US convertible issuance nears 2021 highs as investor appetite remains elevated

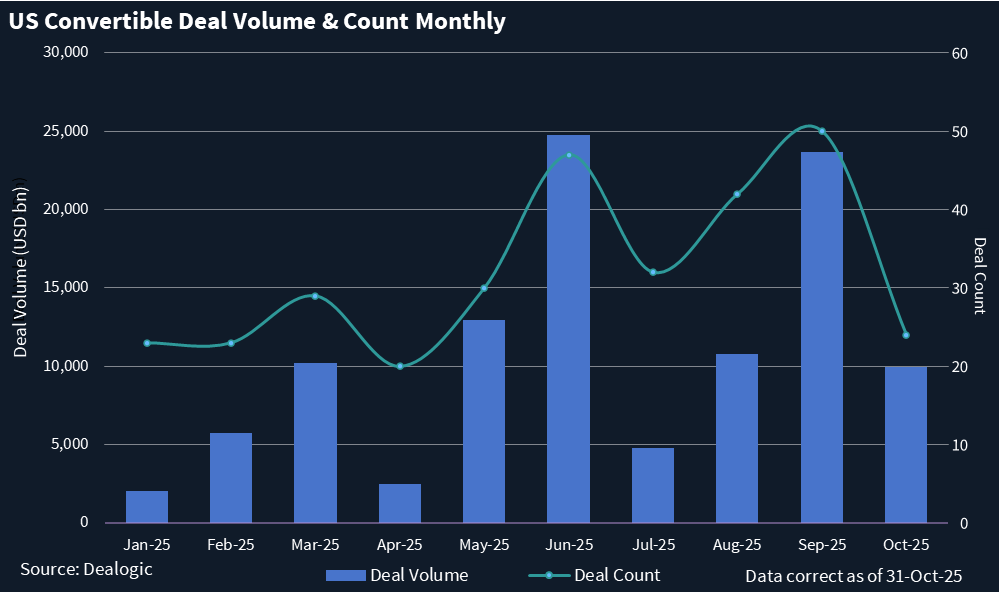

US convertible issuance accelerated in the third quarter, putting 2025 on course for the busiest year since 2021.

Dealogic data show about USD 39.2bn raised in 3Q25. Fourth-quarter issuance so far has hit USD 10bn as issuers move quickly to capture lower yields and strong equity momentum, and investors remain ardent.

While issuance levels are nearing previous peaks, “In 2021, a billion-dollar deal was considered large,” said Bryan Goldstein at Matthews South. “Now almost every other transaction is approaching that size.”

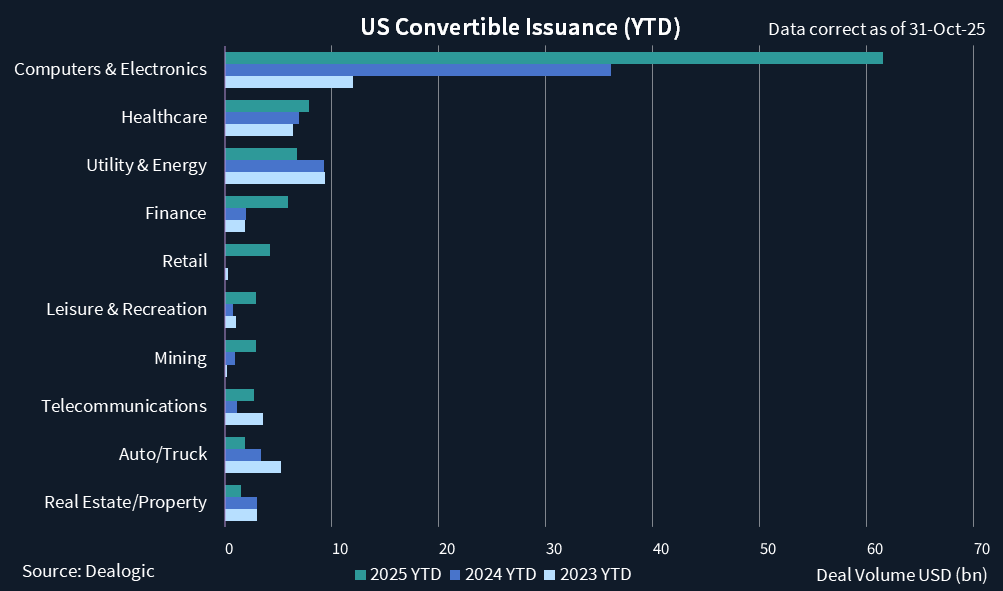

Activity has broadened beyond refinancing as companies take advantage of receptive markets to finance expansion. Goldstein said much of the recent flow has been opportunistic, supporting growth as mergers and acquisitions activity rises.

On the buyside, the surge in supply has created both opportunity and pressure. “The September global CB issuance was the highest we’ve seen on record,” said Ivan Nikolov at Fisch Asset Management. “Convertibles are a living asset class where many companies leave the universe frequently, given their relatively shorter duration than some other credit. New issuance is the lifeblood that enriches the opportunity set for investors.”

Nikolov said the abundance of deals has made investors more selective; structures increasingly feature longer maturities, lower coupons and higher conversion premiums. While that reflects strong appetite, it also points to exuberance in parts of the market.

Aftermarket performance has remained solid even as deal terms grow more issuer-friendly. Goldstein said most transactions continue to trade well, which boosts investor confidence. Low coupons remain common despite the shifting rate environment.

He explained that even as policy rates move lower, the zero-coupon structure remains the floor, and as interest rates fall, higher conversion premiums typically compensate.

One banker said these conditions have encouraged issuers to keep targeting near-zero-cost funding, noting that many companies are “solving for zero-coupon-type alternatives” and that there is little sign of investor fatigue.

Market balance has held steady thanks to consistent demand and maturities. Nikolov said hedge funds remain the core buyers while long-only investors have started to return. Redemptions of 2020-era bonds are also helping to offset new issuance.

Valuation tension is building after a strong equity rally. Nikolov said the secular growth themes that underpin many issuers, particularly in the AI value chain, remain intact and the growth of CB issuers is still priced cheaper than the average of the stock market.

But the valuation cushion has narrowed, making future corrections potentially sharper and the asset class’s asymmetric payoff more compelling, he added.

Goldstein expects the market to find a natural balance as conditions normalize. He said deals continue to perform but the pace of issuance may slow once volatility returns and investors begin to push back on aggressive structures.

The largest transactions of 3Q included Alibaba Group Holding’s USD 3.2bn deal and Nebius Group’s USD 1.6bn issue, both priced in mid-September. The current quarter opened with Live Nation Entertainment’s USD 1.4bn convertible, structured with a six-year maturity, a 2.875% coupon and a 50% conversion premium, mainly to refinance existing debt.

Another notable transaction was AST SpaceMobile’s USD 1bn convertible due 2036, upsized from USD 850m on strong demand. The Texas-based satellite communications company priced the bond on 21 October with a 2% coupon and a 22.5% conversion premium. Market participants described it as an equity-leaning deal with limited read-across for the broader market given its long-dated, quasi-equity profile, as this news service previously reported.

The refinancing pipeline should keep activity elevated into 2026 as the heavy 2020–21 issuance cycle approaches maturity. “Volumes have been significant this year, and there’s still plenty of refinancing coming in 2026,” said a second banker. “There is no reason to think the strong activity we’ve seen won’t continue.”

For now, sentiment remains constructive. “We should expect more volatility and dispersion,” Nikolov said. “Some companies’ stocks haven’t risen excessively, while others have,” he added.

“When corrections arrive, the overextended ones could fall further. It’s likely to be more of a stock-picker’s and a convertible-picker’s market going forward.”