Richard Sanders, Founder and Managing Partner of Sullivan Street, on how to add value from an operational point of view in a private equity transaction

In a recent ION Influencers Fireside Chat, Richard Sanders, Founder and Managing Partner of Sullivan Street Partners, shared his insights on how to add value from an operational point of view in private equity transactions. The conversation delved into the firm’s unique approach, the importance of people, and the secrets to successful partnerships.

Key Takeaways:

- Operational Value Creation: Sullivan Street Partners focuses on operational value creation, recognizing that people and processes are critical to a company’s success.

- Long-term Approach: The firm takes a long-term view, often holding companies for 7-10 years, which allows for a deeper understanding of the business and more effective value creation.

- Specialization: Sanders emphasized the importance of specialization, highlighting Sullivan Street Partners’ expertise in areas like transformation, talent management, and incentivization.

- Diversity and Inclusion: The firm prioritizes diversity and inclusion, recognizing the commercial benefits of a diverse team and the importance of fostering a positive company culture.

- Partnership and Trust: Sanders stressed the importance of building trust with investors and portfolio companies, ensuring alignment and a shared vision for success.

Key timestamps:

00:09 Introduction to ION Influencers Fireside Chats

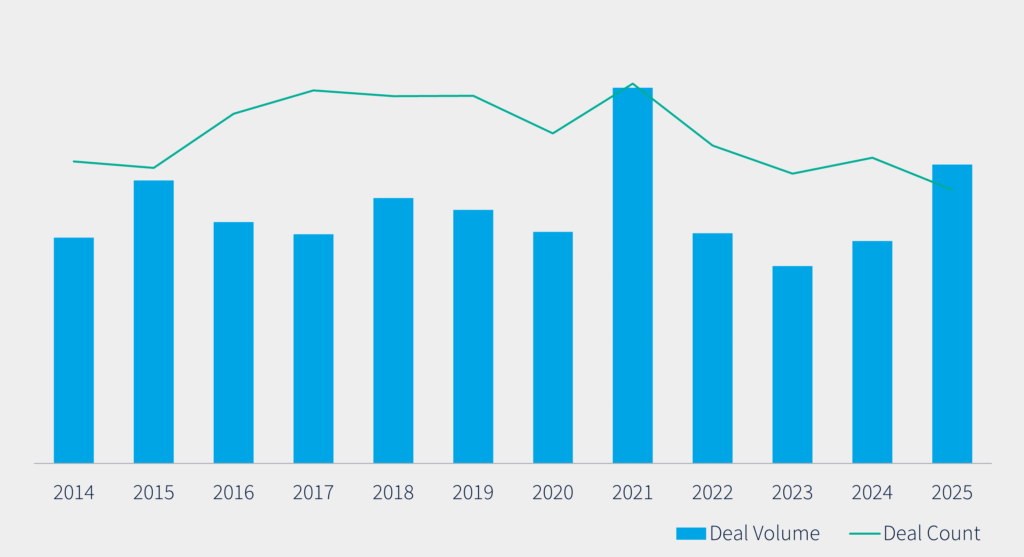

02:00 Investment Thesis and Value Creation

03:30 Understanding Investment Cycles

04:55 Identifying When to Exit Investments

06:10 Time Allocation and Team Dynamics

08:48 The Need for Specialization in Private Equity

10:08 Red Flags in Management Teams

13:47 Diversity in Management Teams

17:45 Partnership Dynamics with Companies

19:40 Scaling Business Models Effectively

20:54 Future Vision for the Sullivan Street Brand

22:10 Managing Growth and Investor Expectations

24:43 Inspirational Figures and Leadership Lessons