Uncertainty clouds outlook despite volume gains – North America Consumer Trendspotter

- Deal count remains low

- Only ‘A+’ assets transacting

- Obstacles include valuation gaps and deal fatigue

Despite a jump in deal volume in North America’s consumer space, the otherwise disappointing results in the first half of 2025 do not signal great promise, sector advisors and experts said.

Continued uncertainty surrounding tariffs, geopolitics, and consumer sentiment remain major obstacles in strategics and financial sponsors’ ability to complete consumer deals, the sources said.

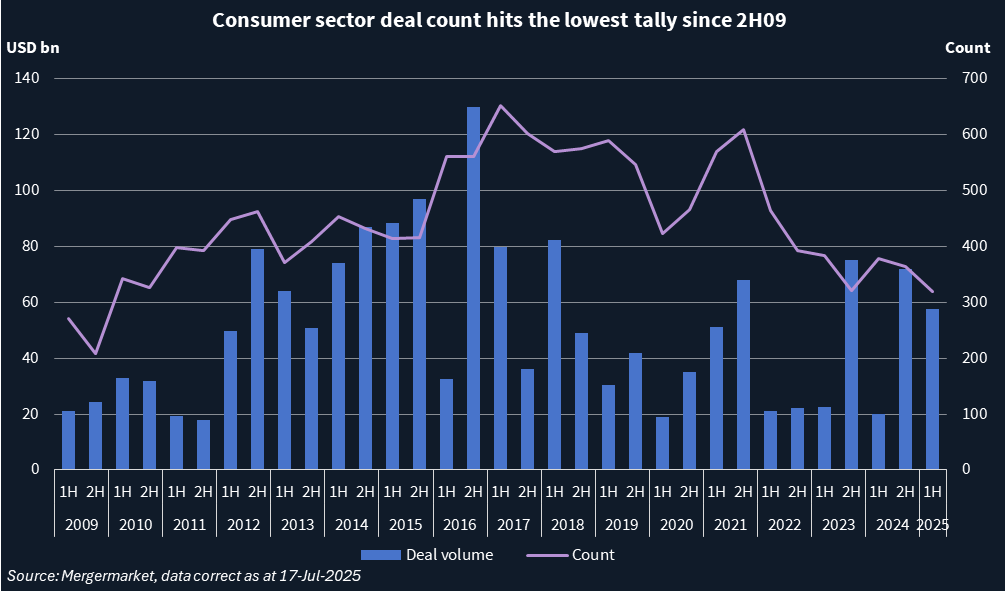

In 1H25, North American consumer deal activity jumped 188% by volume to USD 57.5bn compared to USD 19.9bn in 1H24. However, volume was largely driven by the two biggest deals in the consumer sector so far this year – the pending USD 23.7bn buyout of Walgreens Boots by Sycamore Partners and the ongoing USD 11.3bn buyout of Skechers USA by 3G Capital.

With only 320 deals completed in 1H25, the deal count for the first half of the year is the lowest Mergermarket has recorded since 2H09.

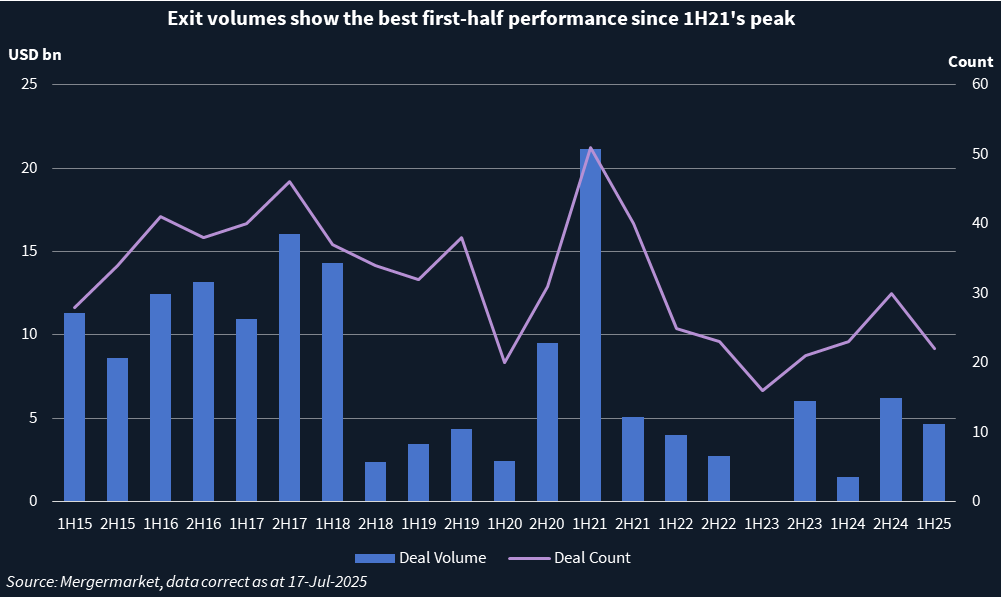

Sponsor exits rose 214% in 1H25 by volume to USD 4.7bn over 22 deals compared to 1H24, but remained low in count, following a post-COVID trend that shows no sign of letting up. The largest exits were the USD 1.5bn exit of Sauer Brands by Falfurrias Management Partners in January and the USD 1.5bn exit of Harvest Hill by Brynwood Partners in April.

The numbers paint a picture that starkly contrasts the message of hope and excitement dealmakers had going into this year under the newly installed Trump administration, and it remains to be seen when sponsors and strategics will adapt to such an unpredictable dealmaking environment, said Mike Ellis, co-head of Proskauer’s M&A Group.

“Overall, it has been kind of a mixed bag – for the time being, we expect that to continue,” Ellis said. “Perhaps more companies will come to the realization that uncertainty may be the new normal, and we’ll see more deals getting done.”

Megadeals not the whole story

Larger deals have dominated the headlines in the consumer space for 1H25, with Ferrero’s USD 3.1bn acquisition of WK Kellogg standing out alongside the Walgreens Boots and Skechers USA deals. But they have still been “few and far between” and dependent on opportunistic value popping up, said Morgan LeConey, Head of US Consumer and Retail at Macquarie Capital.

Despite the uncertainty in the consumer space, “A+” assets displaying high growth will still continue to transact, LeConey said, referencing the acquisitions of LesserEvil, Poppi, Siete Foods, and Simple Mills as businesses that are trading for multiples near all-time highs.

But these higher multiples should not be taken as a sign that the market is broadly recovering, LeConey noted, as weaker assets are not transacting.

“The combination of those larger high-growth deals being bought by public companies in a search for growth, coupled with value-oriented, take-privates, that’s where the activity has been relative to just the flow of more traditional sponsor assets,” LeConey said.

Strategics — particularly the larger ones that could withstand mistakes — aren’t just going to wait around forever, but middle market players may have to remain patient, Ellis said.

“While many deals are taking longer to get done, large players have been finding ways to get them done, often using creative consideration solutions, whereas many smaller players may still be sitting on the sidelines,” Ellis said.

Down the food chain

A significant catalyst for more middle-market consumer dealmaking in 2H25 and 1H26 would be the lowering of interest rates, Ellis and LeConey said.

If rates do stabilize before the end of the year, sponsors will move faster than strategics, said Shane Lucado, founder and CEO of legal marketplace InPerSuit, noting that sponsors could test the waters with tuck-ins and platform add-ons in 4Q. Lucado works directly with M&A counsel and clients in deal environments and leads InPerSuit, which serves business owners and operators who are scaling, buying, or defending their ventures.

“Private equity likes mispriced opportunity,” Lucado said. “Strategic acquirers are still slow-playing due diligence because they do not want to inherit liabilities.”

Valuation gaps are also holding consumer deals back, with some founders buying into the fanfare around their brands too excessively, Lucado said.

“Way too many founders believe their brand is worth 9x EBITDA on Shopify sales alone, that does not fly anymore,” Lucado said. “Sellers need clean books, data-backed customer acquisition costs, and long-term contracts in place. Buyers want more than hype – they want models they can scale by Q2 next year.”

Lucado added that deal fatigue is currently the biggest friction point in consumer dealmaking, due to prolonged diligence processes and sellers getting exposed during financial Q&A.

“Add in platform debt, poor logistics, or brand-reliant founders, and it all stalls,” Lucado noted.

Sectors that could see activity

Food and beverage is a sector that might still see decent activity in 2H25, due to some companies experiencing limited impact from tariffs and still producing staple-type products, LeConey said.

Bakery is one example of a food and beverage subsector which remains warm. Mergermarket recently reported that the TM Capital-led sale process for Engelman Bakery, a Shoreline Equity Partners-backed baked goods manufacturer, has moved into the late stages.

Refresh bids recently came in at a low double-digit EBITDA multiple, with mostly sponsors left in the process alongside one strategic party, as reported. Norcross, Georgia-based Engelman is being marketed off of projected 2025 EBITDA of over USD 20m and could fetch an 8x-10x EBITDA multiple given its premium positioning in rolls and buns, as reported.

M&A in the service business and franchisor spaces should also remain active, he noted.

On the beauty and wellness side, men’s care, clinical skincare, fragrance, and dermatology-backed brands may also see activity, said Dametria Kinsley, vice president of global marketing for beauty company PDC Brands.

This newswire reported last month that Prose, a direct-to-consumer customized haircare and skin brand, was preparing to explore a sale and had mandated Goldman Sachs to advise on the process.

The venture capital-backed company generates around USD 150m in annual sales, as reported. Brooklyn, New York-based Prose uses AI to create personalized hair care products based on an individual’s specific needs and preferences.

Kinsley said that buyers in beauty are now looking for clean, focused brands that aren’t just marketing gimmicks.

“What’s slowing down is a lot of celebrity brands that don’t have staying power,” Kinsley said. “You need more than a name or a trend right now, you need a reason to exist.”