SPACs see resurgence as seasoned sponsors return, new deals emerge

- New SPAC issuance gains traction as discipline boosts embattled asset class

- De-SPACs seen as reliable alternative to traditional initial public offerings

- Redemption risk mitigated through PIPE financings, non-redemption agreements

After years of dormancy and skepticism following the blank-check boom and bust of 2020–2021, special purpose acquisition companies (SPACs) are making a surprising comeback.

Industry experts are noting a sharp uptick in SPAC issuance and a renewed sense of rationality in the asset class, driven by experienced sponsors and more conservative dealmaking.

Daniel Forman, a partner at law firm Lowenstein Sandler, said the resurgence is being fueled by sponsors whose experience with blank-check firms goes back decades. After hundreds of SPACs liquidated without finding a merger partner in the last cycle, these sponsors saw an opportunity.

“A lot of these sponsors looked at the tail end of the bubble and said, ‘I still believe in the product,’” said Forman. “When the surplus of vehicles liquidated and competition subsided, we started to see traditional SPAC sponsors reenter the market last year.”

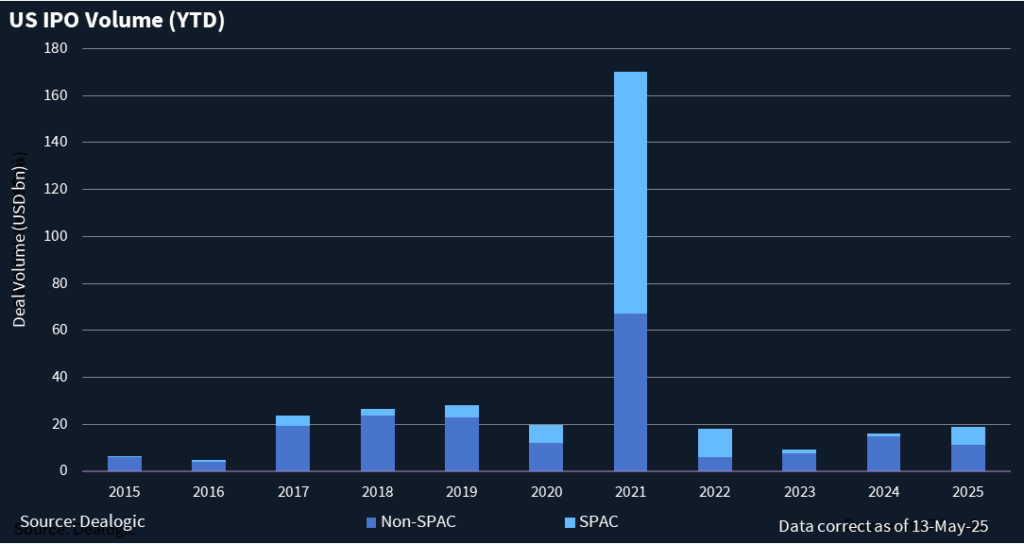

There have been 58 filings for SPAC initial public offerings on US exchanges so far in 2025. Of those, 25 have priced along with 14 that were filed prior to this year, generating USD 7.71bn in deal volume, according to Dealogic data. That’s up significantly from the USD 1.27bn in SPAC IPO deal volume in 2024 and the most since 2022.

While the numbers are modest compared to the peak years, the first four months of 2025 have shown significant momentum.

“I’m even a little surprised by the volume,” Forman admitted. “It can be a really good product and pathway for issuers to go public in the right situations.”

What distinguishes this wave from the frenzy of 2020-2021 is a notable shift toward discipline.

“The market has gotten a lot more rational,” one sponsor said. “We’re far from the hype and excess of the last wave, with all the celebrities getting into the game. The current crop of SPACs is being led by seasoned, credible sponsors with defined strategies and industry expertise.”

The size and scope of deals have also changed. Valuations are more conservative, deal sizes are smaller, and experts say there is a stronger emphasis on profitability over pure growth.

“Three or four years ago, the valuations were pretty wild,” said Forman. “There is a much tighter range this time around. Profits matter as much as revenue now.”

With the traditional IPO market still subdued and interest rates relatively high, SPACs are benefitting from a lack of alternatives for companies.

Forty percent of this year’s IPO proceeds have come from SPACs.

“You wouldn’t notice the SPAC activity as much in a normalized IPO market,” Forman noted. “But right now, SPACs are punching above their weight.”

The liquidation of many blank-check firms over the past two years has freed up capital, allowing traditional SPAC investors to reallocate funds into new vehicles. This recycling of capital, combined with a lower competitive field, has created fertile ground for credible sponsors.

De-SPACs offer certainty amid IPO volatility

As the IPO window remains narrow and unpredictable, the de-SPAC process is viewed as a viable and reliable alternative to create liquidity for businesses and their shareholders.

“With a de-SPAC there is more certainty in the process,” said Forman. “You’re not exposed to a volatile market window where you have one week to open and close your book.”

Still, redemption risk remains a major hurdle. To address this, sponsors are increasingly using tools such as non-redemption agreements, PIPE (private investment in public equity) financings, and structured instruments like convertible notes and equity lines of credit. These mechanisms ensure that enough working capital is available post-merger.

PIPEs in particular are used not only for financing but also as validation tools. When a third-party investor joins via a PIPE, it sends a strong signal to the market that the deal is priced appropriately, said Forman.

Several recent deals suggest growing confidence.

Ares Acquisition II’s pending merger with Kodiak Robotics saw a significant portion of shareholders choose not to redeem their shares at the extension deadline in April, preserving about USD 550m in the company trust — a positive sign in today’s cautious environment.

An advisor with knowledge of Kodiak Robotics said the company had originally considered a growth equity round before ultimately opting for a SPAC due to market volatility.

“The transaction went very well,” this advisor said. “It shows that management teams are warming up again to SPACs and seeing them as a viable route to public markets.”

The deal, which values Kodiak at USD 2.5bn, is expected to close in the second half of this year.

Meanwhile, Oklo, a nuclear energy startup backed by OpenAI CEO Sam Altman, closed its SPAC merger in May 2024 and is now trading around USD 32 — more than triple its USD 10 IPO price.

The aftermarket performance of Oklo has inspired other dealmakers, Forman said.

Nine companies have announced de-SPAC processes so far this year, representing USD 5.72bn in deal volume, according to Dealogic. Last year, there were 41 de-SPACs that generated USD 28.91bn in proceeds. At their peak in 2021, 184 de-SPACs were agreed to, tallying USD 387.6bn in proceeds.

New SPAC targets are spanning a broad range of sectors. Popular themes include crypto and digital assets, such as the pending USD 3.6bn merger between Twenty One Capital and Cantor Equity, as well as artificial intelligence, energy, data centers, and more traditional industries.

“SPACs are touching broad swaths of the economy now,” said Forman. “It’s not just about buzzy sectors anymore.”

However, tariffs and macroeconomics are now a key consideration in deal structuring.

“If a target company has exposure to tariffs, that needs to be part of the discussion,” said Forman, suggesting earn-outs or other flexible mechanisms as ways to mitigate such risks.

While de-SPAC activity is still limited compared to SPAC IPO volume, the outlook is more optimistic than it’s been in years.

Still, success hinges on deal quality. “It is not for everyone,” another advisor cautioned. “It’s a big effort to structure the deal properly and find the right company. But for those who get it right, the SPAC path is once again a credible and strategic option to access public capital.”