PE exit momentum stalls in 2Q25 – Dealspeak North America

- Tariff turbulence scares off animal spirits

- Quality assets still command buyer interest

- Sponsors eye 2H25 rebound, as volatility settles

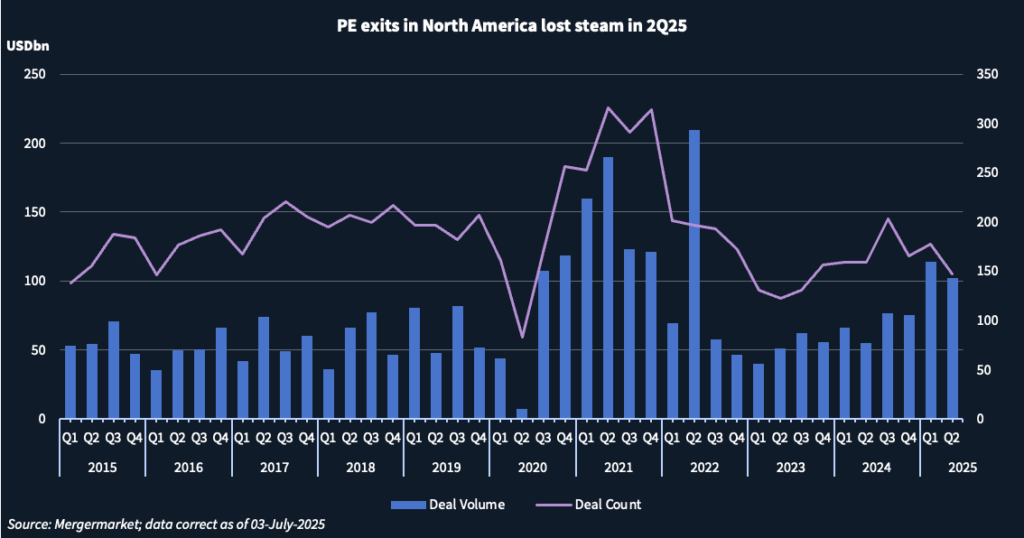

North American private equity exits lost steam in the second quarter of 2025, as sponsors grappled with the fog of policy uncertainty.

Exit volume fell to USD 102bn in 2Q25, an 11% decline from the previous quarter. Deal count also dropped to 147, down 17% from 1Q 2025, according to Mergermarket data.

The second-quarter dip follows the advent of President Donald Trump’s promised tariffs on US trading partners, scrambling many deals processes, and putting a halt to this year’s early momentum.

Back to square one?

Despite that, PE exit volume for the first half was at its highest level for any six-month period since 1H22. A lot of this was fueled by the strong animal spirits immediately after last year’s US presidential election, which placed a massive backlog of deals in the pipeline for launch.

But that sentiment has soured markedly. A recent survey by Alvarez and Marsal (A&M) found that only 31% of respondents expressed a positive outlook for deal activity over the next year. Though largely driven by tariff-related factors, other perennial issues of recent years – elevated interest rates, valuation mismatches, and geopolitical concerns – are still taking their toll.

“The fundamental issue is that a lot of the topics that have been stopping or stalling exit activity have not changed significantly,” said Markus Lahrkamp, a Managing Director in A&M’s Private Equity Performance Improvement group.

Who dares wins

Even if uncertainty is clouding the minds of many sponsors, those sitting on strong assets will still find buyers. While the number of exits in 1H25 was up just 2% year-over-year to 324, the dollar volume of those deals surged by 78% to USD 216bn from the same time last year.

Some mega exits boosted numbers. The biggest was agreed in January before Trump took office: the USD 29.4bn sale of Calpine to Constellation Energy by an Energy Capital Partners-led consortium. The second largest came in April, when GTCR Golder Rauner sold a 55% stake in Worldpay to Global Payments for USD 17.6bn.

Among other noteworthy exits in the second quarter was Sterling Group’s sale of West Star Aviation to Greenbriar Equity for USD 1.5bn, as reported by Mergermarket.

These deals are a reminder of a story that has held true in the markets throughout the year: strong assets will continue to find willing buyers even with other variables injecting uncertainty into the mix.

Some sponsors expect to ramp up exits later this year, noted several market participants. Partly that is because the volatility sparked on April 2’s ‘Liberation Day’ and other headwinds are settling. Looming larger, however, is still the need for sponsors to drum up distributions for their limited partners, especially if they hope to begin raising new funds soon.

Mergermarket’s auction tool lists more than 100 active processes of sponsor-backed companies based in North America.

Many of the busted sales processes that marred the first half are expected to resume. For sponsors holding less desirable assets, however, the path to exit remains murky. For these businesses, the hurdles to a sale go beyond the broader concerns about the macro-environment, said one sponsor banker.

Short of a forced sale, these sponsors are likely to be left with continuing the waiting game they’ve played that clogged up the exit pipeline in recent years.

“Assets that were bought at unrealistic valuations are being held longer,” said Adam Cieply, a partner at White & Case’s Mergers & Acquisitions practice group. “If you have a good asset that is capable of showing growth and can be accretive then those will not face the same challenges.”

For now, selectivity is king.