EMEA Corporate Divestiture Pipeline: Telecom Italia NetCo, Vodafone assets, DB Schenker among top potential deals

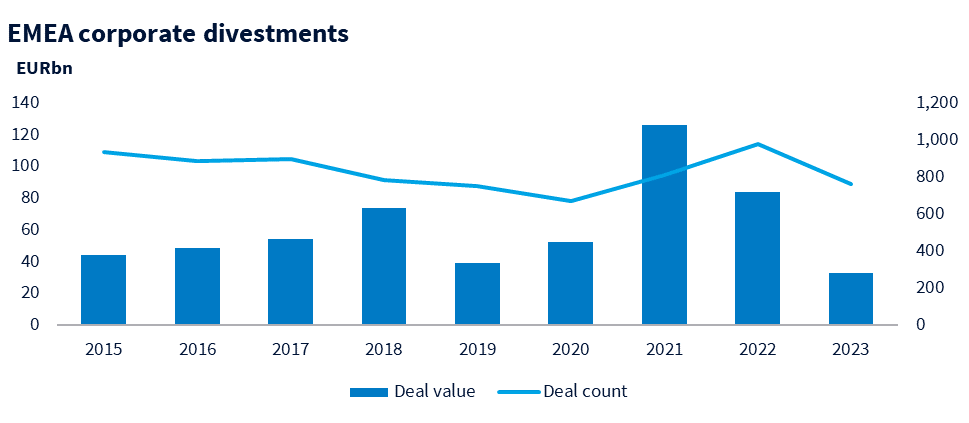

Corporate divestments in EMEA have performed marginally better than total dealmaking so far this year with EUR 33.1bn worth of deals across 764 deals recorded, according to Dealogic data.

The data, prepared ahead of this year’s Mergermarket Corporate Development Forum in London on Thursday (27 April), shows corporate portfolio reshuffling remains a priority even at a time of subdued M&A activity.

And there may even be room for some optimism ahead as a variety of multi-billion carve-outs are being readied which have the potential to transact in 2023.

Among the largest of these deals are Telecom Italia’s [BIT:TIT] mooted EUR 20bn NetCo carve-out, a variety of assets out of Vodafone [LON:VOD] and Deutsche Bahn’s EUR 15bn to EUR 20bn logistics asset DB Schenker.

Novartis’s [SWX:NOVN] divestment, via a spin-off, of generics asset Sandoz is also scheduled to complete in the second half of 2023 and had previously attracted reported bids from financial sponsors worth as much as USD 25bn (EUR 22bn).

Already in 2023, divestments account for 26.5% of EMEA deal value and 19.9% of deal count, up from 23% and 18%, respectively, during the equivalent period last year.

Big-ticket M&A deals have been few and far between year-to-date but there have already been five divestments worth more than EUR 1bn announced so far this year. This includes Groupe Bruxelles Lambert’s [EBR:GBLB] EUR 4.5bn sale of customer services firm Webhelp to California-based Concentrix Corporation [NASDAQ:CNXC] – the third largest deal announced in EMEA this year.

Industrials has been the most active sector by deal count with a total of 175 deals announced, accounting for just shy of 23% of the total number of divestments this year.

TMT also remains active with 136 deals announced worth a combined EUR 1.7bn. This included United Group’s EUR 1.2bn sale of its Bulgarian, Croatian, and Slovenian assets to TAWAL.

Even so, divestment activity is down year-to-date in line with the broader M&A market. Some EUR 29.6bn of divestments across 688 deals were announced in the first quarter of 2023 representing the lowest quarterly value since 3Q20 (EUR 27bn, 611 deals). It was the fewest number of deals since 3Q21 (EUR 67.4bn, 561 deals).

April has seen divestments take a further downturn, with only EUR 3.5bn announced through the first three weeks of the month. But that could soon change if any of a number of large potential deals, highlighted below, start to move forward.

Source: Dealogic

Top potential divestments, EMEA

Telecom Italia NetCo

Telecom Italia [BIT:TIT] has received bids for its NetCo infrastructure unit from KKR and a consortium of Cassa Depositi e Prestiti (CdP) and Macquarie Infrastructure, its board said on 19 April. Directors will meet on 4 May to consider the offers which reportedly are in excess of EUR 20bn.

Vodafone breakup

Vodafone [LON:VOD] has been linked with a range of possible transactions following stake-building by two rival strategic investors. Abu Dhabi telco Etisalat [ADX:ETISALAT] has accumulated a 14% stake and Liberty Global [NASDAQ:LBTY.A/B] took a 4.9% stake in February.

Etisalat could be interested in a deal for Vodafone’s 65% stake in South Africa-listed telco Vodacom [JSE:VOD], according to a media report, worth about USD 9bn at current market prices.

Vodafone is also exploring a merger of its UK mobile network with CK Hutchinson’s [HK:1] Three in a deal which could value the combined entity at EUR 16.5bn. Its Spanish unit has also been attracting interest, according to media reports, and could be worth up to USD 4bn (EUR 3.6bn).

Last year, Vodafone also turned down an EUR 11bn bid from telco rival Iliad and financial sponsor Apax for its operation in Italy, an asset which could represent another divestment option.

Deutsche Bahn – DB Schenker and Arriva

Deutsche Bahn (DB) is preparing its logistics arm DB Schenker for sale, its board announced last December. The asset could be valued between EUR 15bn to EUR 20bn. It has already drawn interest from Deutsche Post subsidiary DHL and is on radar of several private equity firms, who are likely to team up, given its size. The sale process is not expected to be initiated until after the summer break in Q3 or Q4.

Separately, the German rail operator is also considering relaunching the sale or spin-off of its UK rail and bus unit Arriva, according to a media report. It attempted to offload the asset in 2019 but scrapped the plan because of the coronavirus pandemic. DB acquired Arriva in 2010 for GBP 1.6bn (EUR 1.8bn).

Brenntag

Brenntag [ETR:BNR] is facing pressure from activist shareholders Engine Capital and PrimeStone Capital to split-up the business into two separate units, Brenntag Speciality and Brenntag Essentials, to increase shareholder value.

Engine Capital wants Brenntag’s board to prioritise the separation, establish a meaningful share repurchase programme and add a shareholder representative to the supervisory board. Primestone joined in late last month and has indicated it would seek to nominate two board candidates if its concerns were not addressed.

Brenntag, a chemicals distributor with a EUR 12bn market cap, has ruled out issuing an update on the separation until late 2023 and rejected making changes to its board until its shareholder meeting in June 2024, the report mentioned.

FCC Medio Ambiente

Fomento de Construcciones y Contratas (FCC) [BME:FCC] is exploring the sale of an up-to-30% stake in its environment subsidiary FCC Medio Ambiente, according to media reports. Canadian pension fund CPPIB is the most likely buyer and is planning to acquire between 20% and 30% of the shares of the business for between EUR 1bn and EUR 1.5bn, the report said.

Bollore Logistics

Bolloré Group [EPA:BOL] received an unsolicited offer from shipping group CMA CMG Group for Bolloré Logistics and the parties have entered into an exclusive period of negotiations which will end on May 8. The potential deal values the logistics unit at EUR 5bn.

Virgin Media Cornerstone

Virgin Media O2 (VMO2) is exploring a partial or full sale of its stake in mobile towers business Cornerstone, according to media reports. VMO2 owns a 50% stake in the masts business with Vodafone-backed Vantage Towers owning the remainder. VMO2’s share of the asset is being valued at around GBP 1.5bn.

Sodexo Benefits & Rewards

Sodexo [EPA:SW] is planning to spin off its Benefits & Rewards (BRS) unit, its board said alongside first half results on 5 April. BRS attracted the interest of private equity investors CD&R and CVC during 2022 in a possible deal which would have valued it at around EUR 2bn, according to a media report. The demerger is not set to complete until 2024 leaving scope for additional bids from financial sponsors in the interim.

EG Group major asset disposals

EG Group is weighing up a sale of its petrol stations and convenience store assets in the UK to supermarket chain Asda in order to unlock capital from the business, according to media reports. The move would effectively be an internal sale but would allow the owners to inject fresh cash into EG Group, allowing it to reduce debt.

Qiagen Bioinformatics

Qiagen [ETR:QIA] is considering the sale of a minority stake of its bioinformatics unit, this news service reported. The asset which could be valued at USD 1bn (EUR 910m), has piqued the interest of several sponsors including Advent International, Astorg, Bain Capital, Cinven, EQT [STO: EQT], Montagu, Nordic Capital and Novo.

Merck Pigments

Merck [ETR:MRK], the GBP 21bn market cap science and technology group, has been lining up bids for its pigments division, this news service reported in March. Large-cap financial sponsors and private equity-backed strategics have been circling the unit. Merck is hoping to receive about EUR 1bn from the divestment.

by Jonathan Klonowski and Saritha Dantu