Sponsors keep faith with French CV momentum as clouds gather on IPO horizon

News that France was among a host of European nations facing fresh US tariffs for supporting Greenland’s territorial integrity will have made grim reading for the nation’s ECM professionals this weekend.

This risk-off sentiment has been compounded overnight on news that US President Donald Trump apparently posted private text messages from French head of state Emmanuel Macron on social media – following yesterday’s falls, the CAC 40 is down a further 1.14% this afternoon (20 January).

Yet sponsors running the rule on larger 2026 exits can rely on the growing success of continuation vehicles (CVs) in delivering liquidity events for LPs.

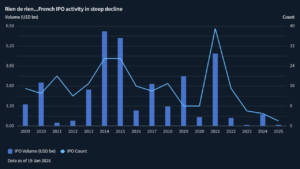

CVs of French assets dwarfed the country’s IPO market last year – and it’s not even close. In 2025, France saw nine CVs at an aggregate valuation of EUR 6.6bn; meanwhile, there were just two IPOs on French stock exchanges, raising a paltry USD 64.2m, according to Mergermarket and Dealogic data.

Following the post-pandemic high of 2021, French IPOs have all but become an oxymoron, with flatlined issuance. In 2025, political chaos at home and abroad did nothing to provide the kind of stability issuers look for to expose themselves to market risk via bookbuild.

By contrast, CVs seem on a tearing run. Those nine CVs in 2025 comprise the lion’s share of the 16 in total we’ve seen since 2020. And the progress appears to be based on momentum, with 2024 having represented the previous peak (five CVs totalling EUR 1bn). Benchmark transactions are becoming the norm: in the wake of the Liberation Day tariffs shock, Tikehau Capital announced in July it had raised a more-than-EUR 1bn CV for its portfolio company Egis, a French engineering and operations group.

Brushing up your CV

CVs can indeed be an attractive option for funds in no rush to sell trophy assets, allowing GPs to continue their value creation journeys, Emmanuel Goldstein, CEO at Morgan Stanley France, said.

GPs consider the timing to be far from optimal for maximising value across a host of trophy assets and those in lower tiers, according to Denis Criton, a Paris-based corporate partner at Latham & Watkins. In this context, CVs are an increasingly welcome solution to deal with liquidity pressure and manage value creation, he added.

Private equity firms have accumulated a backlog of assets acquired between 2019 and 2021, placing considerable expectations on exit pathways, including IPOs, as previously reported.

Somewhat frustrating those exits is the multiples landscape, notwithstanding LPs’ increasing focus on DPI. The average EV/EBITDA deal multiple for French assets over 2019-2021 was 11.6x, while for 2023-2025 that fell to just 9.2x, according to Mergermarket data.

This landscape has further added conviction to GPs’ arguments that it may be better to accompany certain assets for a longer hold period than originally foreseen – with an opportunity for LPs to come along for the ride.

France’s combination of large sponsors, sophisticated domestic investors willing to execute CVs quickly, and pool of quality mid-market assets held as portfolio companies makes the country an effective laboratory for GP-led secondaries, Guillaume Vitrich, partner at White & Case told this news service.

Indeed, France led the European pack in CVs across 2025, with its haul of nine outpacing the UK with eight; the Nordics with six, Iberia with five; and two apiece for DACH and Benelux.

Trop cuit – IPO pessimism overdone?

Yet we should perhaps not be too premature in writing off the French IPO market this year. Given that backlog of prospective exits and no sign of the volatility fatigue that drove the global race for scale via M&A in 2H25 abating, sponsors may decide 2026 offers a more certain window than 2027, which will see a fraught presidential election to select Macron’s successor.

Moreover, just as geopolitical instability is incentivising dealmaking to drive scale and resilience, certain listing candidates may be making their stock market debuts at just the right time. Many dealmakers have high hopes that Franco-German armaments company KNDS will march ahead with its IPO plans, preparing the ground for other listing hopefuls.

Even if an IPO implies an initial discount versus valuations available via auction, staging an exit via an IPO and subsequent block trades is a solid alternative for sponsors pursuing exits of sizeable assets, if supportive market conditions create an appropriate window, Morgan Stanley’s Goldstein said.

The listing of Swiss skincare conglomerate Galderma by an EQT-led consortium in 2024 offers the perfect playbook for such an approach, several ECM experts explained. The IPO completed at a substantial discount versus peers, generating positive aftermarket performance and providing solid sentiment for a series of well executed placings, they said. Additionally, French beauty giant L’Oréal last month bought a further stake from the consortium to take its Galderma position to 20% from 10%.

It may be reductive to pitch IPO exits against CVs – given the pipeline of sponsor exits from French assets that needs to be executed, GPs will be focused on pulling all levers.

That said, France’s IPO market seems to have been particularly vulnerable to geopolitical risk in the past two years – and headlines this month do not immediately augur well for a change in fortunes, KNDS aside.

If fresh listings on the Paris bourse remain thin on the ground, CVs will continue to play an outsized role in bridging larger assets to an IPO when investors feel the window is more conducive.

Assuming Trump’s hemispheric ambitions and France’s political instability continue to monopolise headlines in 2026, sponsors seeking to exit domestic assets may find their approach to the year emerging as plus ça change, plus c’est la même chose.