US recession threat risks stranding greedy sponsors holding out for exit perfection – Continental Drift

- Mid-market activity stall reflects multiple contraction concerns

- Powell’s newfound dovishness points to Fed’s economic jitters

- GPs should seize chance to secure realizations at top of market

Benjamin Franklin mischievously pegged “death and taxes” as unavoidable obstacles. He ought to have added recessions to the list. An economic cycle always turns; animal spirits eventually wane.

US sponsors should take note. Even if a recession isn’t yet the core scenario, economic indicators point to pain on Main Street. Exiting assets after any associated market correction will realize valuations even further from current elevated marks-to-market.

The time to transact is now.

Larger GPs have got the memo. Aggregate North American private equity exits climbed 62% year-on-year to USD 248bn from January-August 2025, according to Mergermarket data. But deal count – a reasonable proxy for the broad swath of mid-market activity – stalled, running flat versus the same period in 2024.

Lender competition means financing terms are “better than ever […] and still M&A isn’t happening,” one partner at a mid-market US GP told Continental Drift.

There are 1,425 US asset sale situations in Mergermarket’s “Missing in Auction” universe (where a potential process was flagged but has gone silent) – some three times the 483 active deals being tracked.

Noting uncertainty over President Donald Trump’s tariffs agenda and moves to upend central bank independence, the partner nonetheless pointed to marks-to-market – particularly on 2021 buyouts – as the major blocker to US sponsor exits.

No portfolio manager wants to sell at 80 cents on the dollar versus the valuation flagged to LPs, even if they are screaming for realizations.

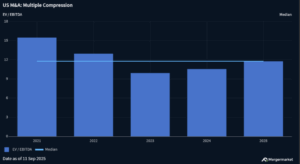

Multiple compression is a real problem – the average EV/EBITDA multiple for US target deals in the halcyon days of 2021 was 15.53x, according to Mergermarket data. It’s just 11.76x in 2025.

Waiting for that gap to narrow is a dangerous game, given where we are in the economic cycle.

Right now, it’s the phony war, where “bad news is good news”. Weak jobs data and a surprisingly soft Producer Price Index (PPI) print set up the Federal Reserve to act on the dovish tone Chair Jerome Powell struck at Jackson Hole last month.

The only debate now is whether the Federal Open Market Committee (FOMC) will cut 25bps or 50bps when it meets on 17 September. Anticipating the Fed punchbowl and buoyed by Oracle’s storming quarterly numbers, the S&P 500 again hit a record high yesterday (10 September).

But “bad news is bad news” eventually.

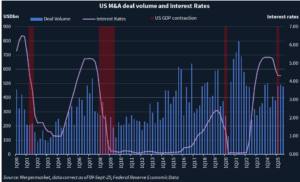

FOMC rate setters know that. Under successive Fed chairs, they’ve turned dovish when economic leading indicators point south. Their track record is solid – every rate-cutting cycle in the past 25 years has preceded a contraction in GDP.

And with it, typically, a substantial dent in M&A activity.

There is also no comfort in 2Q25 US GDP having climbed at an annualized 3.3% following 1Q25’s 0.5% decline. The Bureau of Economic Analysis was quite clear this “primarily reflected a decrease in imports”.

With “Liberation Day” right at the start of the reporting period, restocking supplies already within US borders was the order of the day. This activity was surely a one-off.

And that surprising PPI read reflecting dampened inflation casts the weaker labor market as evidence of demand issues and consumer pain rather than AI-fuelled productivity gains.

Indeed, a National Bureau of Economic Research paper published in July unveiled a new algorithm that correctly identified all 15 slumps over 1929-2021. It indicated a 71% probability that the US was already in recession in May 2025.

Finance commentator Nathan Tankus made a name for himself casting the stock market as a “conventional wisdom processor”, critiquing its ability to correctly price risk and suggesting it only shifts direction when the prevailing consensus becomes manifestly incorrect.

If a cold economic wind changes that conventional wisdom, we could enter correction territory. This would dent sector valuations and make sponsor relationships with LPs even more testy if they missed the chance to secure realizations at the top of the market.

As this column has argued in the context of Europe’s M&A pipeline, volatility fatigue is a key deal driver. Processes held over from the spring and through the summer are ripe to be executed.

You can never rule out further surprises from this White House. The Immigration and Customs Enforcement raid on Hyundai-LG’s electric vehicle facility in Georgia on 4 September sent a chill through the foreign direct investment landscape, notwithstanding the administration’s stated aim of boosting “Made in America” manufacturing.

But Trump is tied up in a legal battle to secure his tariffs agenda. Even with the Supreme Court fast-tracking the case to hear arguments in November, it could be June 2026 before it issues a ruling. Trade policy should tread more lightly on deal pipelines this Fall-Winter.

KKR offloading Atlantic Aviation, and Francisco Partners and Clearlake Capital seeking to exit BeyondTrust – these are emblematic of the larger deals getting underway post-Labor Day. But mid-market deals are also trickling through: Council Capital-backed ViaQuest; York Capital’s Healthcare Linen Services Group; Platinum Equity’s Unical Aviation.

There is a window of opportunity to undertake exits and sponsors should seize it now before it closes.

“You know not how much you may be hindered tomorrow,” after all.

Continental Drift is a weekly column offering commentary on the macroeconomic, political, and policy forces shaping the M&A landscape across the US and Europe. The opinions expressed here are those of the writer only.