Pipeline operators outbid PE firms for midstream assets — Dealspeak North America

Amid a rebound in M&A activity targeting oil and gas pipeline and storage operators, cash-rich corporates are expected to continue filling in the void left by private equity firms, according to market participants.

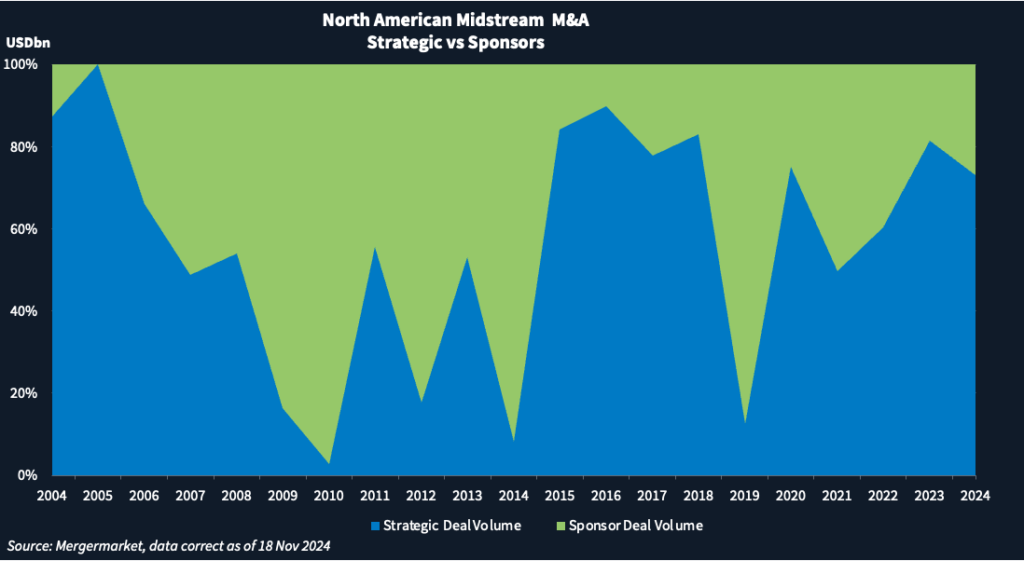

Over the last five years, strategics have been playing an increasingly dominant role in North American midstream M&A, while financial-sponsor participation has declined.

In 2019, private-equity buyers dominated midstream M&A in North America, accounting for USD 65.8bn worth of transactions, with strategic buyers agreeing to another USD 9.4bn, according to Mergermarket data.

In the year to date, strategics have announced midstream acquisitions worth USD 34.9bn in North America, while sponsors have disclosed deals worth USD 12.8bn.

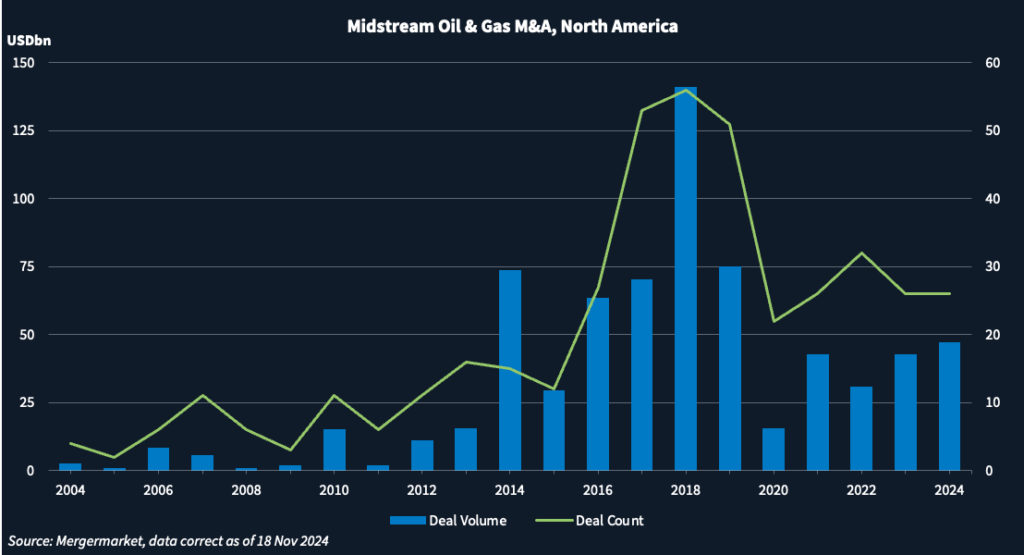

The heyday of North American midstream M&A came in 2018, when both deal volume and count peaked. It then plummeted in 2020 as US oil prices turned negative at the onset of the Covid pandemic, before recovering in the four years since. With six weeks remaining in the year, 2024’s deal volume is the highest since 2019.

Spillover effect

US oil production has soared to record levels under President Joe Biden, reaching an all-time-high of 13.4 million barrels per day in August, thanks to growing demand and the use of hydraulic fracturing (‘fracking’) and horizontal drilling techniques. It led to a big increase in M&A among upstream players – those that explore and extract oil and gas from the ground – which included mega deals from Chevron [NYSE:CVX] for Hess last October and Diamondback Energy’s [NASDAQ:FANG] agreement to buy Endeavor Energy Resources in February.

That surge in upstream M&A is now spilling over into midstream – the oil and gas pipeline and storage operators.

ONEOK [NYSE: OKE] has been particularly active since announcing its USD 18.8bn deal for Magellan Midstream Partners in May 2023 in its bid to create a diversified North American midstream infrastructure company. Most recently, it agreed to pay Global Infrastructure Partners (GIP) USD 5.9bn for EnLink Midstream and Medallion Midstream.

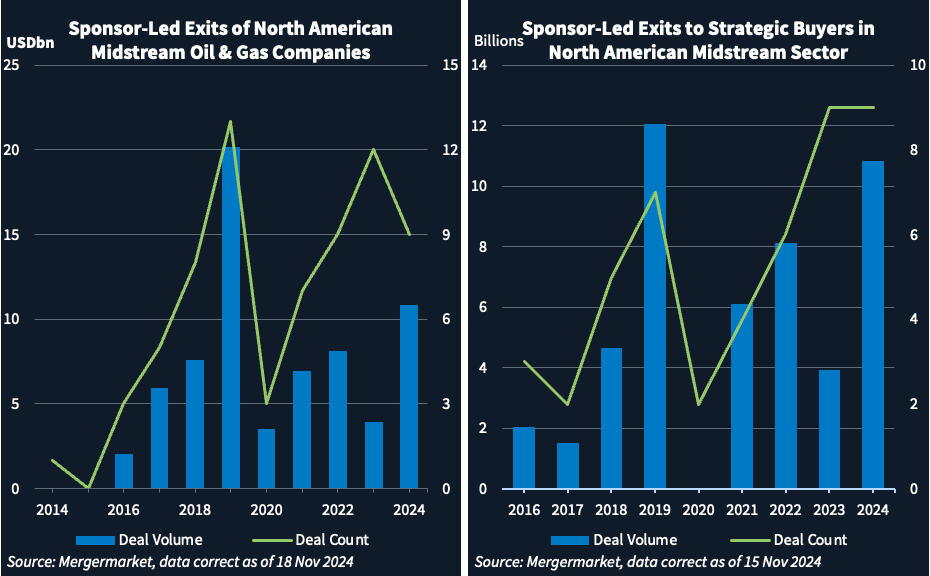

Exit to strategics

Private-equity firms are also selling their midstream assets to strategic buyers in increasing numbers. All nine exits so far in 2024 involved strategic buyers.

In addition to GIP’s sale of EnLink and Medallion to ONEOK, another exit was Stonepeak’s sale of WTG Midstream [NYSE:WTG] to Energy Transfer [NYSE:ET] for USD 3.1bn in May.

“More strategics are filling in the shoes [of] private equity due to their healthy balance sheet,” said a partner at a Houston-based private equity firm specializing in midstream. “We’ll continue to see consolidation in the midstream businesses” and strategics will continue to do the heavy lifting, the partner added.

Today, the number of buyers for midstream assets has halved over the last five years to between two and five bidders – and most of them are strategics, the partner said.

Summit Midstream [NYSE: SMC], following its acquisition of Tall Oak Midstream from Tailwater Capital, is one such strategic buyer of PE-owned midstream assets.

Trump tailwinds

Following the Republican sweep of the White House and Congress, the focus of dealmakers will shift more to traditional energy infrastructure – such as pipelines and terminals – which needs investment, said one advisor. A Republican administration’s greater emphasis on energy security is likely to translate into more midstream M&A and could provide a more friendly regulatory environment for private equity to transact, the advisor added.

But there are caveats. President-elect Donald Trump’s ‘Drill, baby, drill’ mantra, combined with already record oil production, has put downward pressure on oil prices. That could take away the incentive to invest in infrastructure around it, noted the advisor.

One exception is the US natural gas sector. Technology firms need vast amounts of electricity for their artificial intelligence (AI) computations. To meet the surging demand for electricity, greater investments are expected in gas-fired power plants since they can be built quickly and affordably, said an energy lawyer.

With Republicans controlling Congress, permitting reform is expected, which would allow natural gas infrastructure to be built or upgraded more quickly, the lawyer added.

Midstream investors are already wise to the opportunity. Building the gas supply lines to power AI data centers is “a big part of our thesis,” said one investor.