Trump policies lead to wait-and-see M&A sentiment — Dealspeak North America

Tariffs, supply chain issues, labor force disruptions, geopolitical convulsions, and greater-than-anticipated regulatory scrutiny have left dealmakers hitting the pause button on their plans, according to M&A practitioners.

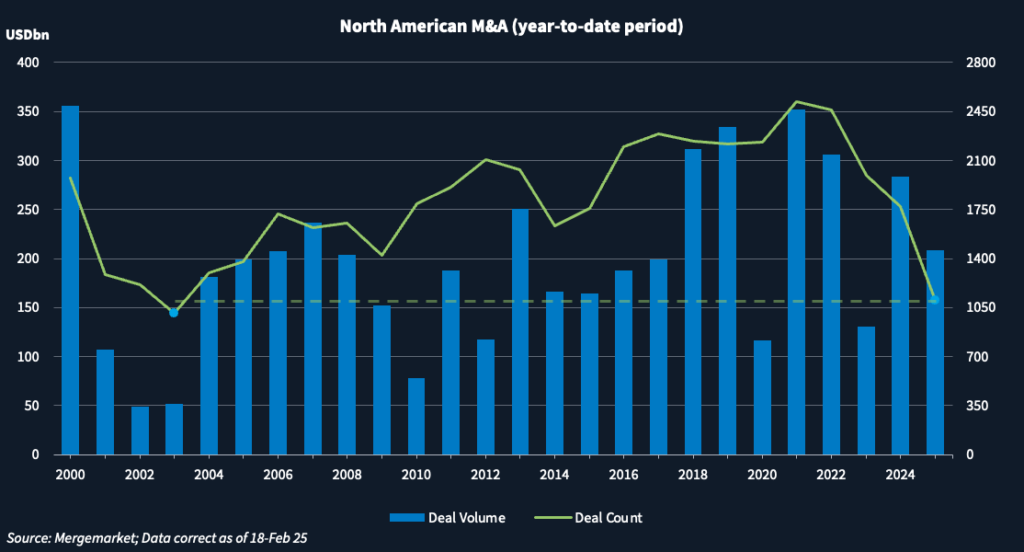

The number of deals has dropped to the lowest level in years amid uncertainty brought about by President Donald Trump’s aggressive policy stance, although dollar volume has remained robust.

Dealmakers signed 1,100 transactions in the year to date (18 February), the slowest start since 2003, according to Mergermarket data. And while deal volume YTD sank 26% year-over-year to USD 208.8bn, it is still 60% higher than in 2023.

“There is a wait-and-see sentiment among those who want to buy and sell,” said John Cho, head of deal advisory for KPMG in the Americas region. “Uncertainty is never good for deal making.”

Mega deals on MAGA pause

After November’s elections, dealmakers were enthused over a potential Trump bump in M&A. The thinking was that lower taxes, less regulation, and a friendlier view on mergers from trustbusters, combined with falling interest rates and the likelihood of a soft economic landing, would all combine to encourage companies to go big again.

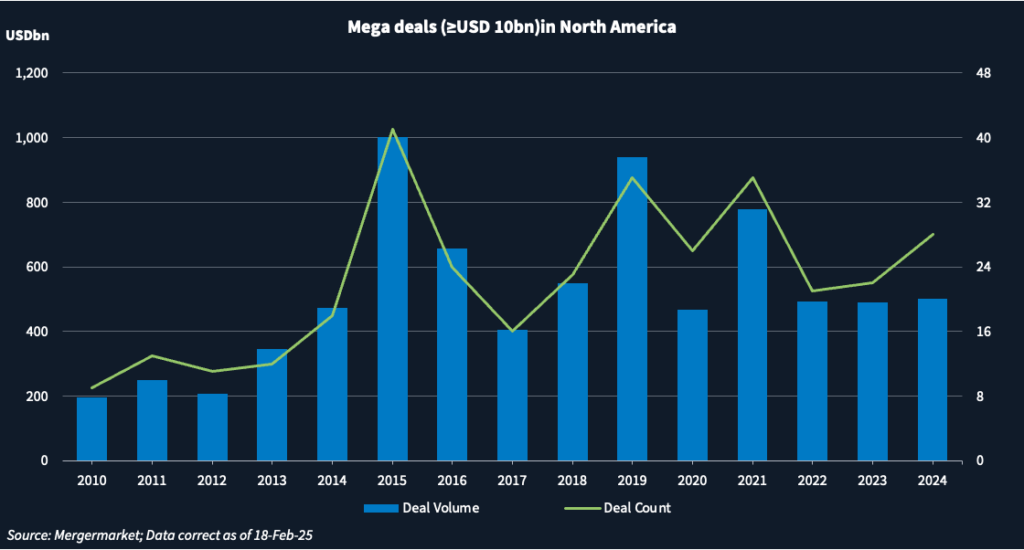

An increase last year in the number of USD 10bn-plus deals to the highest level since 2021’s halcyon days lent credence to that view. Such mega deals numbered 28 worth a combined USD 501.6bn in 2024, up from 22 totaling USD 488.8bn in 2023, according to Mergermarket data.

After three mega deals in the first fortnight of the year – Constellation Energy’s [NASDAQ:CEG] agreement to buy Calpine for USD 29.4bn, Johnson & Johnson’s [NYSE:JNJ] USD 15.5bn offer for Intra-Cellular Therapies [NASDAQ:ITCI], and QXO’s [NYSE:QXO] USD 11.5bn hostile bid for Beacon Roofing Supply – hopes remained high for more. Since then, however, none have been announced.

The Department of Justice’s suit on 30 January to block Hewlett Packard Enterprise‘s [NYSE:HPE] pending USD 14bn takeover of Juniper Networks [NYSE:JNPR] has cast a shadow of uncertainty over the M&A landscape, said Louis Lehot, a partner at Foley & Lardner. It is particularly surprising given HPE is not active in the networking sector and Juniper is considered a much smaller competitor to Cisco [NASDAQ:CSCO], he said.

“The big deals that we do see happen will have compelling reasons to do it despite the uncertainty.”

Tariff threat

Tariffs have arguably had the biggest impact on souring initial optimism for M&A. Companies that source aluminum and steel parts from China and Asia, such as some manufacturers of digital signage, will be affected, said one media banker. Private equity firms, which hold many of these companies, continue to wait for the right moment to find liquidity. “A lot of potential sell-side transactions we previously thought would begin early this year [are] on hold.”

PE firms are monitoring the situation, with some planning to exit portfolio companies by year-end. The falling cost of private credit should encourage them. “We still expect a strong year, but it may be more backloaded.”

Stay positive

In sectors that involve the movement of goods, such as automotive, tariffs have caused some pauses in ongoing deals, as corporate strategy teams reassess price models. But even if that changes the final purchase price, the desire to transact should prevail, said Bill Curtin, global head of M&A at Hogan Lovells.

With Trump, the “master negotiator”, using tariffs in part to cut deals, the situation should stabilize over the next 90 days. That should unlock M&A activity, with a lift in February and March and significant boosts in April and May expected, said Curtin.

Many deals – buttressed by the positivity around M&A after November’s election – have just not been announced yet, delayed only by the holidays and the three-to-four-month timeframe it typically takes to agree to valuations and terms, Curtin said.

“We are working on billions of dollars of deals; we just haven’t finished the deals or finalized the terms.”

One advisor from a bulge-bracket bank still believes 2025 may mark a return of mega M&A in the tech sector. Discussions around larger deals have increased since November and they may eventually materialize as tariff concerns ease or interest rates decline, the advisor said.

Enterprise software – particularly in cybersecurity, fintech, HR software, DevOps, and customer experience automation – is generating most interest. “A wave of M&A [is] getting underway to build bigger platforms,” the advisor said. “A lot of that can be done through small and medium-sized transactions. But there are potentially bigger deals in the pipeline.”