Find new clients where wealth is being created

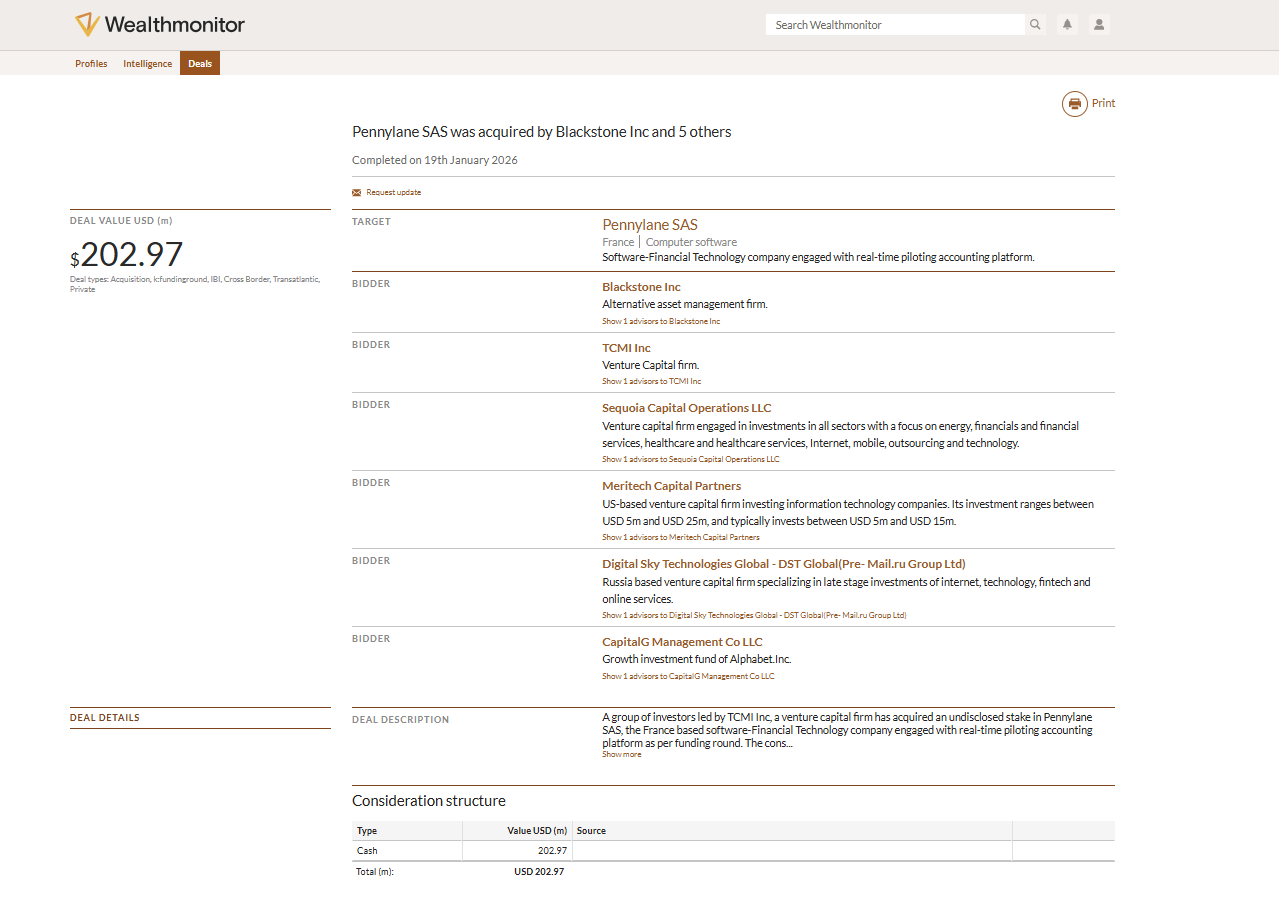

Wealthmonitor delivers a competitive advantage to business development professionals by connecting client origination directly to M&A-driven wealth creation, such as private equity auctions and IPOs. Identify and analyze profiles enriched with contact, career, education, and network details to prioritize outreach and personalize engagement.

Learn moreTurn M&A liquidity into LP opportunities

Wealthmonitor helps private fund managers grow their investor base with intelligence on high-net-worth (HNWIs) individuals and family offices aligned to their private equity, hedge fund, or private credit strategy.

Learn moreFrom wealth creation to capital commitment

Wealthmonitor highlights individuals whose liquidity aligns with sector theses or philanthropic goals, helping advancement and development teams to identify and engage new donors.

Learn moreLatest insights from Wealthmonitor

From M&A-driven liquidity events to individual shareholder profiles, Wealthmonitor analyses how private wealth emerges, moves, and consolidates through deals.

Wealthmonitor connects high-net-worth (HNW) individual profiles to real-time M&A driven liquidity events, helping financial institutions and fundraising teams to identify, qualify, and engage new prospects faster than traditional wealth databases.

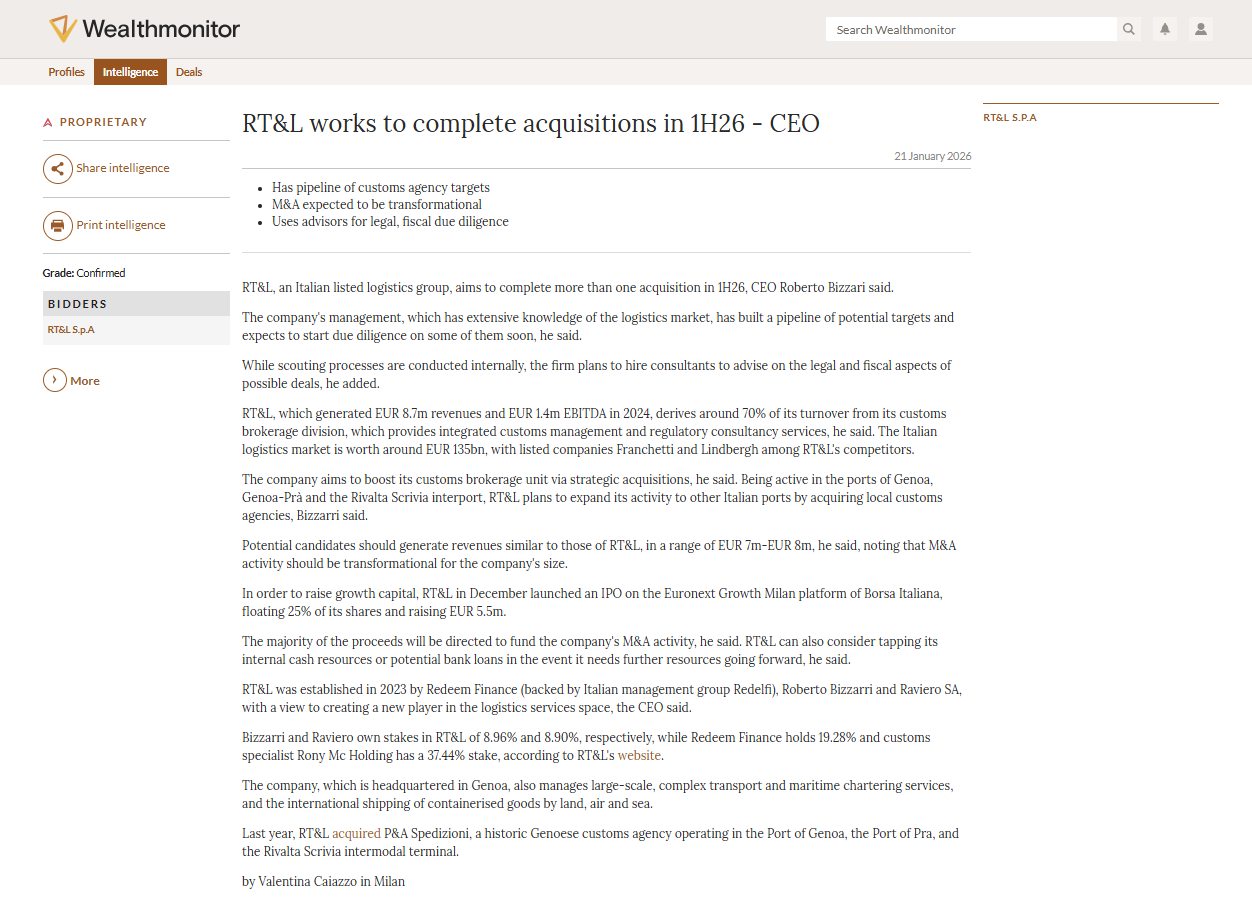

M&A-first signals

Track where new wealth is created — with early, actionable insights into upcoming and ongoing M&A activity worldwide.

Editorial Advantage

Access 2.5 million Mergermarket M&A articles, covering decades of reporting and revealing opportunities before they appear in public filings or wealth rankings.

Dual alerts

Receive timely alerts on deal momentum and newly published profiles, empowering you to act on high‑value opportunities first.

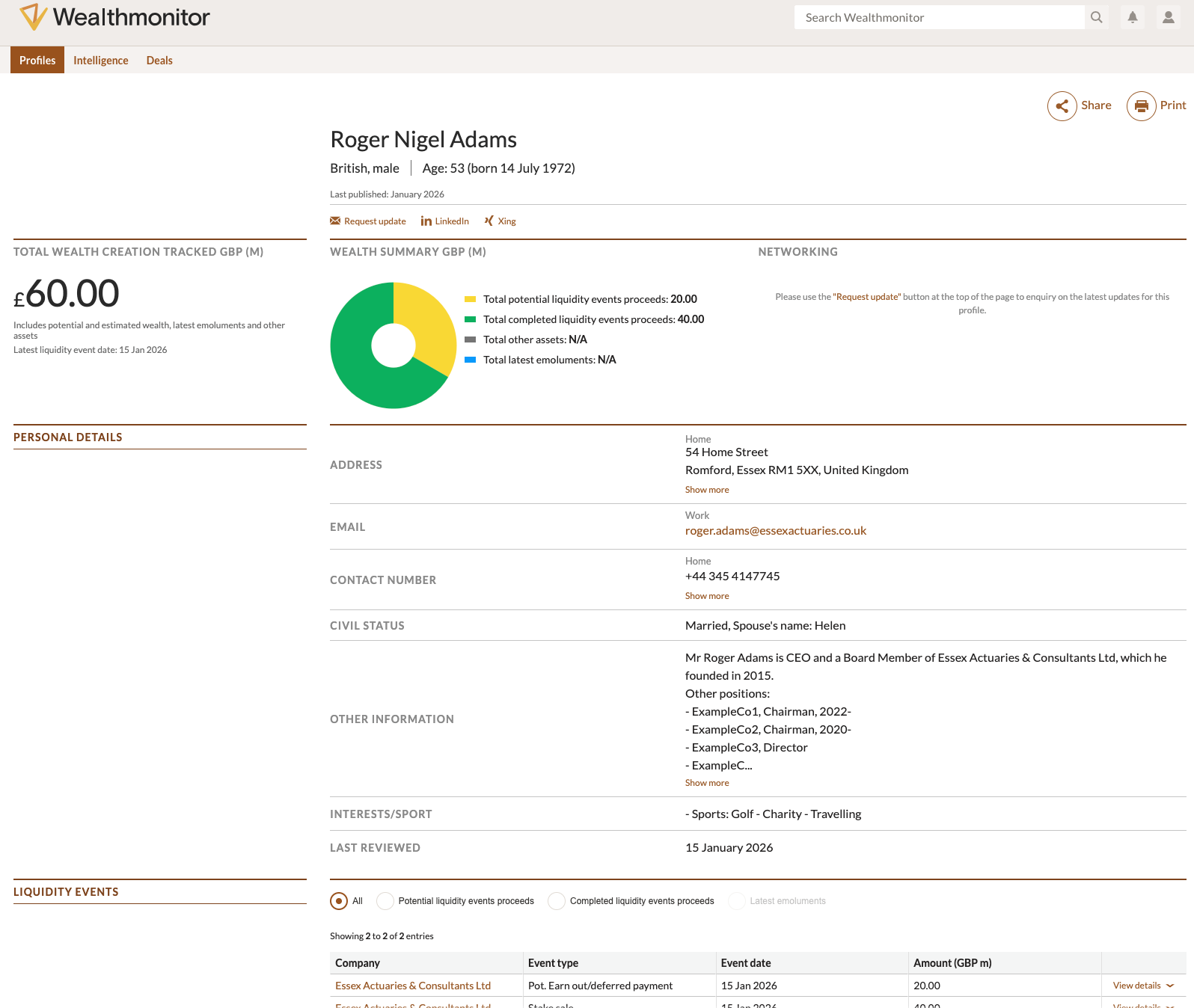

Profiles with context

Accelerate qualification with HNW profiles enriched with career, education, and network insights – each linked to the liquidity events that shaped their wealth.