Venture issuers revisit IPOs – ECM Pulse North America

- ServiceTitan’s successful IPO encourages other VC-backed companies to go public

- AI-driven tech sectors drive recovery, with high premiums for ‘pure-play’ AI firms

- VC firms plot exits after challenging years

Venture capital technology investors are considering giving the IPO market a second chance in 2025 after a couple of years of reduced activity.

The December IPO of ServiceTitan [NASDAQ:TTAN], the cloud-based software provider for trade businesses, which priced above its anticipated range and opened with a 42% increase from the IPO price, is described by market participants as a positive indicator for the market.

Its performance could encourage other venture-backed companies to pursue public listings in 2025.

“This listing will help further accelerate IPO activity as evidence of a super strong demand for companies across growth sectors,” Paul Abrahimzadeh, head of equity capital markets for North America at Citigroup, said.

There’s already strong interest building for the next wave of tech IPOs, which is expected to ramp up in earnest by the end of 1Q or early 2Q, he added.

Key sectors driving this include software, semiconductors, fintech, crypto and digital infrastructure, with a long list of companies incorporating an AI narrative as a premium kicker to their core equity story.

Public software multiples have rallied dramatically post-election, driven by fundamental performance rather than pandemic-like, rates-driven valuation increases. Growth sentiment has risen, with the S&P reflecting strong earnings.

In a higher-growth environment, investors are reallocating to growth portfolios.

“If you believe recession fears are behind us, as evidenced by a robust earnings growth outlook for 2025, it’s the right time to invest in assets growing faster than the broad market and priced at a discount to intrinsic value,” Abrahimzadeh said.

This environment also aligns well with the tech IPO backlog, as valuations in traded private markets are continuing to rebound, he added.

AI companies are commanding a far higher premium than the rest of the public tech equity market, with Abrahimzadeh citing mean 2025 FV/revenue multiples approaching 20x revenue for ‘pure-play’ AI, versus 6-7x for non-AI software companies.

Recent momentum in the public markets has fostered growing optimism in the private markets, according to Natalie Hwang, founding managing partner of Apeira Capital, which focuses on late-stage private companies.

Venturing into the future

If public investors are calling for VC assets to come to market, venture funders are happy to take the call.

“We’re seeing less structured private raises and increasing valuation momentum. There’s some FOMO in the Valley right now, especially for VC-backed companies with a near-term path to IPO,” Abrahimzadeh said.

The VC industry has struggled over the past two years, as issuers fought a combination of macroeconomic challenges, market volatility, and shifting investor priorities. Rising interest rates and inflation dampened valuations, reducing the appeal of IPOs, which historically accounted for significant VC exits.

Public market performance for previous VC-backed IPOs has been more patchy, extending holding periods for portfolio companies.

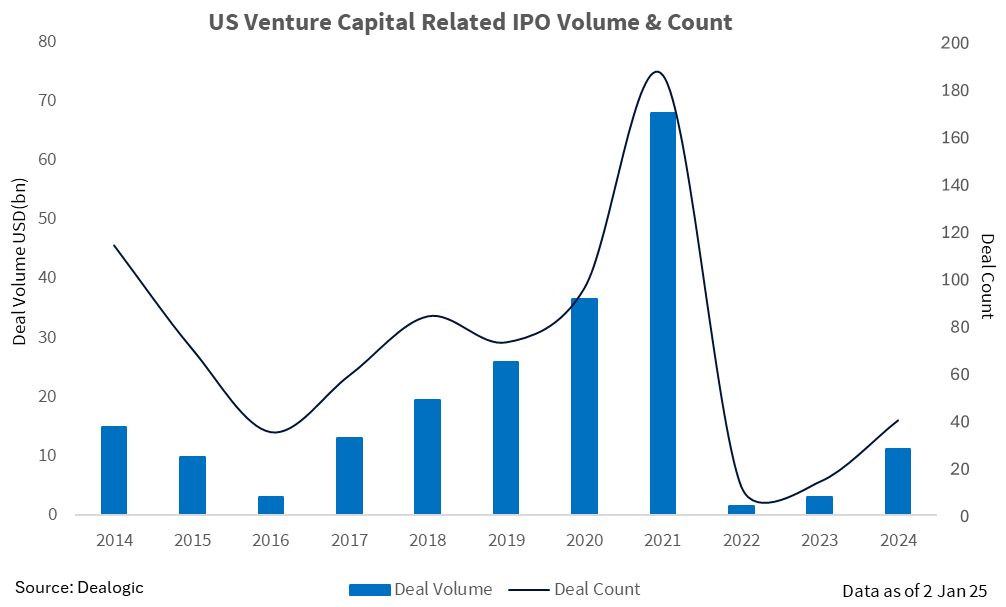

In 2024, there have been 40 such listings worth USD 11.2bn. This is much higher compared to 2023 where 14 IPOs worth USD 3.1bn priced and 2022 where only 12 listings worth USD 1.6bn were printed.

The numbers are a far cry away from 2020 and 2021 which saw IPOs worth USD 36.6bn and USD 68bn, respectively.

“The entire venture industry is waiting for exits,” said Oliver Libby, managing partner of H/L Ventures.

New issuance in the public markets has been slow and sporadic, he noted, while M&A has been burdened by regulators and cautious dealmakers.

“The venture industry is as close to distressed as I’ve seen in two decades,” said Libby.

Limited partners are not funding venture capital firms as freely as they did a few years ago, while portfolio companies have been restructuring their cap tables and taking out bridge notes to continue operating, he explained.

There have been signs the market is changing for the better, Libby added. If IPO activity picks up in the coming months, it will have a cascading effect throughout the VC world that will lift valuations across the fundraising lifecycle, he said.

Well-flagged tech names are crowding advisory imagination for the first half of 2025. Klarna has recently expanded its US IPO team, as the Swedish buy-now, pay-later provider’s offering is set to take place in this upcoming window. The company could be valued at approximately USD 14.6bn, according to reports.

Chime, the San Francisco, California-based financial services provider, has engaged Morgan Stanley for its plan to pursue an IPO next year.

This news service recently reported that Cerebras Systems, a US-based AI chipmaker, is expected to launch its initial public offering in the first half of next year, as a CFIUS review into a planned minority investment from G42 continues.

The enthusiasm around the VC issuer world will still negotiate its ambitions with rigorous buyside parameters.

Candidates will still be expected to be “very close” to profitability and able to communicate how the IPO will bridge the gap to that milestone, said William Blair’s Steve Maletzky.

Revenue growth is still the driver of multiples in public markets, and profitability the second. Larger floats are much more conducive to the current environments. Technical adjustments will ensue.

“You will see many IPOs go out very conservatively on valuation. But if buyside demand is there, you could easily see meaningful oversubscription that yields opportunity to improve the offer price and ultimately land on the high end of the range,” he said.

by Cristiano Dalla Bona and Troy Hooper, with analytics by Raj Saiya (CFA, ICFAI)

Top Venture Capital-related IPOs of 2024

| Pricing Date | Company | Deal Value USD (m) | Sector |

|---|---|---|---|

| 30-Apr-2024 | Viking Cruises | 1,768.00 | Leisure & Recreation |

| 24-Apr-2024 | Rubrik Inc | 863.00 | Computers & Electronics |

| 20-Mar-2024 | Reddit Inc | 860.00 | Computers & Electronics |

| 19-Mar-2024 | Astera Labs Inc | 820.00 | Computers & Electronics |

| 11-Dec-2024 | ServiceTitan Inc | 719.00 | Computers & Electronics |

| 17-Apr-2024 | Ibotta Inc | 664.00 | Computers & Electronics |

| 10-May-2024 | Zeekr | 507.00 | Auto/Truck |

| 24-Jan-2024 | CG Oncology Inc | 437.00 | Healthcare |

| 07-Feb-2024 | Kyverna Therapeutics Inc | 367.00 | Healthcare |

| 12-Sep-2024 | Bicara Therapeutics Inc | 362.00 | Healthcare |