Quantum tech leaps forward as investments surge – Dealspeak North America

- Quantum funding and M&A accelerate in past three quarters

- Startups chase scale, corporates may target venture studios

- Enterprise adoption hinges on 200-1,000 reliable logical qubits

Once the realm of science fiction, quantum technology is now drawing billions of dollars in investment, setting the stage for the next great wave in computing and communications.

Though still early, investors expect winners to reach valuations rivaling today’s artificial intelligence giants. The field spans a few major categories — computing, sensing, and networking — each advancing at its own pace but all attracting capital.

Quantum computing remains the headline act, with startups racing to build utility-scale machines capable of transforming risk modeling, cryptography, and materials research.

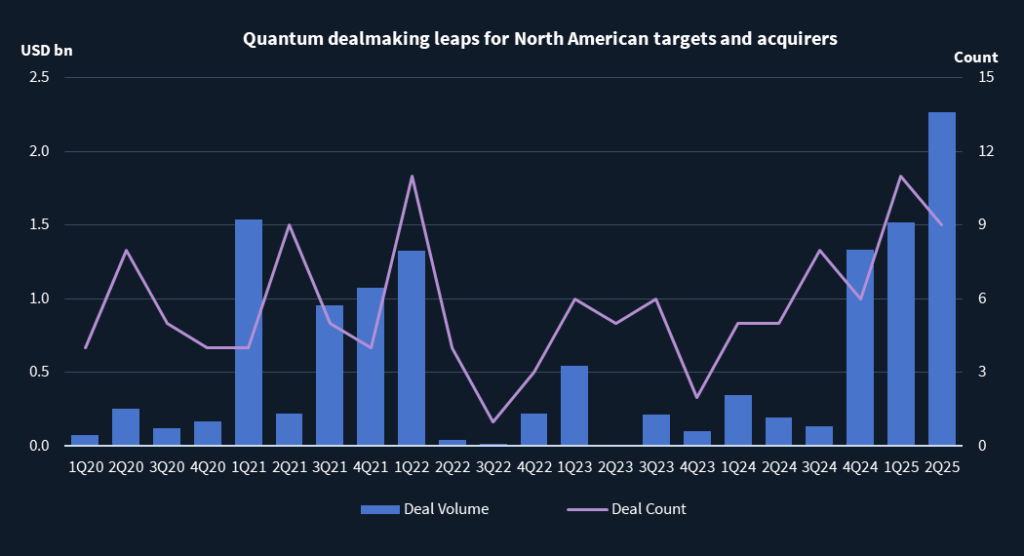

Dealmaking involving North American quantum technology companies surged between March 2021 and February 2022 as IonQ, Rigetti and D-Wave all went public via mergers with special purpose acquisition companies, according to Mergermarket data.

Activity then hit a lull, but momentum has returned: In the past three quarters, a resurgence in North American quantum M&A and fundraising has occurred, with nine deals totaling USD 2.27bn in 2Q25 alone. That includes IonQ’s USD 1.075bn acquisition of UK-based Oxford Ionics in June.

With three weeks to go in the current quarter, six deals totaling USD 2.8bn have been announced, the highest quarterly volume since 3Q18.

Source: Mergermarket, data correct as at 05-Sep-2025.

Dealmakers and disruptors

IonQ, with a market capitalization of nearly USD 13bn, is expected to continue to use its public stock to acquire supply chain and networking startups in pursuit of a full stack offering.

This week, Infleqtion, which builds quantum computers, precision sensors, and software, agreed to merge with Churchill Capital Corp X, a SPAC, at a pre-money equity value of USD 1.8bn. Just three months ago, Infleqtion raised USD 100m at a USD 750m valuation.

Last week, Quantinuum raised USD 600m, with chip giant Nvidia among its new investors. The round lifts Quantinuum’s valuation to USD 10bn, double from early 2024. Honeywell International is the majority owner of Quantinuum, which formed through a merger in 2021, and it has stated its intent to eventually spin off the business, possibly in an initial public offering.

Sandbox AQ, a Google spinout, is another to watch. It is developing quantitative artificial intelligence models for enterprises. It raised USD 450m at a USD 5.75bn valuation in April.

Industry watchers say the market is entering a new phase. Adam Hammer, CEO of Roadrunner Venture Studios, divides development into two eras: “Quantum 1.0,” centered on hardware architectures and led by San Francisco Bay Area firms like Alphabet, Rigetti, and PsiQuantum; and “Quantum 2.0,” focused on applications such as sensing, algorithms, and communications, emerging in research hubs like Colorado, Illinois, Maryland, and New Mexico.

Strategic capital at work

Dan Caruso, managing director of Caruso Ventures, believes the sector’s next generation of winners could be worth hundreds of billions of dollars. But he said it may take years before dominant technical approaches become clear.

Startups are increasingly pursuing dual-use strategies, serving both government and commercial clients. More are spinning out of national labs than garages.

Funding models are also evolving, with mega-funds, specialist investors, and venture studios testing new approaches to company formation.

Corporate investors are also ramping up. Airbus, Cisco, and Deutsche Telekom have backed quantum networking startups, while Alphabet, Amazon, IBM, and Microsoft continue to run major quantum programs intertwined with their long-term AI strategies.

Hammer expects corporates and private equity firms will eventually target venture studios themselves, recognizing their role in commercializing quantum IP.

Large-scale acquisitions remain rare. “Most are waiting for clarity on which approaches will win. Once that happens, we’ll see acquisitions,” Caruso said.

For now, partnerships dominate.

Private companies remain focused on organic growth. “Most are heads-down chasing utility scale,” said Ben Bloom, CEO of Atom Computing.

The company is working with Barclays on potential funding after striking a EUR 80m commercial deal in Denmark and partnering with Microsoft in July. Bloom expects M&A could accelerate if critical technologies emerge but sees scale as the immediate priority.

Path to utility scale

Enterprise adoption hinges on reaching 200–1,000 reliable logical qubits — far above the roughly 50 available today. That threshold could unlock simulations for pharmaceuticals, chemicals, aerospace, and automotive materials.

While some advisors estimate widespread adoption is five to seven years away, others argue the technology is already demonstrating utility.

“Quantum utility isn’t decades away — it’s already here,” said Peter Barrett, co-founder of Playground Global, which backs PsiQuantum. The company aims to build the world’s first fault-tolerant, million-qubit machine, with facilities under construction in Brisbane and Chicago.

Undoubtedly, the quantum era is no longer a distant vision — it’s fast approaching, with real-world applications beginning to surface across industries. Google’s Willow system, for example, recently showed that scaling qubits can reduce error rates, while UK-based Phasecraft is designing algorithms requiring fewer qubits to outperform classical computing.

“I don’t know if it will take that long, but it’ll take longer than a quarter or two,” said Bloom.