US sponsors face “now or never” IPO moment as election approaches – ECM Pulse North America

- Sponsors return to IPO market to try and do deals before US election

- Hopes grow for good 2025 should volatility fall

- StandardAero “frontrunner” for other US IPOs

A sudden window for new IPO issuance has opened in the US, as issuers – particularly sponsors – seek to make the most out of the few weeks left before the election.

Prompted by a rate cut from the US Federal Reserve, and a positive market reaction, several IPO candidates are taking advantage of relative stability to launch a new listing. Market participants hope these deals will leave a sweet taste in investors’ mouths ahead of an expected slowdown around the US election and in the run-up to next year.

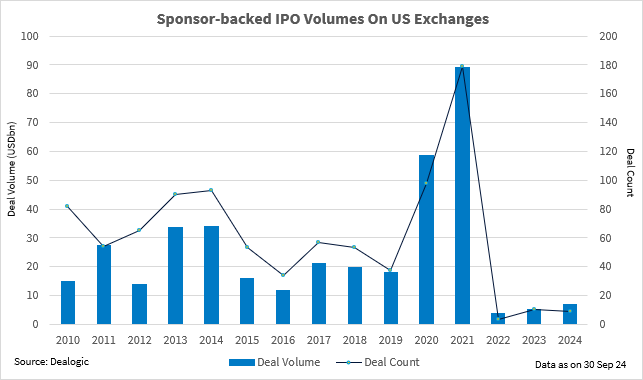

So far in 2024, there have been nine sponsor-backed IPOs worth USD 7.06bn. This is 30% higher than the whole of 2023 (USD 5.4bn) and 87% higher than 2022 (USD 3.8bn).

However, the figure is well below the average seen between 2010 and 2021.

PEs spring into action

For most of the year, private equity sponsors held back promising portfolio companies from public markets, despite continued pressure to increase distributions to their limited partners.

Now though three large private equity-backed companies are on the verge of public market listings.

Lured by the prospects of a higher valuation, Carlyle-backed Arizona-based aviation maintenance company StandardAero is undergoing an IPO after calling off private sale. The markets seems to be rewarding its choice; the Scottsdale, AZ-headquartered company last week raised the proposed deal size.

One ECM banker described StandardAero as “ a strong frontrunner for this window”, citing the fact that the aircraft maintenance sector is benefiting from the growing challenge of aviation companies dealing with worn-out fleets.

“It has scale and is leading its sector. It is a classic PE-backed company IPO and a big check,” he said.

In a completely different sector, KinderCare Learning Companies, the Partners Group-backed provider of early childhood education, is also on a roadshow and targeting sector-specific and consumer investors for a listing that could reportedly fetch a USD 3.1bn valuation, according to a source close to the deal. Partners Group and KinderCare Learning did not respond to requests for comment.

The company’s IPO journey has been a slow one, after it postponed a listing last year. Significant interest in the deal is expected, said the same source, mostly down to the business’s revenue, consistent demand for its services and expansion potential because of its low operational costs. While its main comparable, Bright Horizons [NYSE:BFAM], is trading well, as one sector banker observed, another banker noted that uncertainty over future childcare subsidies based on the new administration’s policies could affect investor enthusiasm.

Only hours after KinderCare’s launch, Platinum Equity-backed Ingram Micro also made public its filing. The Irvine, California-based technology and supply chain company had previously filed confidentially in 2022 but did not go through with a deal because of market conditions. It is now targeting a USD 8bn valuation. “If you ask me: is Ingram important in this market? It absolutely is. It is the second biggest distributor in the world after TD Synnex [NYSE:SNX],” an industry consultant said.

The company is among the top traditional distributors in its sector alongside TD Synnex, Arrow [NYSE:ARW], Also [SW:ALSN], WestCon–Comstor, Esprinet [BIT:PRT] and D&H Distributing. In addition, it has made strides in cloud distribution alongside competitors like Sherweb, AWS, Microsoft [NASDAQ:MSFT], and Google Cloud.

Cerebras, the IPO-bound manufacturer of artificial intelligence chips, also filed for an IPO this week, hoping to ride the AI wave to public markets. The company, which is not sponsor-backed, will seek to replicate the good fortune found by predecessor Astera Labs [NASDAQ:ALABS] while also setting the tone for possible 2025 AI IPO candidates, including the anticipated listing of CoreWeave.

Well-calculated risks

While arriving in quick succession, these filings are not coming out of thin air. Companies are coming to market after months of extensive preparation and meetings, according to advisers. A syndicate note shared by a large bank noted that testing-the waters-valuation views are ever more critical to determine price range at launch.

“I expect other companies waiting on the sidelines to take advantage of this period. Not all of them might go through, but the atmosphere is, ‘Let us get things going with the necessary forms’. Activity behind the scenes is ramping up,” said one banker.

Most advisory attention right now is focused on building up the pipeline for a fruitful 2025, but there is an expectation that market volatility, geopolitical uncertainty and sector disruption from artificial intelligence will make “take it or leave it” windows the norm.

However, one fund manager said next year could be “juicy for IPOs,” reflecting the sense of optimism that has been growing across advisory and buyside ranks during the summer.

“Post-election maybe the economy will stabilize and do better with rates coming down and valuations could expand with more certainty. It could be a pretty good year,” said the same fund manager. “It should at least be better than the last couple years.”