US IPOs Gone Cold: Healthcare sector

IPOs Gone Cold is a series focusing on companies that planned to list but have gone into silent running or have recently changed their plans. The table is divided into three sections: filed, lapsed and withdrawn.

Lapsed includes companies that had their prospectus approved by the relevant regulators, but their approval period has expired or companies that had considered a listing where there has been no update in six months. Withdrawn includes companies that have publicly withdrawn their IPO plans.

All data has been gathered by triangulating ION Analytics’ proprietary and aggregated intelligence, pipelines, and company information. This provides a series of actionable situations where the companies may either look to resume or adapt their listing plans, or explore alternative dealmaking avenues. For more information, check out Dealogic’s Market Analytics page.

This edition is focused on healthcare companies looking to list on US exchanges.

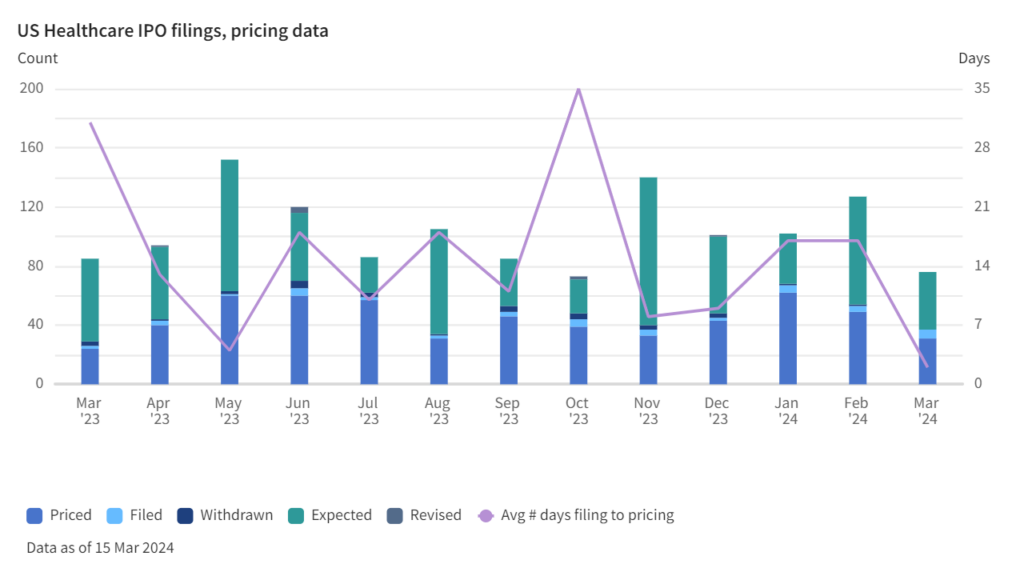

After an initial burst of activity, healthcare IPOs in the US are still on the slow lane, set to finish the quarter at their lowest point since 2012.

So far (up to 15 March), the sector has seen 10 listings worth USD 2.1bn compared to 24 IPOs worth USD 2.7bn in the same period last year and USD 2.6bn raised from 32 deals in 2022.

The current year figures are expected to be boosted by the ongoing USD 420m IPO of Peru’s Auna SAA and the USD 75m listing of NeOnc Technologies.

The USD 693m listing of KKR [NYSE:KKR]-backed BrightSpring Health Services [NASDAQ:BTSG] is the biggest deal year to date. This was followed by the USD 437m listing of CG Oncology [NASDAQ:CGON]. The USD 367m IPO of Kyverna Therapeutics [NASDAQ:KYTX], and the USD 201m float of ArriVent Biopharma [NASDAQ:AVBP].

Source: Dealogic

Source: Dealogic

BrightSpring has not done well since listing and is down almost 30%. However, CG Oncology, Kyverna Therapeutics, and ArriVent have performed much better, up 118%, 28%, and 14%, respectively.

Apart from IPOs, the slowdown was also reflected in the follow-on segment which saw 127 transactions worth USD 16bn compared to 470 deals worth USD 37.8bn during the same period last year.

Some of the companies in the IPO pipeline include Israeli hearing assistance company Orcam Hear, US clinical-stage biotechnology company Treadwell Therapeutics, Swiss-US company specialised in longevity-focused therapies ImmuneAGE Bio, Washington-based single-cell sequencing company Parse Biosciences, Netherlands-headquartered provider of sleep diagnostic and monitoring solutions Onera Health, contract drug development and manufacturing firm SK Pharmteco, and Japan-based MaRI, among others.

And with 21 filed deals pending and 24 more in the pipeline, listing activity in the sector can still pick up this year.

Filed List

| Company | Company Geography | Filing Date | Potential Deal Value (USD m) | Exchange |

|---|---|---|---|---|

| Lirum Therapeutics Inc | United States | 11-Mar-24 | — | Nasdaq – All Markets |

| Jyong Biotech Ltd | Taiwan (China) | 07-Mar-24 | — | NYSE Mkt LLC |

| Boundless Bio Inc | United States | 06-Mar-24 | — | Nasdaq – All Markets |

| Aprinoia Therapeutics Inc | United States | 26-Jan-24 | 24 | Nasdaq – All Markets |

| Zhengye Biotechnology Holding Ltd | China | 09-Jan-24 | 20 | Nasdaq – All Markets |

| Wangdiqiyuan International Holdings LTD | United Kingdom | 06-Dec-23 | — | Nasdaq – All Markets |

| Sequoia Vaccines | United States | 06-Nov-23 | 25 | NYSE Mkt LLC |

| Aibafang Group CO | Cayman Islands | 30-Oct-23 | — | Nasdaq – All Markets |

| Invea Therapeutics | United States | 20-Oct-23 | 75 | Nasdaq – All Markets |

| MED EIBY Holding Co Ltd | China | 24-Feb-23 | 20 | Nasdaq – All Markets |

Withdrawn IPOs

| Company | Company Nationality | Withdrawn Date | Potential Deal Value (USD m) | Exchange |

|---|---|---|---|---|

| Jinrong Holdings Ltd | China | 13-Dec-23 | Nasdaq – All Markets | |

| Carmot Therapeutics inc | United States | 11-Dec-23 | 100m | Nasdaq – All Markets |

| Eleison Pharmaceuticals Inc | United States | 29-Jun-23 | 40m | Nasdaq – All Markets |

Lapsed IPOs

| Company | Company Nationality | Last Filing Date | Potential Deal Value (USD m) | Exchange |

|---|---|---|---|---|

| Advanced Biomed Inc | Taiwan (China) | 18-Jul-23 | 113m | Nasdaq – All Markets |

| WORK Medical Technology | China | 30-Jun-23 | 14m | Nasdaq – All Markets |

| Cortigent Inc | United States | 07-Jun-23 | 15m | Nasdaq – All Markets |

| MDNA Life Sciences Inc | United States | 25-Apr-23 | 13m | Nasdaq – All Markets |

| New Ruipeng Pet Group | China | 23-Jan-23 | 100m | Nasdaq – All Markets |

| Jupiter Neurosciences Inc | United States | 02-Dec-22 | 15m | Nasdaq – All Markets |

| Regentis Biomaterials Ltd | Israel | 04-Nov-22 | 15m | Nasdaq – All Markets |

| Alopexx Inc | United States | 06-Sep-22 | 15m | Nasdaq – All Markets |