US IPOs edge toward restart as shutdown ends, but Thanksgiving and year-end complicate relaunch – ECM Pulse North America

- Fades of recent pops temper issuer enthusiasm for a December rush

- SEC backlog and private-public valuation gaps keep many candidates leaning toward 2026

The end of the 43-day US government shutdown comes at an awkward moment for IPO issuers, who now face a narrow window to launch before year-end or the prospect of waiting until 2026.

The vote on 12 November to reopen federal agencies will restart the SEC’s review process, but it may also coincide with the period when investors are least inclined to take risks.

The pipeline is primed, yet somewhat fragile. The market’s enthusiasm over the summer and early fall has cooled, and dispersion in recent trading is testing investors’ patience.

“The risk appetite has definitely moderated since September,” a fund strategist said. “Not every deal is popping. Investors are coming at each one fresh, sometimes skeptical.”

Dealogic data shows why there is such tension. The average weighted performance between offer-to-current of the 10 largest US IPOs since 1 September is just 3% compared with an average 20% pop at close on day one.

This gap suggests that some of the exuberant openings have had little follow-through. In the case of Klarna, a 14.6% first-day rise has flipped into a loss of almost 10%. Crypto exchange Bullish, up 88% on debut, now trades roughly 26% above its offer.

“December IPOs are tricky, a narrow window with investors in portfolio-protection mode,” one ECM syndicate banker said. “Large deals blowing up can hurt portfolios. But this year’s strong markets mean some funds are chasing performance, seeing late IPOs as catch-up gifts.

“Still, everyone, bankers and hedge funds alike, is silently asking, ‘This will work, right?’”

The reopening of the SEC gives companies the technical ability to move again, but bankers expect only a measured restart. “It’s pretty fortuitous that the shutdown ended right after the last big week of IPO activity,” the fund strategist said.

“The pipeline is reopening, but the SEC’s backed up, so there won’t be a rush of new filings. Maybe two active weeks in December if everything goes right.”

Roughly a dozen issuers with deal sizes above USD 100m are waiting for clearance. That group includes Medline, which filed publicly after several postponements and could become the year’s biggest US listing, along with BitGo and travel platform Klook.

Each amended its prospectus in recent weeks but fell short of lining up imminent launches.

“Holiday season, shutdown, and recent moderation in excitement are all weighing on the market,” the strategist said. “If every deal had popped last week, we’d see more accelerate.”

The calendar leaves little room for error. “A few companies want to come in before Thanksgiving, which really leaves the first half of next week,” another ECM banker said. “It’s up in the air. A lot depends on how quickly the SEC can open the gate.”

He described the pipeline as “aggressive in the best way possible,” with issuers eager to follow the reopening headlines, but argued that 2026 may still be the more logical launchpad.

“Unless everything’s firmed up with a strong investor base and story out there for some time, it’s better to hang up for the year and line up January,” he said.

Frothy trading prompts debate on market structure

While IPOs have broadly made investors money this year, the uneven secondary performance of high-profile names shows how sensitive sentiment has become.

Companies that rush to exploit the reopening risk competing for a fatigued investor base that has spent the past months protecting gains and trimming exposure ahead of the holidays.

Any buyer in a late-November or December deal is likely to flip quickly to lock in profits, a dynamic that could worsen volatility for new listings.

To the ECM syndicate banker, the recent pattern of oversubscribed deals expanding in size and price only worsens that problem. He pointed to the aftermarket performance of a company like Beta Technologies, which was 20x oversubscribed and upsized. The electric aircraft developer opened flat in its New York Stock Exchange debut, an underwhelming outcome for a company widely framed as a test of early-stage electrified aviation sentiment.

“Deals should be bigger and priced rationally, not popping 80%. Oversized pops make no sense at this stage,” he argued.

Another brake on supply lies in the gap between public and private valuations, he said.

Private rounds have seen small sums raised at “absurd valuations” as of late, he noted, meaning that when those companies go public, public investors will likely balk at 18x sales multiples. “Private markets are still out of control,” he said.

That disconnect explains why many issuers will likely choose patience over urgency, particularly for smaller listings. “Imagine sitting in your trading-desk row, nobody’s saying, ‘Let’s buy this small IPO after Thanksgiving,’” he noted.

The counterargument is that waiting too long introduces its own risks. Companies that delay until next year may need to update numbers and reframe their equity stories.

Waiting until 1Q implies the risk of dealing with a weaker market and a different set of financials than what issuers have built their pitch around.

For others, the reopening marks the start of a longer recovery arc. “We’re optimistic,” the fund strategist said. “There’s a healthy pipeline: companies filing confidentially, meeting banks, hiring CFOs with IPO experience, all signs of a 2026 rebound.”

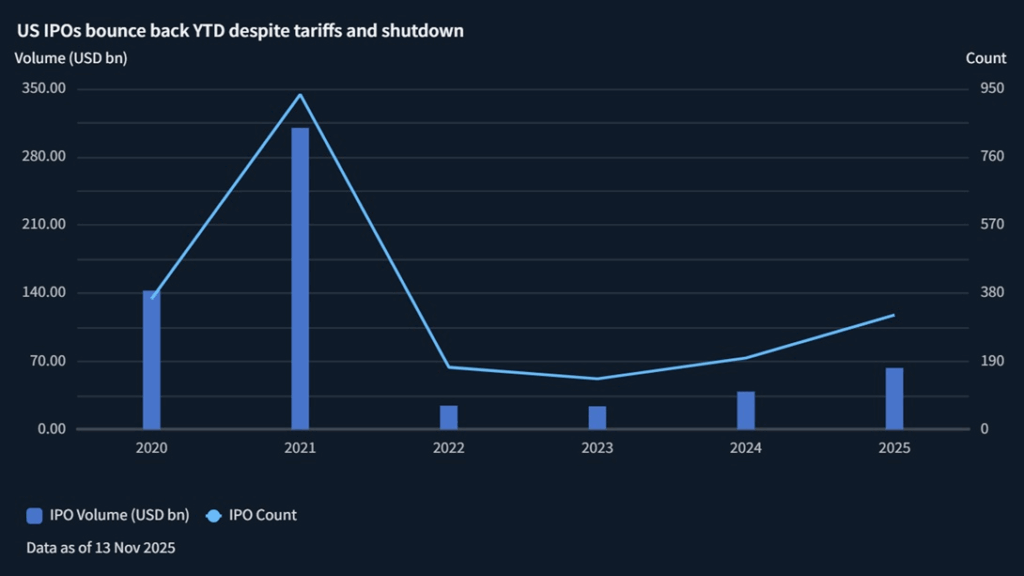

The tariffs and shutdown, he added, prevented 2025 from being a normal year. “Without them we’d have seen maybe 150 plus IPOs raising USD 50bn.”

The weeks beginning on 1 and 8 December are the final realistic slots for the year, assuming companies file by this Friday. Beyond that, most attention shifts to early-2026 debuts, when more normalized filing activity and investor focus could return.

Until then, dealmakers remain divided between opportunism and discipline. More than ever, they must believe in the strength of their financials, the likelihood of their projections, and the persuasiveness of their equity story.