Trioworld among earlier-stage sponsor exit candidates in rapidly-consolidating packaging sector – LTE Charts of the Week

LTE Charts of the Week showcase the power of Mergermarket’s Likely to Exit (LTE) predictive analytics engine. Find more financial sponsor exit opportunities by activating a two-week trial to Mergermarket or log in if you are a subscriber.

- DS Smith, WestRock mega-mergers have put packaging consolidation in the spotlight

- Sector’s top acquirers include Smurfit Kappa, WestRock and International Paper

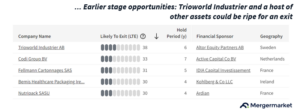

- Trioworld, Codi Group, Fellmann Cartonnages among potential earlier-stage sector sponsor exit opportunities

Multi-billion dollar mergers between DS Smith [LON:SMDS] and International Paper [NYSE:IPR] and Smurfit Kappa [LON:SKG] and WestRock [NYSE:WRK] mean the packaging sector is firmly in the M&A spotlight during 2024.

International Paper’s offer for UK-based DS Smith, announced last month following a bid from rival Mondi [LON:MNDI], valued the business at GBP 7.7bn (USD 9.8bn) and is one of Europe’s biggest deals to-date.

That has boosted M&A deal volumes in the packaging sector, with the industry off to its fastest start to a year since 2015.

Smurfit’s deal with Atlanta, Georgia-headquartered-WestRock valued the latter at USD 21bn and was announced late in 2023.

The transaction has catapulted Smurfit to the top of the sector’s dealmaking tables in the past decade. Smurfit, WestRock itself and International Paper are the sector’s biggest acquirers over that period. They are followed by Amcor [NYSE:AMCR] and financial sponsor Apollo.

With sector activity running hot, a host of paper and packaging assets owned by financial sponsors could be edging into the M&A spotlight.

Trioworld Industrier, Codi Group and Fellmann Cartonnages are three assets which could represent earlier-stage opportunities, according to Mergermarket analysis of packaging sector LTE Scores.

Smalandsstenar, Sweden-based Trioworld was acquired by financial sponsor Altor in 2018 for an undisclosed sum from Bo Larsson, son of founder Vilhelm Larsson. Altor was preparing the plastic packaging solutions provider for a sale during 2022 but no deal has yet been announced. Trioworld, which has an LTE Score of 38 out of 100, could be an asset to watch out for in the year ahead with signs sector M&A is hotting up. It generated revenue of EUR 851m during 2023, according to Altor’s website.

With an LTE Score of 33 out of 100, wet wipes and packaging supplier Codi Group is another earlier-stage opportunity in the packaging sector. It was acquired by financial sponsor Active Capital Company from Value Enhancement Partners during 2017. Veenendaal, Netherlands-headquartered Codi is now one of the five largest operators in the European wet wipe market with revenue of around EUR 100m, according to Active Capital’s website.

Finally, Alsace, France-headquartered food packaging specialist Fellmann Cartonnages is another asset to keep an eye on. Owned by financial sponsor Arkea Capital, the business has revenue of between EUR 20m and EUR 50m and an LTE Score of 31.

LTE Scores are generated using a machine-learning algorithm developed by ION Analytics data scientists, engineers, and journalists leveraging 20+ inputs from more than a decade of proprietary Dealogic deal data and M&A intelligence. Find out more about the score’s predictive capabilities in Mergermarket‘s LTE Predictive Scoring Whitepaper.

Note: Data correct as of 3 May 2024

Source: Mergermarket.ionanalytics.com