US sponsors target increased deployment in resurgent Europe – Dealspeak North America

- US PE deal count up 5% year-over-year

- Apollo, Blackstone signal long-term European deployment plans

- US LPs boost Euro fund allocations

Two years ago, US private equity interest in Europe sank to multi-year lows.

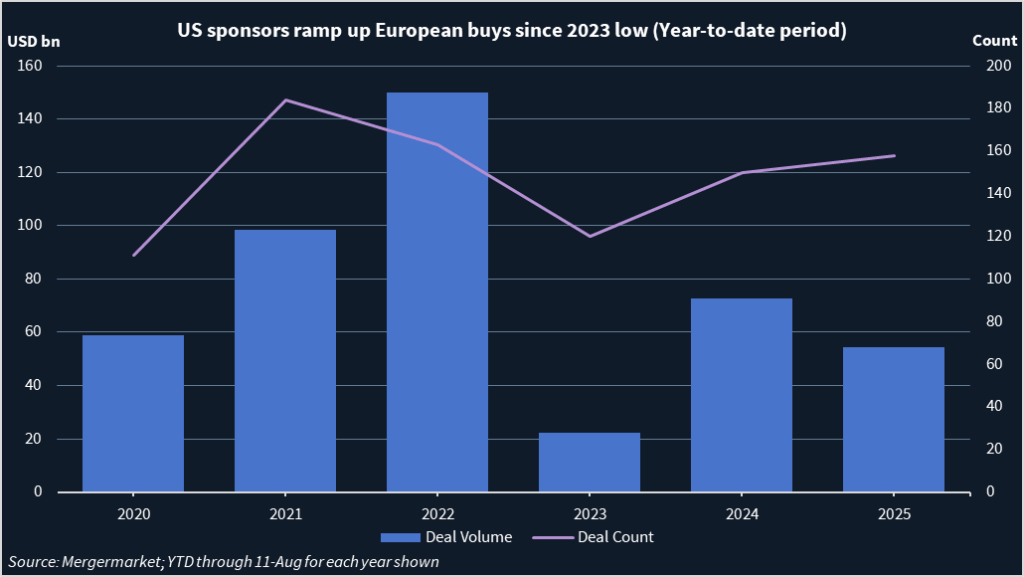

As the continent grappled with sluggish growth and the fallout from Russia’s war with Ukraine, buyout volume of European assets by US sponsors plunged more than 85% in the first eight months of 2023. “There was very little momentum from US investors,” recalled one private funds lawyer.

The mood music has changed in the last six months. While Liberation Day sowed uncertainty in the US, European governments have committed to increasing investment in defense, technology and infrastructure.

This has created both renewed optimism for growth and a vast need for capital, according to Gavin Geminder, global head of private equity at KPMG.

“The macro for Europe is appealing for private equity deployment,” he said. Enthusiasm for the European investment thesis – barely discussed just six months ago – is now building among financial sponsors, he added.

The world’s largest private markets investors are taking note. On its latest earnings call on 5 August, Apollo said it would invest USD 100bn in Germany over the next decade to support the country’s growth initiatives. Apollo’s peers have signaled similar intent in recent months, with Blackstone reportedly planning to deploy USD 500bn in Europe over the next decade.

That rise in interest is starting to show in the numbers. Year-to-date, there has been a 5% rise in the number of deals involving US-headquartered financial sponsors acquiring in Europe, even as announced dollar volume declined 25% (see first chart). And while there was a retrenchment in activity in 2025’s first half, following the surge seen in 2H24, the level of interest has trended upwards since 1Q23’s trough (see second chart).

The biggest inbound deal this year involved UK precision-measurement company Spectris, over which a bidding war erupted between KKR and Advent International. Both US sponsors have announced some of the year’s biggest European deals, including Advent’s USD 3.36bn bid for a portfolio of homecare brands from the UK’s Reckitt Benckiser and KKR’s USD 3.1bn deal for OSTTRA Group, also based in the UK.

Mid-market maneuvers

To be sure, many of the US’s biggest sponsors – such as KKR and Blackstone – have been investing in Europe for decades. Some mid-market players have joined them. Among them are Abry Partners and Charlesbank Capital Partners, both based in Boston, Lee Equity Partners of New York and Graham Partners of Newton Square, Pennsylvania. All those firms have an established presence in Europe and are currently actively deploying capital, said advisory sources.

Abry invested in the UK’s Burgess Hodgson in June and co-invested in Greece’s European Dynamics in April, while Charlesbank-backed Front Row bought Netherlands-based Build in Amsterdam in May.

Both Abry and Charlesbank have also been underbidders on some of Europe’s most competitive auctions. The former signaled interest in UK-based Broadstone before Lovell Minnick made a strategic growth investment in the business, while the latter was circling AAB in a process that was ultimately won out by GSAM.

Whether more mid-market US GPs and their smaller brethren join them in building out European strategies remains to be seen. But signs point to growing interest among this cohort.

“We’re seeing more dollar-denominated funds coming to Europe across all facets of the market – from venture capital and growth equity to turnaround and traditional buyouts,” said Josh Adams, a partner at OpenGate Capital Management, which is dual-headquartered in New York and Paris.

OpenGate, which is deploying its third fund, specializes in corporate carve-outs with EBITDA between USD 10m to USD 50m. Adams said the firm is focusing its deployment efforts mainly on Europe, where he sees ample opportunity, specifically for carve-outs.

Founded in 2005, OpenGate has long invested in Europe. Adams cautions that newer entrants may struggle with the complexity of the European market. “It’s not a beta play, it’s an alpha play,” he said. “You need to be comfortable with the risk/return profile that comes with that.”

US firms must also demonstrate differentiation from other sponsors, for instance, via showcasing specific sector expertise or global expansion capabilities.

Access is another hurdle. “To be successful, they need local teams,” said a London-based private equity advisor who recently met with US groups exploring European expansion.

LPs follow the lead

More broadly, the expected uptick in deployment is also influencing limited partner (LP) decision-making. Previously reticent US institutions are now looking to increase their allocations to Europe-focused funds.

A source familiar with a European general partner (GP) that is currently raising its flagship buyout fund said the vehicle is attracting commitments from US LPs that until now had shied away. “Two years ago, they didn’t want to commit further dollars to European strategies, but we’ve seen this change,” the source said.

KPMG’s Geminder noted that LP allocations tend to follow deployment trends.

Meanwhile, on a global level, US GPs also face strategic tradeoffs on where to deploy their capital, he argued.

For many years, US firms have focused on scaling in Asia Pacific, most notably in Japan and Australia. Advent International, for example, opened a Sydney office last year, and acquired a majority stake in luxury fashion brand Zimmermann for a reported USD 1.15bn in 2023.

Still, the European opportunity is a long-term one. “There is substantial rationale for countries like Germany, but it’s a little early,” said Geminder.