Tariff uncertainty temporarily freezes oil and gas M&A

- Oil price drop and increased costs adds to turmoil

- Natural gas producers have better shot at transacting

The market uncertainty resulting from President Donald Trump’s on-and-off tariff actions have all but frozen the oil and gas M&A market.

“Many deals in the market have been pulled back, or put on hold, due to current uncertainty around tariffs,” said the CEO of a Texas-based oilfield services firm, adding that the company is one of the few in its space that continues to scout for bolt-on acquisitions.

For the next six months, any deal that gets close will be the exception, not the rule, said a sector banker.

Salvatore Milanese, founding partner of Brazil’s financial advisory firm Pantalica Partners, sees an even longer timeline, predicting that the next 12 to 18 months will be challenging because the tariff chaos has also caused very high volatility in exchange rates.

Trump’s tariff actions have also caused futures on West Texas Intermediate, the US reference crude price, to drop 11.9% since 2 April, when the US president announced a 10% global tariff on imports.

Tariffs on imported steel, on the other hand, are hurting the cost strategy of oil and gas companies, said Eric Nuttall, senior portfolio manager at Canadian alternative investment manager Ninepoint Partners.

“I have never felt more uncertainty about our business in my entire 40-plus-year career,” said a respondent to an energy survey by the Federal Reserve Bank of Dallas.

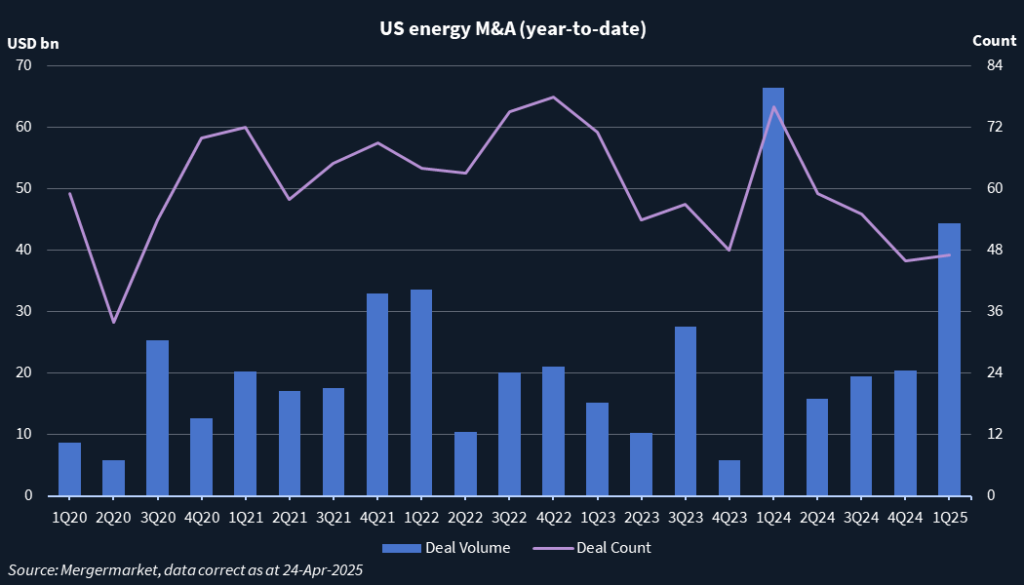

There were 47 M&A deals in the US energy sector in 1Q25 for a total deal value of USD 44.4bn, a 33% drop from the USD 66.4bn in 1Q24, according to Mergermarket data.

“This is a short-term blip, and these tariffs incorporate an artificial degree of volatility, so there may be a little blood in the water where you can get more favorable deals,” said Dan Romito, managing director at energy-focused financial services platform Pickering Energy Partners.

But unlike in past downturn cycles, there is no existential crisis in the industry, said the sector banker. Most oil and gas companies maintain strong balance sheets, so there is no significant risk of a bunch of bankruptcies, and they can wait for the next viable market window to transact, the banker added.

This will likely push private equity firms to continue using continuation vehicles (CVs) to hold on to their oil and gas portfolio companies a bit longer, a sector lawyer said.

Energy Capital Partners, for instance, put Calpine into a USD 1.6bn CV in 2022 rather than selling the power producer. In January, Constellation Energy agreed to buy Calpine for USD 29.4bn.

Kayne Anderson Capital Advisors has also reportedly placed Houston-based Kraken Resources into a USD 911m CV.

“We are optimistic that once trade negotiations have concluded, the US energy sector will see an improved business environment,” said Mike Harling, KPMG’s head of deal advisory & strategy for energy, natural resources & chemicals. “We could see M&A in the second half of 2025 as there is plenty of capital and pent-up demand from previous years. … If you have a sustained downturn in the market, those with strong balance sheets may consider buying attractive assets at lower valuations,” he added.

Natural gas producers such as Ascent Resources and Aethon Energy Management have a better shot at closing deals in the near term as the stock of their public comparables has gone down less and is trading at a higher valuation than that of traditional oil and gas firms, said the banker.

This news service reported in March that Ascent’s sponsor First Reserve is working on a single continuation vehicle for its stake in the company that is expected to be north of USD 1bn in size. And Dallas-based Aethon has reportedly tapped Goldman Sachs and Citi to consider strategic options, including an initial public offering (IPO) or a sale that could value its assets at USD 10bn including debt.

If crude prices stabilize and the S&P 500 index hovers around 5500, there is a shot for natural gas producers to explore an IPO in 4Q25, the banker said.

The market’s interest in natural gas extends beyond the US. Brazil, which has discovered major pre-salt gas reserves in deep water, is well positioned to increase its gas exports to Europe as the region weans itself off Russian gas, said Pantalica’s Milanese. “Brazil’s national oil company Petrobras has the capacity to supply gas, and it is simple to liquify it,” he said.

According to Brazil’s oil and gas regulator ANP, there were three new discoveries of hydrocarbons this year, one of them of gas specifically, by Shell in the C-M-659 block in the Campos Basin. Four new hydrocarbon discoveries were announced in 2024 and 17 in 2023, 12 of them of gas specifically. Brazil’s oil company Petrobras reported proven gas reserves of 10,508 billion cubic feet in 2024. On 25 March, Petrobras announced the discovery of hydrocarbons in its Norte de Brava block in the Campos Basin.

Many discoveries have been made in the southern Pelotas Basin, which is considered a new exploration frontier for E&P along with the Equatorial Margin in northern Brazil.