Stargazing: Space technology offers hope for dealmakers

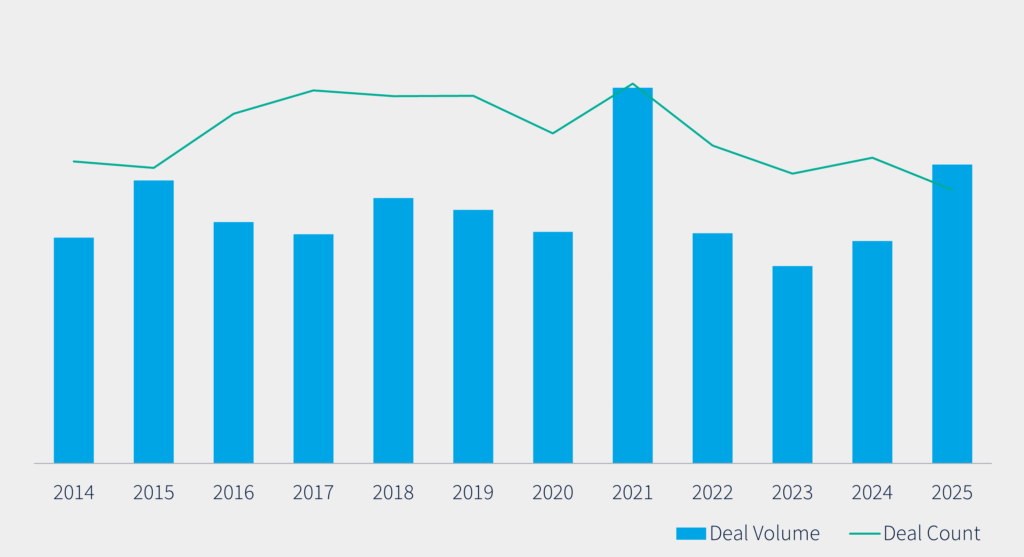

For most of this year, M&A dealmakers have been staring into a black hole. Deal volume in Europe, the Middle East and Africa (EMEA) across all sectors has fallen more than half to EUR 364bn and deal count has dropped by a fifth to 8,801 from the same time last year, according to Mergermarket data.

But somewhere, in a galaxy far, far away, there are deals to be made. With traditional sectors struggling to prop up volume, M&A activity in the space industry remains robust. So far this year, there have been 27 deals in the EMEA space sector for a total volume of EUR 1.37bn, already surpassing the EUR 1.29bn total volume from 38 deals recorded during the whole of 2022, according to Mergermarket data.

This year’s largest deal was the acquisition of Blackstone-backed aerospace component manufacturer MB Aerospace by Barnes Group [NYSE:B] in June. The deal valued Motherwell, Scotland-based MB Aerospace at USD 740m.

Using the force

Satellites are used today to gather, monitor, analyze and store climate change data, detect and prevent forest fires, as well as for GPS navigation. They are also playing an important role in the global mobile phone industry, building telecommunications networks for new direct-to-satellite technologies.

European entrepreneurs are becoming increasingly adept at harnessing the potential power of space technologies and converting them into investment-ready businesses. Last February, Finnish micro satellite producer ICEYE raised USD 136m in a Series D round led by Seraphim Space.

ICEYE is a strong IPO candidate and could pursue a public listing next year depending on market conditions, Adam Niewinski, General Partner at the company’s venture capital (VC) backer OTB Ventures, told this news service in May. The company has a Likely VC Exit score of 10, according to Dealogic's predictive algorithm*

Meanwhile, investment into the capital-intensive upstream industry is also gathering pace. Scotland’s Orbex, for example, plans to start raising a Series D round next year to accelerate the development of its satellite launch technology. The rocket launcher secured GBP 40.4m (EUR 47.1m) in Series C funding from investors including the Scottish National Investment Bank and Jacobs in October.

One giant leap

The potential for continued investment into the space industry is growing alongside the boundaries of space itself. Swiss space debris removal specialist ClearSpace, for example, plans to raise EUR 80m-EUR 100m in a Series B round next year, CEO Luc Piguet told Mergermarket this month. The company raised EUR 26.7m from OTB Ventures, Swisscom Ventures and others in January.

Others expected to imminently embark on fundraising efforts include Portugal’s Neuraspace and Germany’s OroraTech, according to Mergermarket reporting.

But there is still work to be done. Public sector funding provides vital support for emerging start-ups, but it cannot be relied upon if the industry is to thrive and mature in the long term, Neuraspace’s CEO Chiara Manfletti told Mergermarket this month. “The industry has to be more active in trying to get VCs and other private funding on board,” in order for the sector to become commercially viable, she said.

All the more reason, then, for M&A practitioners to take one giant leap into spacetech dealmaking.

by Dominic Pasteiner, with analytics by Santosh Shetty

*Based on a number of key industry, holding behaviour, and dealflow criteria, Dealogic’s next-generation platform assigns a Likely VC Exit score to each exit opportunity, with a higher score corresponding to a higher likelihood for a future transaction.

Analytics by Santosh Shetty

Did you see last week's Dealspeak EMEA?

Feast or famine: Nordics dealmakers face slim M&A pickings but P2P and tech present sweet spots