Work smarter: Technology drives staffing M&A – Dealspeak North America

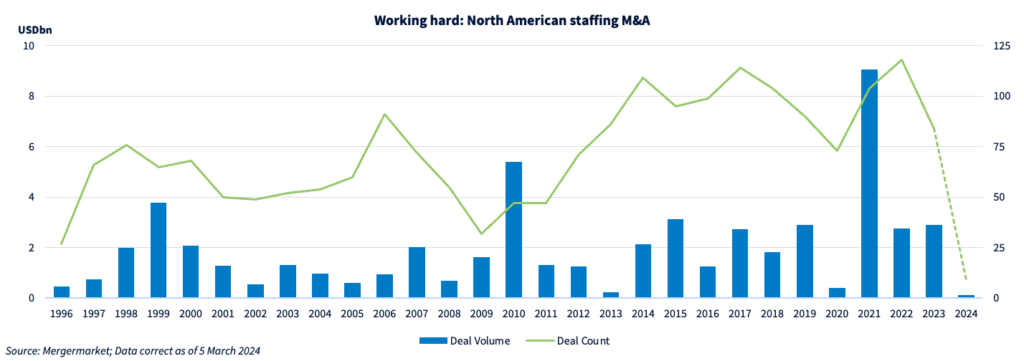

The staffing sector in North America saw lower levels of dealmaking in 2023 for the same reason M&A activity slowed in other segments – a higher interest rate environment and economic uncertainty.

What’s more, the industry was coming off a record run-up in 2021 and 2022 owing to “The Great Resignation” following the Covid-19 pandemic.

“Staffing is still a big challenge post-pandemic but (M&A) growth has slowed,” says Barry Asin, chief analyst of Staffing Industry Analysts.

There were 84 announced deals worth USD 2.9bn in North America in 2023, down from a record 118 deals worth USD 2.75bn in 2022, Mergermarket data show. This year has started even more slowly, with nine deals worth USD 117m signed through 5 March.

Let’s get digital

Healthcare staffing led the gain in 2022 driven by travel nursing demand during the pandemic, according to data from Staffing Industry Analysts, but Asin calls this “unsustainable growth.”

In 2023, most staffing deals came in the permanent placement segment, in particular executive search firms. After that came deals in IT employment and then healthcare, followed closely by professional staffing firms specialized in finance and accounting, marketing and creative, and life sciences, Asin says.

Technology also drove significant levels of M&A last year, particularly around talent acquisition. So-called workforce solutions – software tools that help companies find, manage and develop workers –accounted for a significant swath of deals related to staffing in 2023 and the trend is likely to continue, reckons Asin.

Despite the fall in staffing M&A, 2023 was still a historically strong year, says Asin. With unemployment continuing to stay low and a tight labor market, tailwinds exist for a decent 2024. But in which direction will M&A go?

Uberization of staffing

Parminder Jassal, CEO and founder of Unmudl, a skills-to-jobs marketplace, believes the spheres of education and workforce development are coming together through technology. In a manifestation of that convergence, education technology company Cengage Group invested in Unmudl’s seed round last April. Another recent example was the February acquisition of the SkillPointe technology platform by the National Association for Community College Entrepreneurship (NACCE).

Unmudl, which also partners with community colleges and technical schools, is already receiving investment interest from large staffing companies of the caliber of Manpower [NYSE:MAN], Adecco Group [SWX:ADEN] and Kelly Services [NASDAQ:KELYA,KELYB]. It plans to target such investors for its upcoming Series A raise this summer, Jassal says.

Artificial Intelligence (AI) is also becoming a big driver of deals in talent acquisition technology. For example, Aya Healthcare, a dominant player in healthcare staffing, in July acquired Polaris AI and in November acquired Winnow AI.

Andela has also been active on the tech front, acquiring Qualified, a skills assessment platform, in March.

Elsewhere in the workforce ecosystem, investments have been made in technology-driven platform models. Two examples, says Asin, are SeqLL’s purchase of Lyneer Staffing Solutions, and the acquisition of iLearning Engines by blank check company Arrowood Acquisition.

The aim, Asin says, seems to be to determine “who will become the Uber of staffing.”

Hire calling: Top 5 sponsor-backed staffing firms most Likely to Exit*

| Company Name | Nationality | Likely To Exit Score (LTE) | Hold Period (y) | Financial Sponsor | Entry Enterprise Value (USD) |

|---|---|---|---|---|---|

| NSC Technologies LLC | United States (Virginia) | 27 | 7 | White Wolf Capital LLC | 75-250m |

| Eliassen Group LLC | United States (Massachusetts) | 26 | 5 | Stone Point Capital LLC | 250-750m |

| Motion Recruitment Partners LLC | United States (Massachusetts) | 26 | 5 | Littlejohn & Co | 750m-1.5bn |

| Vaco LLC | United States (Tennessee) | 24 | 6 | Olympus Partners LLP | 1.5bn+ |

| Soliant Health LLC | United States (Georgia) | 23 | 4 | Olympus Partners LLP | 612m |

Source: Mergermarket; Data correct as of 5 March 2024 / * Mergermarket’s LTE predictive analytics assign a score to sponsor-backed companies to help track and predict when an exit could occur through M&A and IPO, a direct listing or a deSPAC transaction.