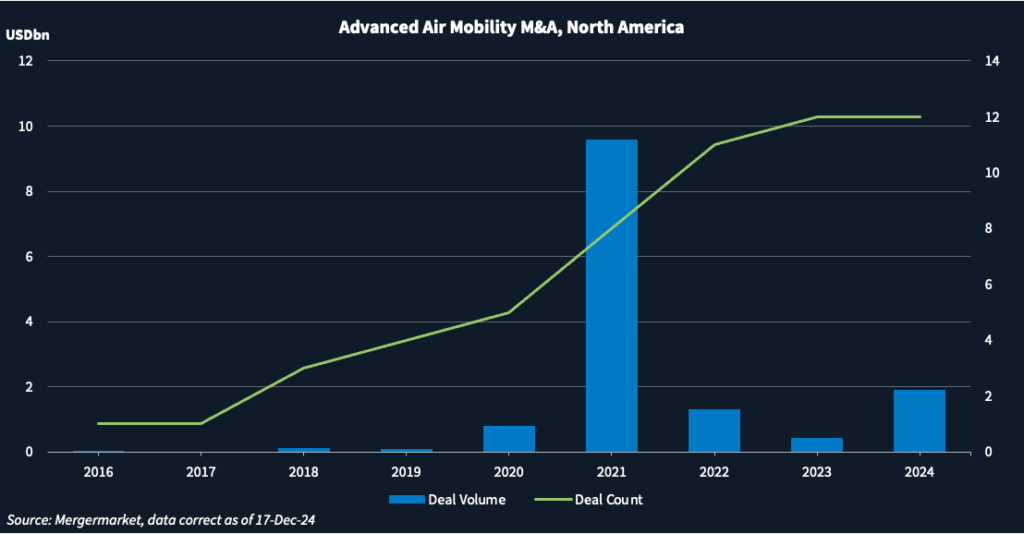

Dealmaking activity for such companies is at an all-time high in North America, with 12 transactions in the year to date (17 December), according to Mergermarket data. Deal volume was USD 1.9bn for 2024 YTD. It is the highest since a record USD 9.6bn in 2021, the year Joby Aviation [NYSE:JOBY] and Archer Aviation [NYSE:ACHR] both merged with special purpose acquisition companies (SPACs) and went public.

The trough of disillusionment

Many believe that if trailblazers Joby and Archer succeed, it will unleash a new wave of funding and M&A.

Both have raised billions of dollars in capital, but still require more investment. Joby raised USD 500m from Toyota Motor [NYSE:TM] in October and Archer raised USD 430m from United Airlines [NASDAQ:UAL] and Stellantis [NYSE:STLA] earlier this month to help fund development of a military VTOL with Anduril Industries.

Ever since going public in 2021, both Joby and Archer have traded mostly underwater, although shares have rallied in recent weeks.

Aside from sufficient capital, one of the biggest hurdles AAM startups face is landing the necessary safety and operational certifications from the Federal Aviation Authority (FAA). It helps that the FAA has an implementation plan – known as Innovate28 – which aims to scale AAM operations in the US in time for the 2028 LA Olympics.

Other hurdles include building the necessary infrastructure, gaining public acceptance, the competition faced from more mature companies, and financial sustainability.

“We are deep in the trough of disillusionment, trying slowly to come out,” said Rajaraman, in a reference to the Gartner Hype Cycle that describes a period of waning enthusiasm after the initial hype.

Much remains to be seen. Once the first AAMs receive certifications to operate, will people use those services as much as hoped? Current assumptions about future utilization are aggressive and if goals are not hit, investors will pull back.

Future modes of air transport need to be cost competitive with cars or trains to gain public acceptance, said DiamondStream’s Flynn, who co-founded and grew Volaris, a Mexican budget airline, by making it cost competitive with buses.

Lockheed Martin’s thesis

Lockheed Martin’s AAM investments include Electra Aero, developer of a hybrid-electric uSTOL, Elroy Air, which is building an unmanned hybrid-electric VTOL cargo plane, and Regent Craft, whose fully electric sea gliders would ferry passengers along coastal routes.

Lockheed Martin prefers to invest in hybrid-electric flight technology, which has a longer range than today’s fully electric technology.

Most of its AAM companies are early-stage startups with a prototype that are looking to raise more funding to go into production, Rajaraman told Mergermarket.

The defense contractor invests in game-changing companies that match its strategic vision. Buying them is not a part of the investment thesis. Instead, exits happen through an initial public offering or a sale to another strategic partner, he said. One exception was for portfolio company Terran Orbital, a spacecraft manufacturer.

Startups to watch

Startups investors are watching include Venus Aerospace, a Houston-based startup that aims to use hypersonic rocket technology to take passengers halfway across the globe and back in time for dinner. It raised USD 20m in Series A funding in 2022 and counts Airbus Ventures as an investor.

Another is Jetzero, a Long Beach, California-based startup developing a blended wing aircraft for 250 passengers. It claims its design cuts fuel burn and emissions in half. Current backers include DiamondStream, Northrop Grumman [NYSE:NOC], and Alaska Air [NYSE:ALK] .

A third is Skyports, a developer of landing infrastructure for AAM, which won a bid to operate a heliport for eVTOL aircraft in downtown Manhattan.

The last is closest to reality. Once operational, a whole new segment of the equity world will invest in the space, predicted Yotam Avrahami, of Next Generation Renewable Partners.