Turbulent public markets attract buyout interest – Dealspeak North America

A funny thing happened on the way to the US stock market hitting record highs this year. Several publicly traded companies decided they would be better off operating in the private markets.

An increase in regulatory and reporting requirements has made the public markets too burdensome for some small and midsized companies. Several larger enterprises, meanwhile, believe going private will unlock new growth channels and maximize shareholder value. Many others, say financial advisors, should never have gone public in the first place, having listed their shares through mergers with blank check firms amid the mania of 2020-2021 only to see their valuations shrivel.

“The reality is there are companies which for a variety of reasons would benefit from no longer being public,” says Daniel Ganitsky, co-head of global private equity and M&A at New York law firm Proskauer.

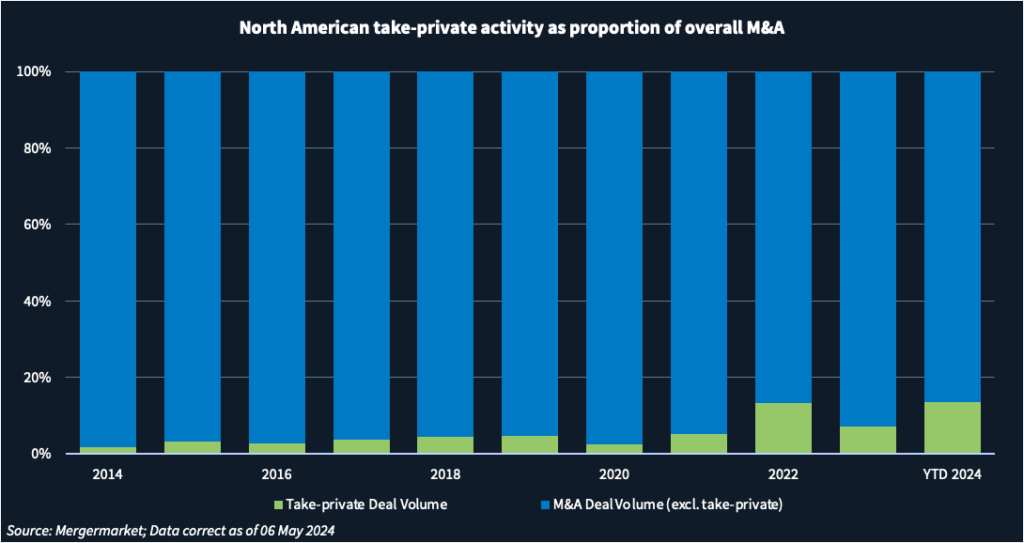

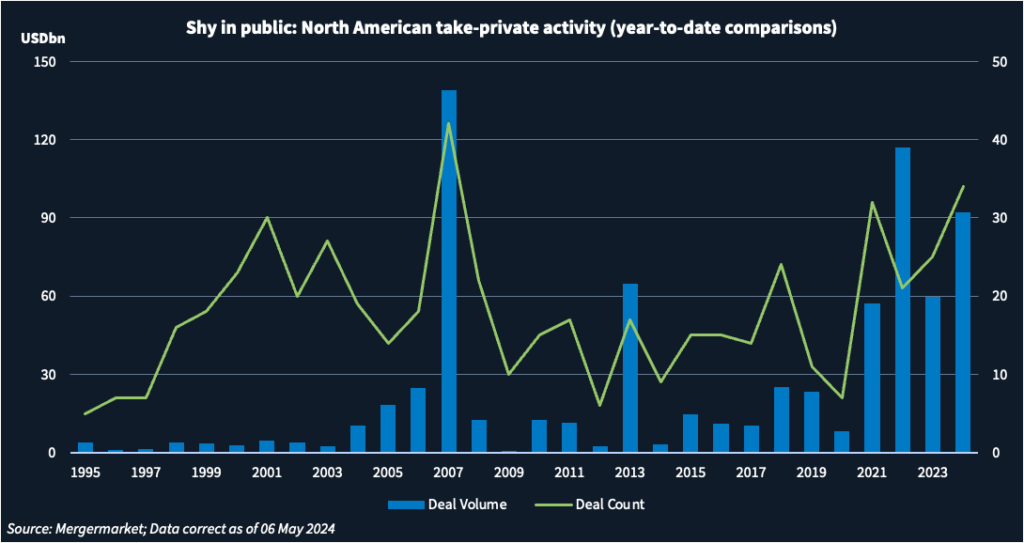

Take-private activity is at its highest level in nearly two decades, according to Mergermarket data. In the year to date, 34 companies have gone private – the most since 2007. Take-private transaction volume of USD 92bn in 2024 YTD as a percentage of total M&A is at 13.7%, the highest level since 2007, according to Mergermarket data. The number of take-private deals as a proportion of total M&A is 1%, the highest level on record.

Motivated buyers

A mix of motivations exists for companies looking to leave the Nasdaq and New York Stock Exchange. One common theme, however, unites the buyers bidding for them. Private equity firms have vast amounts of capital to deploy and see more opportunities on the stock exchanges than in the private markets where a valuation gap between buyers and sellers persists.

The technology sector in particular suffers from a dislocation. Several tech companies used the craze for special purpose acquisition companies (SPACs) to go public in 2021. Many are now “orphaned IPOs,” blighted by performance issues and unloved by investors.

“If they are big enough and have good technology, those are moving to the forefront of potential take privates,” says West Riggs, head of equity capital markets at Truist Securities. “We are starting to have an uptick in conversations.”

Leveraged financing costs have also dropped in the last six to 12 months, fueling take-private activity among tech firms, Riggs adds. Average yields on loans used for leveraged buyouts dropped to 9.79% in the first quarter, the lowest level since 2022’s third quarter, according to Debtwire data.

Big deals

Notable deals this year include Silver Lake’s USD 14.9bn buyout of sports and entertainment company Endeavor Group Holdings. When Endeavor’s majority stake in TKO Group Holdings [NYSE:TKO] is considered, Silver Lake believes their combined total enterprise value of USD 25bn makes it the largest take-private transaction by a private-equity sponsor in more than a decade.

Otherwise, the largest take-private deal this year has been investment firm Novo Holdings‘ proposed acquisition of drug manufacturing subcontractor Catalent for USD 17.3bn. If approved, Novo Holdings intends to sell three of Catalent’s manufacturing facilities to its publicly traded subsidiary Novo Nordisk [NYSE:NVO].

Sixteen of the 34 take-private deals announced in North America this year are valued at USD 1bn or more. They include activist investor Arkhouse Management and Brigade Capital’s bid for iconic department store Macy’s, valued at USD 12bn, including USD 5.8bn in net debt.

Rescue me

More take-private deals are in the works. Nordstrom [NYSE:JWN], another iconic department store, wants to go private and buyout firms like Sycamore Partners have reportedly expressed interest in acquiring it.

Another is 23andMe whose CEO, Anne Wojcicki, wants to take the DNA testing company private. The company was valued at about USD 3.5bn when it went public via a SPAC merger in 2021, but it has become a penny stock worth USD 240m today.