War, what is it good for: Defense M&A heats up on back of conflict — Dealspeak North America

Amid rising geopolitical unrest, demand for defense-related products is driving dealmaking activity in North America.

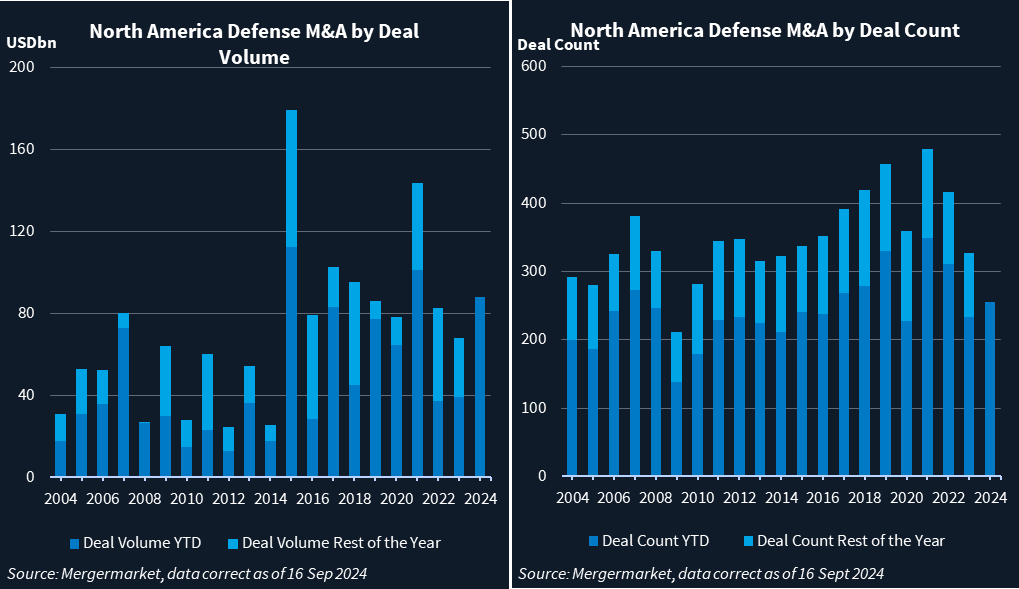

Defense sector dealmaking of USD 87.6bn so far this year puts 2024 on track to be the third highest by volume, behind only 2021 and 2015, according to Mergermarket data. With three and a half months still left, 2024 has already surpassed M&A volume for the whole of 2023 and 2022.

Russia’s invasion of Ukraine has forced the US and Europe to reassess their own war readiness, leading to a realization that greater investment is needed to keep up with rivals China and Russia, notes one sector advisor.

Demand for weaponry to support allies in Ukraine and the Middle East also have depleted US stockpiles. That has led Pentagon officials to cite replenishment of US missile stocks as an important priority, adds Ted Smith, president and co-founder at Union Square Advisors. His technology-focused investment bank advised solid rocket motor (SRM) maker X-Bow Systems on a USD 70m Series B funding round in July.

Spending areas

One area benefiting the most from Ukrainian demand is the production of small defense missile systems such as HIMARs and GMLRS, notes the advisor.

Maritime is another area of focus. More government spending is needed on building ships, submarines, and shipyards to boost US naval strength in the increasingly volatile Indo-Pacific region, the advisor adds. The Navy awarded a USD 981m contract to BlueForce Alliance on 10 September, on top of a USD 2.4bn contract to Deloitte Consulting in July, aimed at upping submarine production. Private equity firms have expressed interest in buying companies expected to benefit from that increased naval spend, he says.

Drones also could see a boost, as the US government looks to revamp its air power to stay competitive with China’s drone swarms.

Strategics make their mark

Major strategic players have been making acquisitions in increasing numbers, a second sector advisor says. (see chart below).

Several public companies have announced deals in 2024, including Boeing’s [NYSE: BA] proposed USD 8.3bn acquisition of Spirit AeroSystems [NYSE:SPR], Honeywell’s [NASDAQ:HON] buy of CAES from Advent International for USD 1.9bn, and Lockheed Martin’s [NYSE:LMT] buy of Terran Orbital [NYSE:LLAP] for USD 450m in August.

Those acquired businesses would have been logical targets for private equity firms. But strategics, which have a steady amount of cash on hand, made the deals instead and are likely to continue searching for more, the second advisor notes.

The acquisition of Terran Orbital, which makes satellites for Lockheed Martin, is an example of a large defense contractor buying its own supplier. The deal underscores the defense sector’s current desire to stabilize the entire supply chain, the first advisor says.

Bill Curtin, a partner at law firm Hogan Lovells, which advised Lockheed Martin on the deal, expects other defense majors to pick up more supply chain assets and bring them in-house to streamline delivery.

Government contract wins

Defense spending and the number of government contracts awarded remain at high levels, says the second advisor. The Department of Defense’s budget for 2025 increased 3.3% to USD 852bn, dwarfing European spend.

A long-held truism is that defense companies that have won contracts are likely to become potential acquisition targets for those that miss out on the contract.

A trio of companies fit the bill. Silvus Technologies, a portfolio company of TJC, was pegged as a potential acquisition target after its StreamCaster SC4400 MANET radios were selected for an anti-tank system.

Modern Technology Solutions (MTSI), a provider of support services to the military, was also viewed as a potential target after winning a contract from the Missile Defense Agency.

Kratos Defense [NASDAQ:KTOS] also could be targeted as it racks up contract wins for its drones, spatial awareness, and scramjet technology, say advisors.

Some deals are already in the pipeline, according to several Mergermarket reports.

Cubic, which is backed by Veritas Capital and Elliott Management, hired Evercore to sell its training business, according to a July report.

Northrop Grumman [NYSE:NOC] was last month exploring the sale of its warfighter training business.

Karman Space & Defense, a Trive Capital-backed missile products company, was this month working with Citi on a possible sale.

“Current geopolitical conflict will impact M&A and investment generally. Include China in the mix,” says another sector advisor. “We expect deal activity will edge up in 2025.”