The Fed, more than Trump/Harris contest, is keeping IPO advisers up at night – ECM Pulse North America

With the US election less than three months away, advisers are less concerned about an unpredictable political outcome than the Federal Reserve’s decision around rates.

While the impact of new policies will go a long way in determining which sectors will benefit, or not, from the new administration, equity capital market participants are bracing for the potential near-term effects of a Federal Reserve rate cut in September.

This comes as Chair Jerome Powell teased a potential cut following the most recent FOMC meeting, citing moderating inflation and reasonable economic growth. The move could present a weeks-long window for a revival in issuance ahead of an expected slowdown in the run-up to the November election.

“I think the election is a distant driver of investor sentiment compared to the primary driver, which will be Fed rate policy,” said the managing director of a US investment bank. “It might create a market blackout for weeks and fewer days to get deals done, but the outcome of the election will not be the main driver of investor appetite,” he said.

The view was echoed by other bankers who said that if the Fed cuts rates to a level in September that meets market expectations, there will be an open capital markets window both for IPOs and follow-ons.

“The Fed meeting in September is a bigger driver of capital markets activity and volatility than the election, regardless of the candidates,” another banker concurred.

The view emerged as volatility is likely to bite into both issuer opportunism and investor appetite, while many other variables are still affecting the upcoming race that cannot yet be digested entirely by the market.

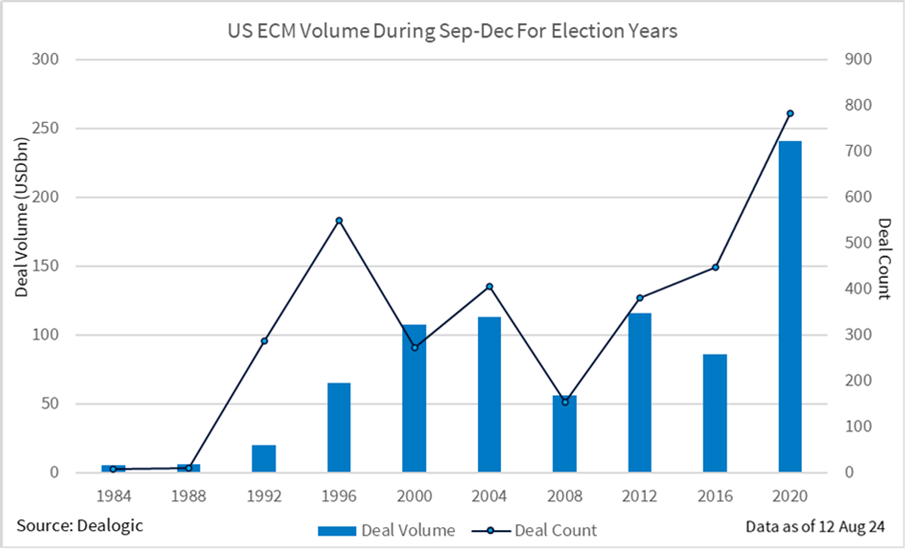

History still shows that elections rarely pull the rug out from under the equity capital markets. According to an analysis of election years, ECM volumes from September to December have shown mixed performances, according to Dealogic data.

The highest volume ever recorded came in 2020, with USD 240.9bn raised from 782 deals, when Joe Biden won the election. In the 2016 election, which saw Donald Trump ascend to the presidency, deal volume in the run-up to the election was lower, at USD 86.2bn from 447 deals.

While the same period in the nineties never surpassed the USD 100bn threshold, the months surrounding both Bush wins recorded USD 107.2bn and USD 112.9bn, respectively. Finally, in the months ahead and following the elections in the Obama years, 2008 and 2012, volumes hit USD 56.2bn and USD 115.5bn, respectively.

Another managing director at a US bank said that it is too hard to fathom issuance tendencies in these periods of both high uncertainty and rising volatility. “We looked in great detail around issuance in election years, trying to find a correlation. We have seen years when incumbents won and lost, and when Republicans or Democrats did. In any which way, we did not find a direct correlation. As a rule, issuance is just expected to slow down between the third and fourth quarter,” he said.

In this particular year, the sudden shift in the Democratic ticket, with Vice President Kamala Harris replacing President Biden, has thrown any predictions in further disarray.

Just days before the announcement that Biden would step down, advisers speaking with the Pulse had conveyed an atmosphere of increasing acceptance around a second Trump administration, which, while unpredictable on the geopolitical and international trade front, was still largely expected to be pushing for further tax cuts and deregulation of fast-developing industries like blockchain.

With Harris now spearheading the Democratic ticket, the market is taking a different approach, especially in light of her moving up in the polls. Still, they are looking forward to having a better sense of her policy outlook, which could be laid out over the coming weeks.

One banker noted that policies on both sides of the political spectrum could well incentivise or deter candidates in certain industries, yet the impact will only play out in the coming year. He singled out defence, industrials, tech and healthcare among the sectors most closely examined for policy repercussions.

“We are now back to a more balanced and wait-and-see approach,” he added.

The Fed factor

Regardless of the candidates and their policies, increased volatility is one thing advisers expect to see in the autumn and the one factor that is more likely to hurt issuance. If the CBOE Volatility Index (VIX) is below 20 in that period, investors will be less fearful about potential market fluctuation. But anything above that will encourage everyone to pull the brakes.

In this context, changes in interest rates may be the make-or-break factor in any decision-making, setting the mood for months to come. Issuers are already approaching the public markets more thoughtfully due to the prolonged downturn in activity. Deals are being valued and priced rationally, with high levels of pre-marketing to reduce risk.

Still, there is more optimism in the air. A recent global sell-off has sparked fears about IPO postponements that could impact this autumn’s issuance window, as reported. However, the US initial public offering market has been on a rebound so far this year, showcasing strong reception and driving investor returns. These are seen as the first steps toward a wider recovery that could fuel a bump in issuance in 2025.

No one has factored in dramatic jumps in issuance for the second half. “The IPO calendar still feels heavily weighted to next year and beyond,” said the managing director for ECM of another bank.

In the meantime, according to a Big Four accountancy firm partner, clients are being told that, if they have an attractive asset and they are ready to go public at the right discount, they should resist going pencil down because of the election.

Another banker took the same approach. “If the stock market is in a bad state and investors do not want to invest, then that will inform the decision, not an election that is close to call,” he said.