Andrade Gutierrez Engenharia 4Q23 Credit Report – Backlog boost offers strong hope for interest payments on 2029 bonds from June

Andrade Guiterrez Engenharia (AGE) signed an addendum to the BRL 3.1bn Las Placetas hydroelectric plant project in the Dominican Republic, bringing the size to BRL 4.7bn. Normally the Brazilian construction company doesn’t announce such project expansions, but it has also never had an addition as significant as this one, representing such a contribution to the overall backlog.

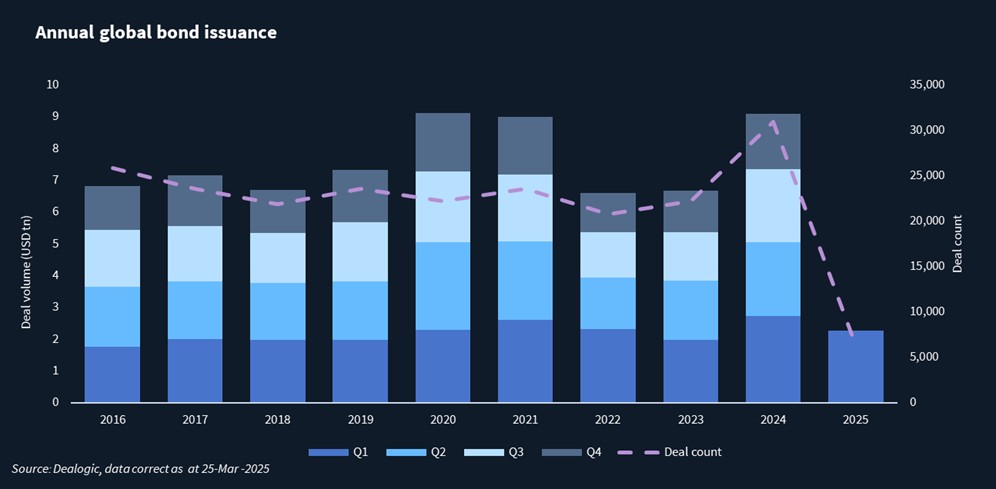

Las Placetas seems to be a project that has been going on forever, never executed at full speed. Initially it was going to be an 87MW hydroelectric power plant, and now it will be 300MW and the largest hydroelectric power plant in the Caribbean. It is expected to be completed by 2030. Execution is not linear, as we have learned, but if we simply assume a 7%-10% execution during 2024, we are talking about BRL 335m-BRL 480m incremental revenue for this year and, using an 8% EBITDA margin, BRL 27m-BRL 38m (USD 5.5m-USD 7.7m) incremental EBITDA. This will not be the only solution for AGE, but there is USD 37m in interest expenses due on the 2029 bond this year, and this would cover 15%-20% of that, which is not insignificant.

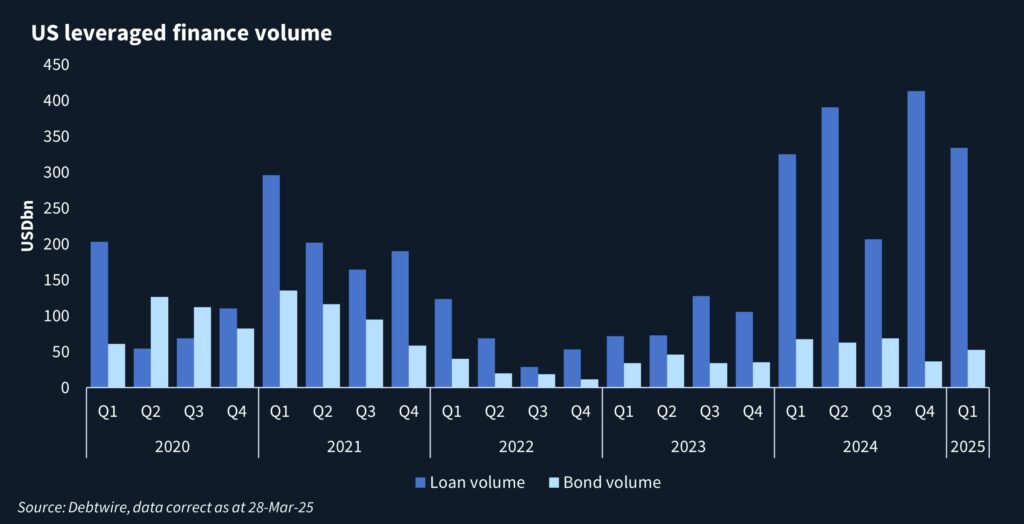

“Only in the first 4 months of 2024, BRL 4.1bn in new projects were added to the backlog, and approximately BRL 7.5bn are in the final phase of negotiation and close to signing,” AGE wrote in its 4Q23 earnings release. The BRL 4.1bn amount is almost the same as what the Brazilian construction company added in 2023 (See Figure 1). AGE is in the process of signing a BRL 3.7bn project to build two refineries for Petrobras, part of the additional BRL 7.5bn “in the final phase of negotiation and close to signing.” Should this all materialize, AGE would effectively double its backlog in 1H24.

We believe that AGE will be able to start making bond interest payments in June given the positive momentum. If this were to happen, we would expect the 2029s — currently trading in the mid-20s — to see a nice boost in price.

Further drilldown into the backlog

The backlog as of 4Q23 was BRL 10.6bn, a slight decline from BRL 10.9bn three months prior. There are three noteworthy comments to make:

- The Las Placentas hydroelectric project saw additions of BRL 1.6bn and the size of the project rose to BRL 4.8bn. Equally important is that works started “for real” in January, so we should see significant revenues starting 1Q24 (in the past, the project has been pretty stalled).

- The BRL 1.6bn Barcarenas thermal power plant project has disappeared from the backlog, as the client couldn’t secure a supply of natural gas. However, on 23 April AGE announced that it signed a BRL 2.1bn contract with New Fortress, who has acquired the project, expanded it a little bit and hired AGE to build it

- The big projects in Angola, Ghana and Mozambique haven’t yet showed in the whole year (some small ones have, but they represent a very small portion). We are talking about a combined backlog of BRL 3.3bn there, but it’s not producing.

- Angola (BRL 1.2bn): Financing with a German Export Credit Agency is being structured and the expectation is to start one project in late 1H24 and the other in early 2H24

- Mozambique (BRL 0.8bn): two big projects are with Total. Due to the terrorism in the country, Total stopped operations during 2023. This year the France-based oil company resumed operations , so hopefully at some point it will also resume construction of its LNG plant. In the meantime, it’s on hold.

- Ghana (BRL 1.3bn): The government defaulted on its sovereign debt in December 2022. As such, the banks that were funding the project stopped disbursement of funds, so no execution took place during 2023. Even though the country is still in default, Euler Hermes said that the project is of major importance and that construction should resume even if the government is in default. As such, the project could possibly resume in May or June (See Figure 2).

Financial highlights for 4Q23

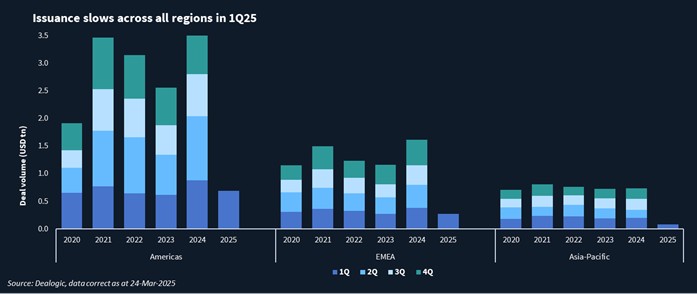

In the past, we would construct a table saying “assuming a certain level of execution and a level of gross profit margin, AGE needs to increase its backlog by x% to paying able to cover operating expenses and interest payments.” The conclusion was always that the company needed to increase the backlog by 40%-50%.

The yearly execution rate we assumed was 28%. During the last two quarters of 2023, quarterly execution rates were 8.2% and 8.9%, respectively (and this is considering the totality of the backlog, and we noted that some projects have not been executed lately). If we use these last two indicators, the yearly execution rate would be ~34%, which helps accelerate the booking of EBITDA (See Figure 3).

If indeed backlog basically doubles in 1H24 and we further consider an accelerated execution rate, this reinforces the view that AGE will start paying coupons in June (and hopefully won’t stop).

Consolidated EBITDA was BRL 156m, AGE’s highest in at least two years (See Figure 4).