PE exit pipeline building as sponsors prep for busier H2

Private equity firms expect to see increased exit activity in the second half of the year – with both sales to strategic investors and sponsor-to-sponsor transactions to the fore – notwithstanding Federal Reserve reticence to push ahead with interest rate cuts.

“People are waiting to see where rates go,” said Stephen Pratt, a partner at Dechert. “I’m optimistic there will be a continuing pickup in deal activity, but it may just be a bit muted in terms of the start-point and delayed into the second half of the year.”

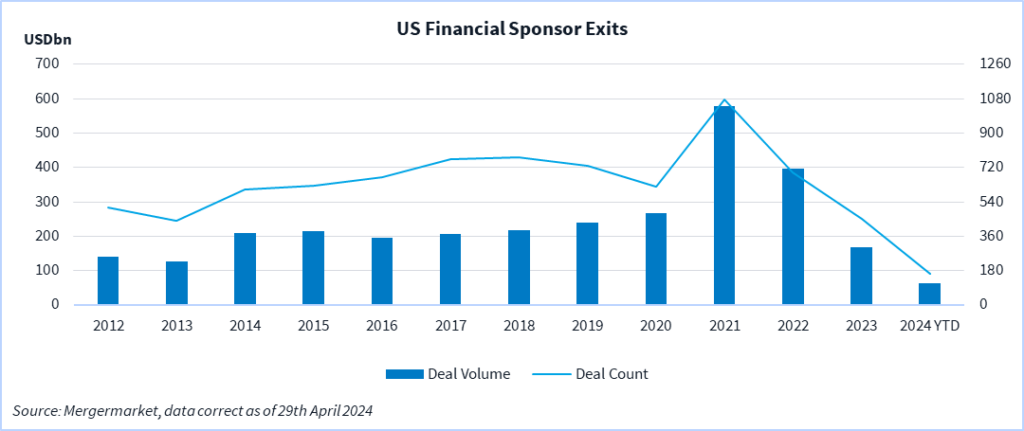

Disclosed US private equity exit deal volume rose 43% to just over USD 53bn in the first quarter, while the deal count climbed from 107 to 128 deals. While encouraging, those numbers pale in comparison to the highs of 2021, which saw 1Q exit volume of USD 155bn across 229 deals. Last year was the worst for sponsor exits since 2013, with just USD 169bn of deal volume.

A hoped-for emphatic recovery in 2024 is yet to fully materialize, as the expected timeline for rate cuts is pushed further out. However, bankers claim the groundwork is quietly being laid for a swath of processes slated to launch later in the year.

“There are a lot of non-process processes,” said Chris Gough, a managing director in Houlihan Lokey’s technology group. “They [sponsors] are not out with a deck broadly shopping an asset but they are doing highly targeted outreach and warming up parties well before a formal launch.”

“There’s a different level of conversation in the first quarter of this year versus where we were late last year,” agreed Neil Shah, senior managing director and co-head of financial sponsors at Evercore. “We’re seeing more activity in terms of some of the larger transactions being prepared to launch later this year.”

Shah specified that these transactions could range from the “high single digits” to up to USD 20bn in enterprise value. “They’re monster transactions,” he said. The question is, how do you finance them?”

Shah added that consortia deals could return to absorb some of these large-ticket transactions, although sales to strategic investors and IPOs – assuming the window remains open – are also valid options.

The one exit in this size range from the first quarter did feature a strategic investor. In late March, Home Depot agreed to acquire Leonard Green and Berkshire Partners-backed, Texas-based building supply distributor SRS Distribution for USD 18.25bn.

Among potential exits in the USD 5bn-plus bracket, Mergermarket reported in February that first-round bids were due for GI Partners and TA Associates-backed Netsmart. The Overland Park, Kansas-based healthcare solutions and software provider has over USD 200m in EBITDA and could fetch an over USD 5bn valuation, according to a prior Mergermarket report.

Meanwhile, Bain Capital is reportedly considering an exit from Varsity Brands, a Memphis, Tennessee-based sports uniform maker with over USD 400m in EBITDA, in a deal valued at over USD 6bn. Bain has held Varsity since 2018.

Getting creative

In lieu of regular M&A exits, many sponsors have turned to continuation funds and dividend recaps as they look for ways to act on demands from LPs for more liquidity.

Global secondary volume rose 20% year-on-year to USD 27-USD 32bn in the first quarter, according to PJT Park Hill. GP-led deals accounted for around 30%, with an increase in the number of multi-asset continuation funds. For example, Lexington Partners supported a USD 750m fund for two consumer healthcare assets held by Hildred Capital – Hyland’s Naturals and Crown Laboratories.

Dividend recaps, typically used for portfolio companies with debt coming due, have also grown in popularity. “These transactions can allow sponsors to satisfy two needs with one transaction – extend maturity on debt and generate returns,” said Michael Vogel, a partner at Paul Weiss. “They’re a great opportunity to enhance portfolio performance.”

According to Debtwire‘s March 2024 Leveraged Highlights report, there were six dividend recaps in March alone from Monotype Imaging, Bakelite, SunSource, Kindercare, Citrix Systems, and ZVRS.

Tech bright spot

When traditional M&A exits are feasible, they are often taking longer to execute. Rodin Hai-Jew, an M&A partner at Kirkland & Ellis, attributed this to investment committees intensifying due diligence efforts and tightening the requirements for an investment. Top-tier assets with motivated bidders can still get done quickly, he added, noting that he had recently signed a sell-side deal in 48 hours.

On a sector basis, technology emerged as a bright spot in the first quarter. According to Mergermarket data, sponsor exits of US-based computers and electronics assets amounted to just over USD 20bn. The construction and building sector saw greater deal volume, but this was largely underpinned by Leonard Green’s mammoth SRS Distribution sale.

In 2023, computers and electronics exits plunged 77% year-on-year to USD 48.77bn. The turnaround is linked to a reset in valuation expectations. The bid-ask spread for technology assets was among the broadest given the earlier boom, but it has been narrowing, said Brian White, co-head of technology investment banking at Piper Sandler.

Jerry Darko, a technology-focused managing director at William Blair, agreed with this assessment, adding that buyers are prepared to pay richer multiples for profitable, high-growth businesses with high customer retention rates.

Notable deals so far this year include Francisco Partners’ USD 1.2bn acquisition of Jama Software from Insight Partners and Madrona Ventures in March. Meanwhile, earlier this month, EQT Private Equity agreed to buy software developer Avetta from Welsh, Carson, Anderson, & Stowe for USD 3bn.

“These companies are market leaders in niche areas,” said Darko. “It’s easier to understand what the competitive dynamics are in those businesses, and there is less of a need to worry about market disruption risks.”

Advisors also expect areas such as cybersecurity and fintech to see heightened deal flow. In December, Thoma Bravo sold cybersecurity firm Imperva to Thales in a deal that valued Imperva at about USD 3.6bn in enterprise value. Meanwhile, Advent agreed to take Nuvei, a Canadian payments firm, private in a USD 6.3bn that saw existing shareholders Philip Fayer, Novacap and CPPQ roll over a majority of their equity.

Borrower-friendly terms

The absence of rate cuts is a sticking point because many sponsors baked a lower cost of capital into their assumptions for 2024, said one direct lender. With the Federal Reserve adopting a more conservative stance, buyers are rethinking how much debt they can take on and sellers are under more pressure to drop pricing.

Still, borrowers have the benefit of a friendlier lending market compared to 2023 and creative financing options to help move deals along. “It’s a very aggressive market for good customers,” said Ted Swimmer, head of corporate finance and capital markets at Citizens Financial. “Demand is out-stripping supply pretty aggressively.”

Competition among private credit, broadly syndicated loans, and high yield bonds has led to compression in the debt capital markets, added Bill Sacher, a partner and head of private credit at Adams Street Partners. “You have seen spread compressions of 100 to 200 basis points or more … that has already lowered the cost of debt for the private equity sponsor,” he said.

The impact varies by market segment. According to Ted Dennison, co-head of NXT Capital, pricing squeezes and erosion of terms are most prevalent among larger issuers, typically companies with more than USD 35m of EBITDA. The lower middle market is more disciplined on terms but prices are tightening.

“Generally, we are seeing deal flow in the lower middle market pick up,” Dennison said. “What we have seen in periods of a wide bid-ask spread is that seller expectations tend to come down faster for founder sellers than for sponsor-to-sponsor transactions, which drives much of the upper middle market.”

Private credit lenders are seen as having the flexibility to move deals along in the more difficult sponsor-to-sponsor market. Some are using debt at the holdco level or structuring loans so that a portion is payment-in-kind (PIK) and the sponsor can get a bit more leverage, said Adams Street’s Sacher. “That too has helped bridge the [pricing] gap [between buyers and sellers],” he noted.

Election impact

As the process of adjusting to a higher interest rate environment and the quest for liquidity continue, the specter of November’s US presidential election looms in the background. A new administration would impact private equity, but advisors claim there is less uncertainty than in previous election cycles.

“You have two known quantities that are up for president, so it’s not like other years where there’s been this massive unknown,” said William Blair’s Darko, pointing to the nomination runs of Elizabeth Warren or Bernie Sanders – each of whom advocated for industry reform – in 2020. “Now, it’s a little more muted. It’s more an issue of, what is the Fed going to do?”