Power sector deal volume triples as AI boom strains grid – Dealspeak North America

- M&A volume reaches record USD 87bn in year-to-date

- Buyouts at 18-year high, exits surge

- Competition between sponsors and corporates drives up asset prices

Summarizing this story with an artificial intelligence (AI) chatbot uses about as much electricity as running a microwave for one second. With billions of queries daily, it’s no wonder the US power grid is straining.

“We may need three times as much power over the next five to 10 years than we have today,” said Jeff Eaton, executive VP and partner at Five Point Infrastructure, at the Mergermarket Private Equity Forum Austin last week.

That investment thesis is fueling dealmaking, both by corporate and private-equity buyers.

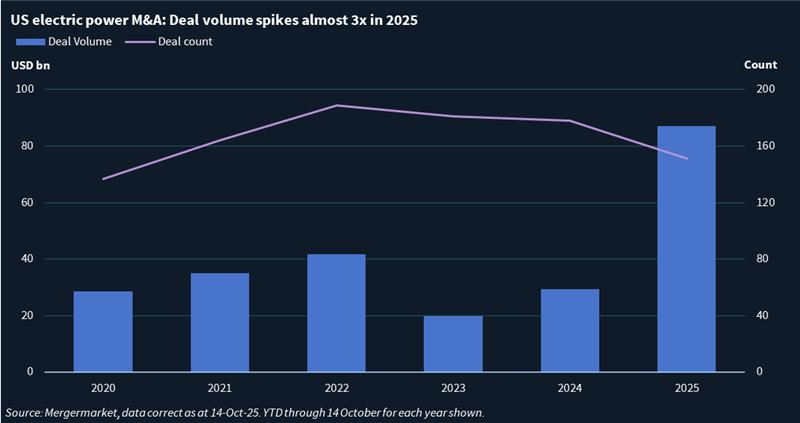

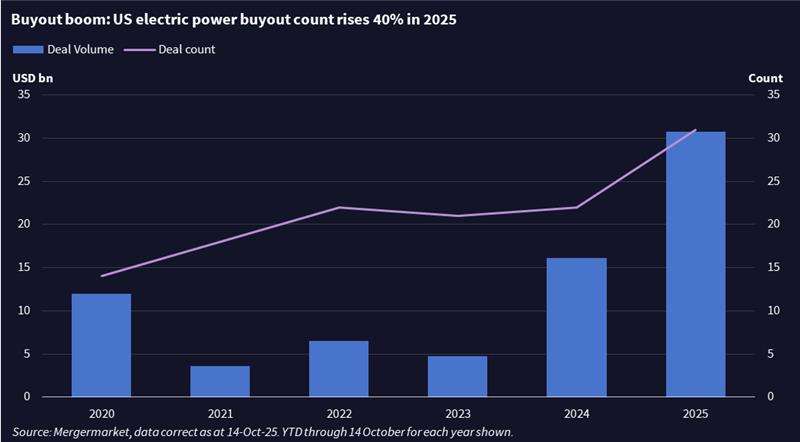

In the year-to-date, M&A targeting US-based electric utilities reached USD 87bn over 151 transactions, the highest volume on record and nearly threefold what it was a year ago. Sponsor-backed buyouts accounted for USD 30.7bn of the total – the most since 2007, according to Mergermarket data.

Calpine’s USD 29.4bn sale to Constellation Energy was the biggest transaction in 14 years.

In another big strategic move, NRG Energy spent USD 12.5bn on a portfolio of LS Power Equity’s natural gas generation facilities.

Meanwhile, Blackstone’s USD 11.8bn offer in May for TXNM Energy – a regulated utility operating in New Mexico and Texas – was the largest buyout in eight years. And in another big sponsor-led deal, Brookfield agreed to pay USD 6bn for a 19.7% stake in Duke Energy Florida in August.

Regulated uncertainty

Despite those headline deals from sponsors, further buyouts of regulated utilities are unlikely, said Xander Hector, co-head of Houlihan Lokey’s Power, Utilities, and Renewables Group. “There were a number of very high-profile bankruptcies in the 2000s and 2010s, which may have made investors a bit gun-shy.”

Utilities are heavily regulated, with local regulators deciding how much they can spend on capital expenditure and the return they can earn on those investments.

“The standards are kind of vague … It’s highly political,” said David Kurzweil, a New York-based partner at Latham & Watkins.

Recent moves by state governments – including bills in New York and Rhode Island that propose a cap on utilities’ return on equity, and Indiana Governor Mike Braun’s appointment of a new commissioner to evaluate utilities’ profits – underscore the risk.

High-voltage rivalry

Outside regulated utilities, competition for power assets is rising as buying existing plants is cheaper than building new ones, Kurzweil said.

PE firms are having to compete for assets with listed independent power producers (IPPs) –including Vistra, NRG Energy, Talen, and Constellation Energy – all of which are flush with cash, Hector said.

The economics are certainly attractive. In the PJM Interconnection – which spans 13 states, including Virginia, home to the world’s largest concentration of data centers – capacity rates have risen more than tenfold, according to Hector.

Competition for those assets has driven up prices. Average buyout deal value is USD 990m for the year to date, the highest since 2017, according to Mergermarket data.

If power asset prices keep climbing, PE firms may have to shift to niche portfolios in markets where listed IPPs are not allowed to acquire more assets, Hector said. He pointed to Constellation Energy having to sell four power plants totaling 3,546 megawatts in the PJM as part of its Calpine purchase.

Exit window opens

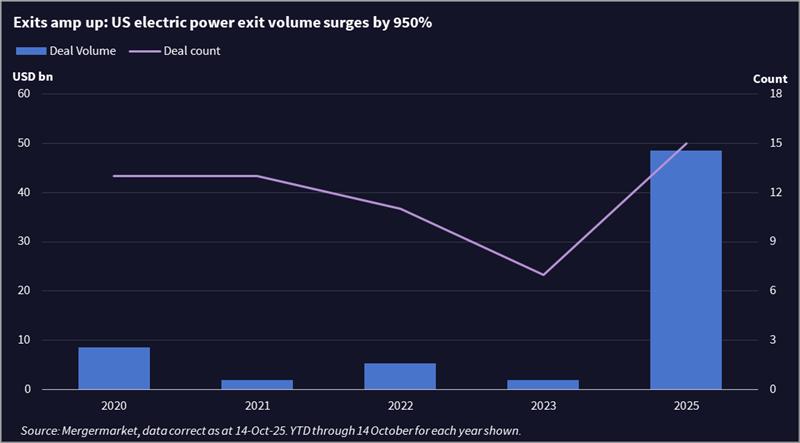

PE firms are also capitalizing on IPP’s appetite for power generation assets to pursue exits. “Domestic thermal M&A processes that are either in process or going to be in process in the next few weeks [are] about 15 [when] it used to be … probably two or three at any given time,” Hector said.

PE exit volume has reached USD 48.5bn year to date, the highest on record, according to Mergermarket data.

“Everyone who has been forced to hold power generation assets for an extended period of time has been waiting for an opportunity to monetize and this is the seller’s market they have been waiting for,” Hector said.