Private equity’s show of creativity in the oil and gas sector – Dealspeak North America

Necessity is the mother of invention, as ancient Greek philosopher Plato famously said.

That is true of private equity firms active in the oil and gas space. Faced with soaring interest rates, uncertainty in the secondary loan market, banks cutting their hydrocarbon lending, and large buyout shops such as Blackstone retreating from fossil-fuel investments, many have had to resort to innovative and alternative ways of financing transactions. That includes private credit, preferred equity and other hybrid instruments, the use of seller notes, net asset value (NAV) credit facilities, and earnouts.

“I’m seeing a lot of complex equity structures … triggered by rising interest rates,” says Kfir Abutbul, head of Allen & Overy’s US energy private equity practice. That trend should continue into 2024 even as rates remain steady, he thinks.

Sergio Urias, a partner in Akin Gump Strauss Hauer & Feld’s private equity transactions group, agrees. Just as in 2023, “we expect PE firms resorting to creative ways to finance deals” in 2024, he says.

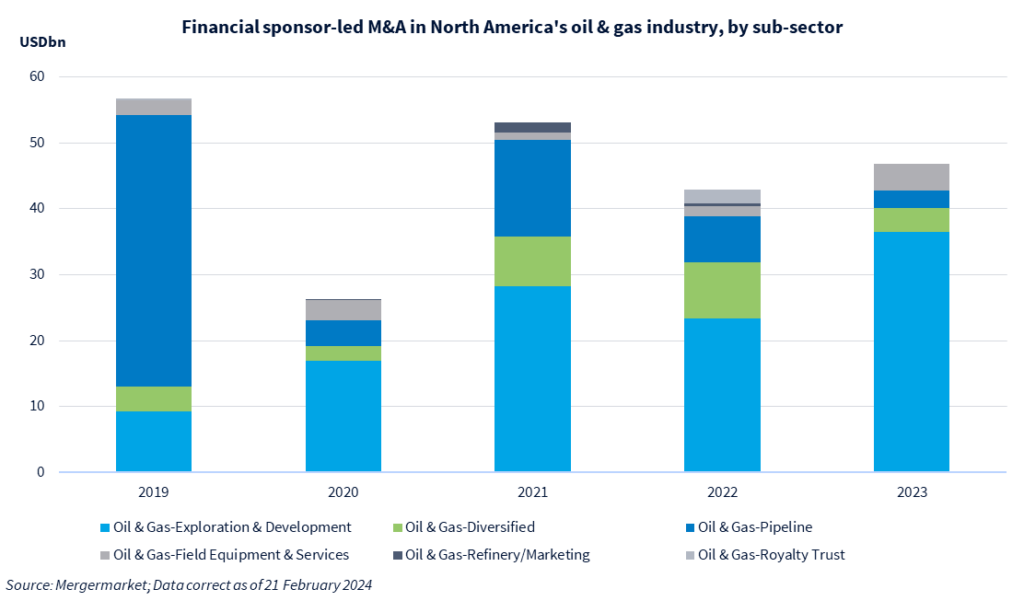

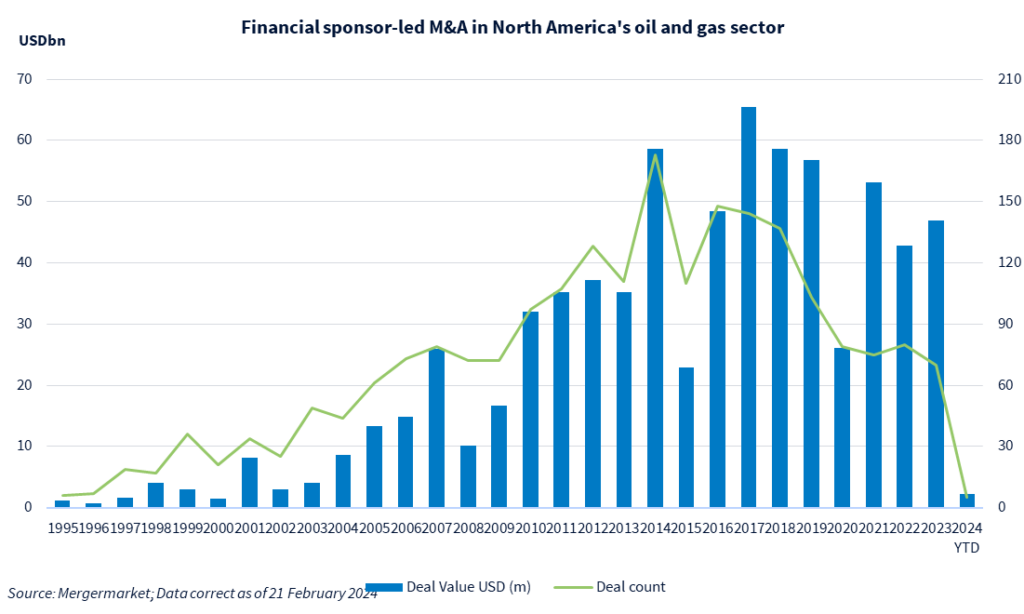

The number of financial sponsor-led transactions in North America’s oil and gas sector fell 13% to 70 in 2023, the lowest since 2005, according to Mergermarket data. By contrast, deal volume remained strong, rising 9% to USD 46.8bn in 2023. So far, 2024 has gotten off to a slow start.

Hydrocarbon comeback

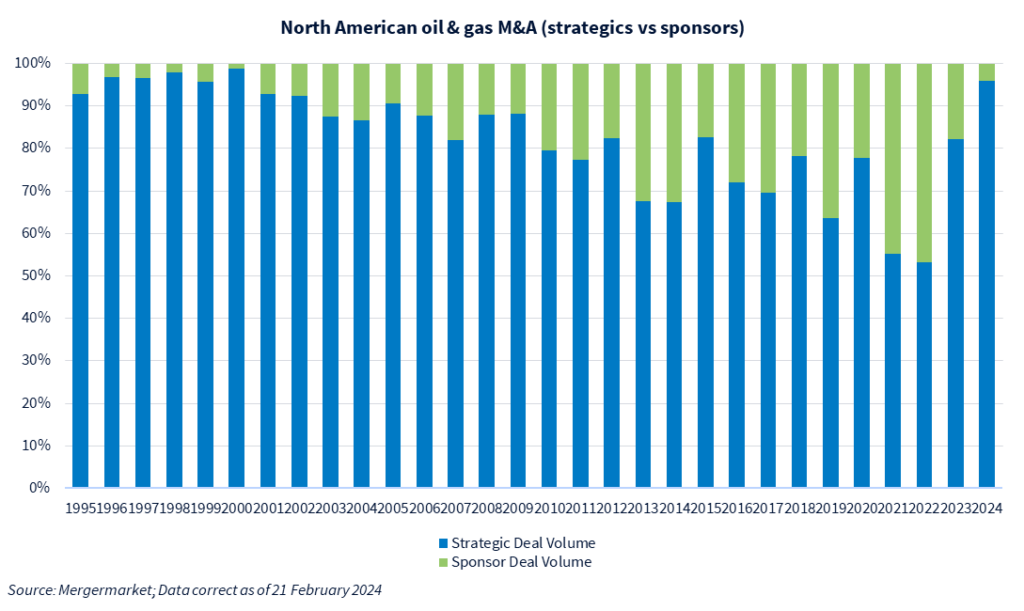

As a proportion of overall M&A in North America’s oil and gas sector, financial sponsors accounted for nearly half of all disclosed deal value in 2021 and 2022, the highest levels on record. That proportion shrank to 18% in 2023 and 4% in the year to date, as several mega mergers involving strategics took place, led by ExxonMobil’s [NYSE:XOM] USD 65.3bn acquisition of Pioneer Natural Resources, Chevron’s [NYSE:CVX] USD 59.7bn bid for Hess, and Endeavor Energy Resources’ USD 25.8bn sale to Diamondback Energy [NASDAQ:FANG].

Could those massive deals presage greater private equity involvement in fossil fuels? Some think so, especially if the Federal Reserve cuts rates later in 2024.

“If interest rates come down, even a little bit, that could kick the market into gear,” says Brandon Beard, a partner in deal advisory and strategy in KPMG’s energy, infrastructure and chemicals practice. “Every subsector has pent-up demand for divestitures and buys.”

Jesse Betts, a partner at Akin Gump, adds, “We continue to see interest in oil and gas investment, largely led by private capital sources, including family offices, with some public institutions and endowments making a comeback to make targeted hydrocarbon investments with proven fund managers.”

Prepping for an exit

Private equity groups invested heavily in energy services in 2015-2019 and those investments are now maturing, note industry sources. Many sponsors spent the market uncertainty of 2022 and 2023 taking capital from direct lenders to improve the EBITDA profile of their portfolio companies and get them exit-ready.

One alternative lender providing such capital is Crestline Investors, which gives loans to PE funds who in turn reinvest that capital as an equity investment into their underlying holdings. Typically, that new capital is used to target acquisitions that immediately enhance the value of an existing asset and thereby accelerates its exit strategy, says Dave Philipp, a partner in Crestline’s Fund Liquidity Solutions group.

As market conditions start to improve in 2024, the exit window will widen.