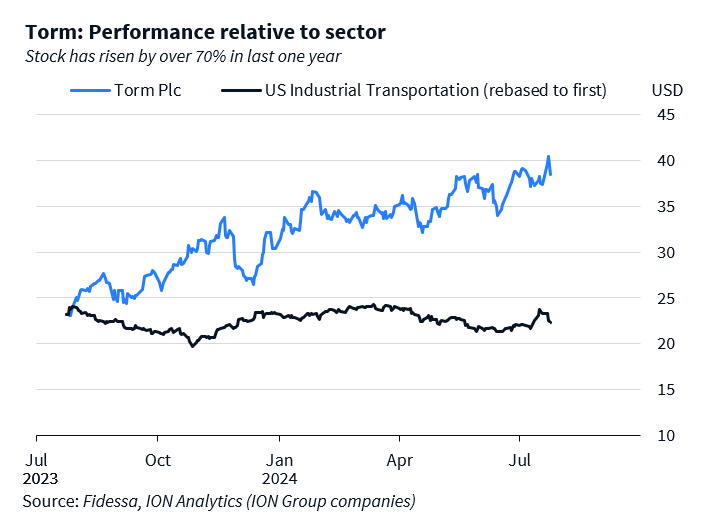

Torm 47% shareholder Oaktree likely to exit lock-up expiry: North America Lock-up Expiry Tracker

The North America Lock-up Expiry Tracker flags upcoming lock-up expiries from Dealogic’s proprietary database. It analyzes potential outcomes of selected lock-up expiries including the likelihood of a block trade, potential and historical stock price impact, performance of the issuer and factors likely to influence the exiting shareholders’ decision. Click here to view Dealogic’s Lock-Up Report.

A 60-day shareholder lock-up for Oaktree Capital holding a 46.7% stake in Torm plc [NASDAQ:TRMD; CPH:TRMD-A] expires on 30 July.

The sponsor entered the lock-up after it sold a 7.3% stake in the Denmark-based shipping company on 31 May at USD 36.48 per share to raise USD 251.6m.

Given that Oaktree is making a decent return on its investment, and the share price has risen sharply, another sell-down by the sponsor could happen after the lock-up expires.

The deal was priced at a discount of 5% to the previous day’s closing share price of USD 38.4 per share, according to Dealogic. That represented a ratio of -0.7x the size of the stake sold – a metric tracked by this news service as the Price of Liquidity (PoL) and used to assess how expensive block trades are for sellers.

Historically, a ratio close below -1x represents a good deal for the selling shareholders.

Oaktree Capital and other Torm creditors acquired a 99.2% stake in the shipping firm on 13 July 2015 for USD 1.38bn in a debt-for-equity swap. According to a filing in November 2015, Oaktree held a 63.5% stake, which would value its investment at USD 876m.

Founded in 1889, the company has been listed on the Nasdaq Copenhagen since 1905 and started trading on the Nasdaq New York in 2018. It joined the OMX Copenhagen 25 stock index on 24 June.

Oaktree’s stake was first cut in January 2018 when the company raised USD 100m from a primary share sale on the Nasdaq Copenhagen.

Torm shares closed trading on the US Nasdaq at USD 8.4 per share on 20 February 2018.

Oaktree first tried to sell down its stake in March 2023, but called off the sale due to market conditions. It then sold a 3.4% stake on 27 November 2023 at USD 30.4 per share to raise USD 85.3m.

Torm share price closed at USD 40.45 per share on 23 July, giving it a market capitalisation of USD 3.8bn and valuing Oaktree’s stake at USD 1.79bn.

Given that Oaktree has started trimming its stake, the share price has increased since the last block trade and the sponsor is making good money on its investment, a sell-down after the lock-up expiry could be on the cards.