US sponsors home in on UK take-private targets with stateside revenues

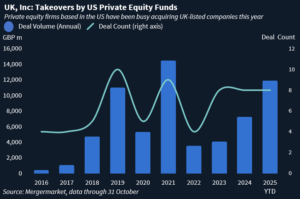

US private equity firms are increasingly prioritising UK-listed targets with significant transatlantic revenue exposure in their search for suitable take-private candidates, according to dealmakers and market practitioners.

UK companies with significant US revenue can be bought at relatively low London valuations, while the US market’s tendency to value domestic earnings highly creates the potential for more lucrative exits down the line, noted one lawyer.

“I have seen a step up in dialogue on this topic recently,” one senior banker said. And given the increased cash levels PE is sitting on and the continued relative valuation arbitrage between the UK and the US, “it is a topic that is getting greater cadence and engagement now than it has previously”.

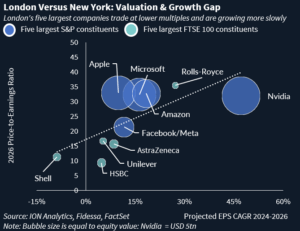

London’s largest listed companies are valued lower than their New York-listed counterparts and are growing more slowly, according to analysis by this news service.

Out of the five largest FTSE 100 constituents, only aerospace and defence engineer Rolls-Royce trades at a 2026 price-to-earnings ratio above 20x.

AstraZeneca, Shell and Unilever are valued at between 10x and 20x while HSBC is trading at 9x.

Out of the five, only Rolls-Royce is expected by analysts to deliver double-digit earnings growth over the period 2024-2026.

By contrast, all five of the largest S&P 500 companies are valued above 20x and are expected to deliver double-digit earnings growth over the comparable period.

Companies that derive at least 40% of their revenue from the US, and often those that have already executed smaller bolt-on acquisitions in the region, are attracting the greatest attention, the senior banker added.

“Finally, the merits of UK-listed companies have become apparent to US and wider North American investors,” said Patrick Sarch, head of public M&A at White & Case. Overseas buyers are “typically” drawn to businesses whose earnings are already majority non-UK, he continued.

Thoma Bravo’s USD 5.3bn take-private last year of UK firm Darktrace, which has previously disclosed that the US is its largest revenue market, is emblematic of the trend, as is the same buyer’s takeover of cybersecurity peer Sophos in 2019, a second banker said.

More recently, London-listed Craneware received and rejected an offer from Bain Capital. The provider of invoicing software to hospitals had been ramping up its US presence via M&A for nearly two decades prior, and following its most recent earnings release in September CEO Keith Neilson said the company was eyeing acquisitions designed to deepen its US offering.

Looking further ahead, some advisers suggest that an exit via a US IPO could be part of the rationale for taking UK plc private today: you buy, scale the business, then pursue a higher-value US listing in a few years.

Others, however, cautioned against assuming such an outcome. Specifically buying a company to then list in the US for multiple expansion is “not a focus for our clients,” said Sarch. And it’s “not a primary driver” of UK take-private activity, he added.

Slaughter and May’s Richard Smith agreed. “It really hasn’t happened yet,” he said.

“The US IPO market is not that much less risky than the London IPO market. There haven’t been many IPOs anywhere, and the narrative that US listings always achieve higher valuations is often a false assumption – peer group companies in both markets are generally rated similarly,” he said.

“It can be a strategy, but if you were taking it private now, you’d likely be looking at an exit around 2030, so there’s some uncertainty over how the business might evolve by then,” noted a third banker.

Potential targets

Advisers point to technology and healthcare as the most active areas for UK targets with a US focus, followed by consumer and industrials.

London-listed medical technology company Smith & Nephew and communications company WPP have both been flagged as potential takeover candidates for US PE firms by this news service’s The Morning Flash column.

Smith & Nephew said in its 1H25 earnings report that it generates roughly 53% of its revenue from the US. One adviser highlighted that the company has faced shareholder pressure to spin off its orthopaedics unit and noted that doing so may give it time to implement some further changes ahead of potential PE ownership.

WPP, meanwhile, reported that around 38% of its revenue in 1H25 came from North America, which is its largest market. Earlier this year, the company attracted PE interest and held takeover talks with US-based consulting giant Accenture.

According to one adviser, US private equity may acquire all of WPP or select divisions. WPP’s 40% stake in market research unit Kantar could also prove attractive, they said.

Global identity technology company GBG group, on the takeover radar for many years, derives 35% of group revenue from its largest market in the US, although the UK is close behind at 33%.

In the healthcare space, pharmaceutical firm Hikma, which generates 59% of its earnings in North America, has re-emerged in the takeover spotlight amid strong appetite for high-quality generics in Europe. In September, The Morning Flash noted that peers Stada and Zentiva had received offers from PE firms at EBITDA multiples well above where both Hikma and the broader listed generics sector is trading.

In the industrials space, one banker pointed to engineering company Weir Group. According to its most recent financials, around 40% of Weir’s non-current assets are based in the US, which is also its second largest market in terms of revenue.

Deal mechanics

Advisers stress that US-linked revenues alone are not enough to make a target viable – deal mechanics must also align. Key components include the valuation arbitrage and financing backdrop, but a strong US dollar has also helped fuel appetite for UK take-privates.

As Slaughter’s Smith noted: “The consistent macroeconomic feature has been the strength of the dollar versus the pound. If you’ve got dollars, you can buy non-dollar assets relatively cheaply, just as a matter of FX.”

“If you have a higher valuation multiple, do your valuation in the US, and you apply that to a UK business trading at a lower multiple – today that would be immediately value-enhancing,” he said.

He added, however, that the valuation spread has narrowed over the course of this year, meaning FX alone is no longer the main driver.

“The good news for take-privates is that the debt markets are in rude health,” the senior banker said.

That includes abundant liquidity and a readiness to fund leveraged deals.

“We’re seeing a lot of activity in leveraged finance and a willingness to increase leverage to fund these assets. Two or three years ago, we had the cash but not the debt markets – now all the pieces are working,” the senior banker added.

Or in the words of London-based Smith: “We’ve got some really good businesses here, and the US have got a lot of money. Some of the big European balance sheets have got a lot of money, and PE has a lot of money. So, it’s a perfect environment for acquiring UK businesses – the stars are aligning.”